As Bitcoin edges closer to the $100,000 threshold, a surge of activity has been observed from previously dormant, vintage Bitcoin wallets. On January 16th, two wallets originating from 2016 unexpectedly became active again, transferring a combined total of 1,087 BTC—equivalent to over $103 million—for the first time in nearly a decade.

Revival of Long-Inactive Wallets

The start of January 2026 has seen remarkable movement among Bitcoin wallets that had been silent for years. For instance, on January 10th, a colossal holder dating back to Bitcoin’s infancy in 2010 reemerged by moving 2,000 BTC directly to Coinbase—their first transaction since those early days.

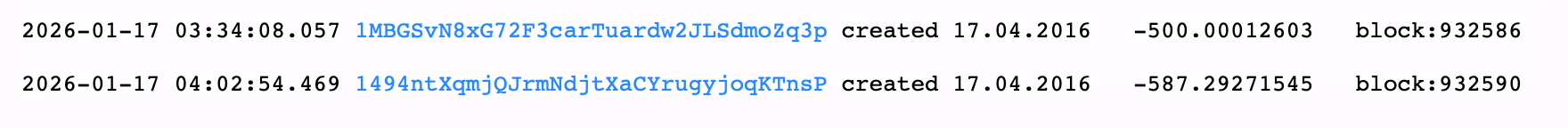

Following this event, numerous other long-dormant wallets began showing signs of life. Most transactions involved amounts under 50 BTC; however, on January 13th one wallet containing exactly 136.30 BTC made its first move since March 5th, 2014. Then on January 16th and into the next day btcparser.com recorded an even larger transfer: an impressive sum of approximately 1,087.29 BTC valued at around $103.8 million based on exchange rates as of January 17.

This burst originated from two distinct P2PKH (Pay-to-Public-Key-Hash) addresses created on April 17th ,2016—one holding exactly 500 BTC and another with roughly 587.29 BTC. The former moved funds at block height #932586 while the latter followed shortly after at block #932590.

The wallet containing about 587.29 BTC transitioned its coins into newly generated Taproot (P2TR) addresses—a more advanced type offering enhanced privacy and efficiency features within the network.

From these fresh Taproot addresses:

- 300 BTC were transferred into one new P2TR address

- The remaining ~287.29260474 BTC were sent separately to another P2TR wallet

As reported around mid-morning Eastern Time that day both sums remained securely parked in their new Taproot destinations.

A similar process occurred with the original wallet holding exactly

500BTC—it was consolidated into a single Taproot address before splitting again between two separate recipients:

- An amount equal to precisely

0 .10000000BTC went to one recipient; - The remainder (~499 .90003619BTC) was assigned as change back into another address controlled by the same entity.

This behavior suggests routine consolidation or preparatory steps possibly related to escrow arrangements or OTC desk handling rather than immediate liquidation.

Such patterns are common when large holders organize their assets ahead of potential sales but do not necessarily indicate panic selling.

In essence these movements appear more like internal housekeeping than actual market distribution—old coins simply changing form instead of ownership abruptly shifting hands.

The Bigger Picture Amidst Rising Prices

With Bitcoin flirting near six figures for price per coin,

the awakening activity among decade-old dormant wallets adds complexity and intrigue within market dynamics.

Whether these transfers foreshadow upcoming sell-offs or merely operational tidying remains uncertain.

However it is evident that approaching significant price milestones often motivates even patient holders

to adjust holdings quietly without causing dramatic fluctuations.

This phenomenon underscores how dormant supply can gradually reenter circulation over time through deliberate measured actions aligned with broader market cycles.

Frequently Asked Questions ⏱️

Why did this whale move over

1 ,087BTC now?

The most plausible explanation is consolidation or preparation for custody services/OTC trades coinciding with prices nearing $100K.

How old were these bitcoin wallets?

Both originated in April

2016 and had remained inactive for more than nine years prior.

Were any bitcoins sent directly onto exchanges?

No — all coins moved exclusively between private Taproot addresses without entering exchanges.

Might this signal imminent selling pressure?

Not necessarily — such transfers frequently represent internal restructuring rather than active distribution.