This week, the United States is set to witness the launch of two new exchange-traded funds (ETFs) focused on altcoins, specifically XRP and Dogecoin, as regulatory attitudes towards cryptocurrency investment products become more favorable.

The REX-Osprey XRP ETF is anticipated to debut this week, according to an announcement made by the fund issuer on Monday. Trading under the ticker symbol XRPR, it will mark a significant milestone as it becomes the first U.S. ETF offering direct exposure to XRP, which ranks as the third-largest cryptocurrency by market capitalization.

Having successfully navigated through a 75-day review period mandated by the Securities and Exchange Commission (SEC), REX and Osprey are poised for trading commencement on Friday—assuming no unforeseen delays arise, which are not expected at this time.

This financial product will be launched in accordance with the Investment Company Act of 1940. This legislation provides a more streamlined approval process compared to that of the Securities Act of 1933 utilized for spot Bitcoin ETFs.

Distinct from other offerings that directly possess underlying assets, this structure allows for automatic launch after 75 days post-filing unless there’s an objection from SEC officials.

Nate Geraci, President of Nova Dius, remarked that this development serves as “another good litmus test for ‘33 Act spot XRP ETF demand,” noting that futures-based XRP ETFs are already approaching $1 billion in total assets under management.

Upcoming Launch of Dogecoin Fund

The impending introduction of an altcoin ETF isn’t limited solely to XRP; another one is set for release shortly thereafter.

Bloomberg’s ETF specialist Eric Balchunas reported on Monday that “the Doge ETF DOJE is scheduled for launch on Thursday.”

The REX-Osprey Dogecoin (DOGE) ETF has also received approval under the same Investment Company Act framework typically associated with mutual funds and diversified ETFs. It will represent a pioneering entry into memecoin ETFs within U.S. markets.

Earlier in July, REX-Osprey introduced its inaugural Solana staking ETF (SSK). However, interest has been tepid since its inception; it currently holds only $274 million in assets under management and less than $25 million in inflows over recent trading sessions according to Farside Investors’ analysis.

Additonally ,in late August ,REX-Osprey submitted paperwork seeking approval for a BNB (BNB) staking ETF .

A Wave of Altcoin ETFs Awaiting Approval

In parallel developments ,over 90 crypto exchange-traded products remain pending SEC authorization as noted at August’s end by Bloomberg analyst James Seyffart .

Related:SEC postpones decisions regarding BlackRock’s and Franklin Templeton’s crypto ETFs

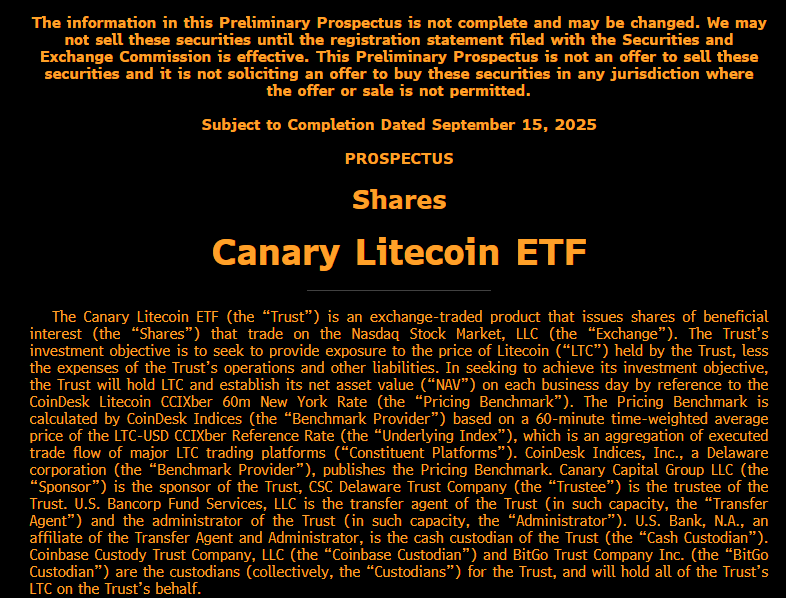

Seyffart highlighted Tuesday how Canary Capital had revised their prospectus filing concerning their Litecoin ETF ,which awaits final judgment from SEC during early October .

Canary Capital Litecoin ETF prospectus source: James Seyffart

Bitwise also submitted documentation last Monday proposing a spot Avalanche(AVAX )ETF .According Seyffart,the only other active applicants pursuing Avalanche-related filings include VanEck & Grayscale .

However,the SEC postponed decisions regarding Bitwise’s proposed Dogecoin & Grayscale’s Hedera ETFs while establishing November12th deadline instead .

Magazine:XRP poised again? Bitcoin unlikely stagnation long :Hodler ‘s Digest