Is Bitcoin on the Verge of a Collapse? A Trader’s Dilemma

The cryptocurrency landscape is at a pivotal moment, with Bitcoin once again in the spotlight. On one hand, major players like BlackRock and Fidelity have recently sold off $363 million worth of Bitcoin through ETFs, raising alarms about a potential market downturn. Conversely, some experts see gold’s recent surge as an encouraging sign for Bitcoin’s future.

So, is Bitcoin headed for a crash or poised for another upward movement?

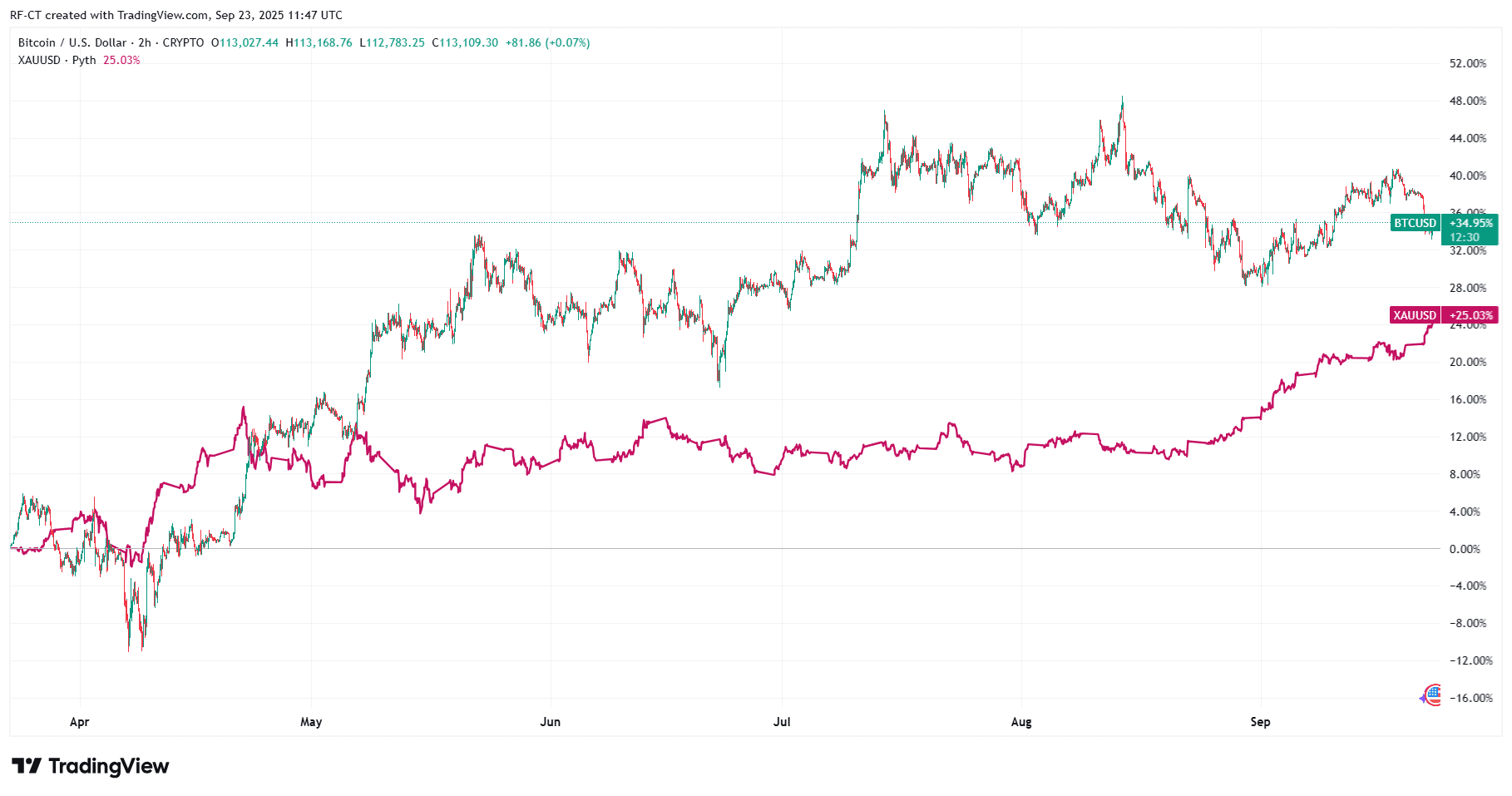

By TradingView – BTCUSD vs XAUUSD_2025-09-23 (6M)

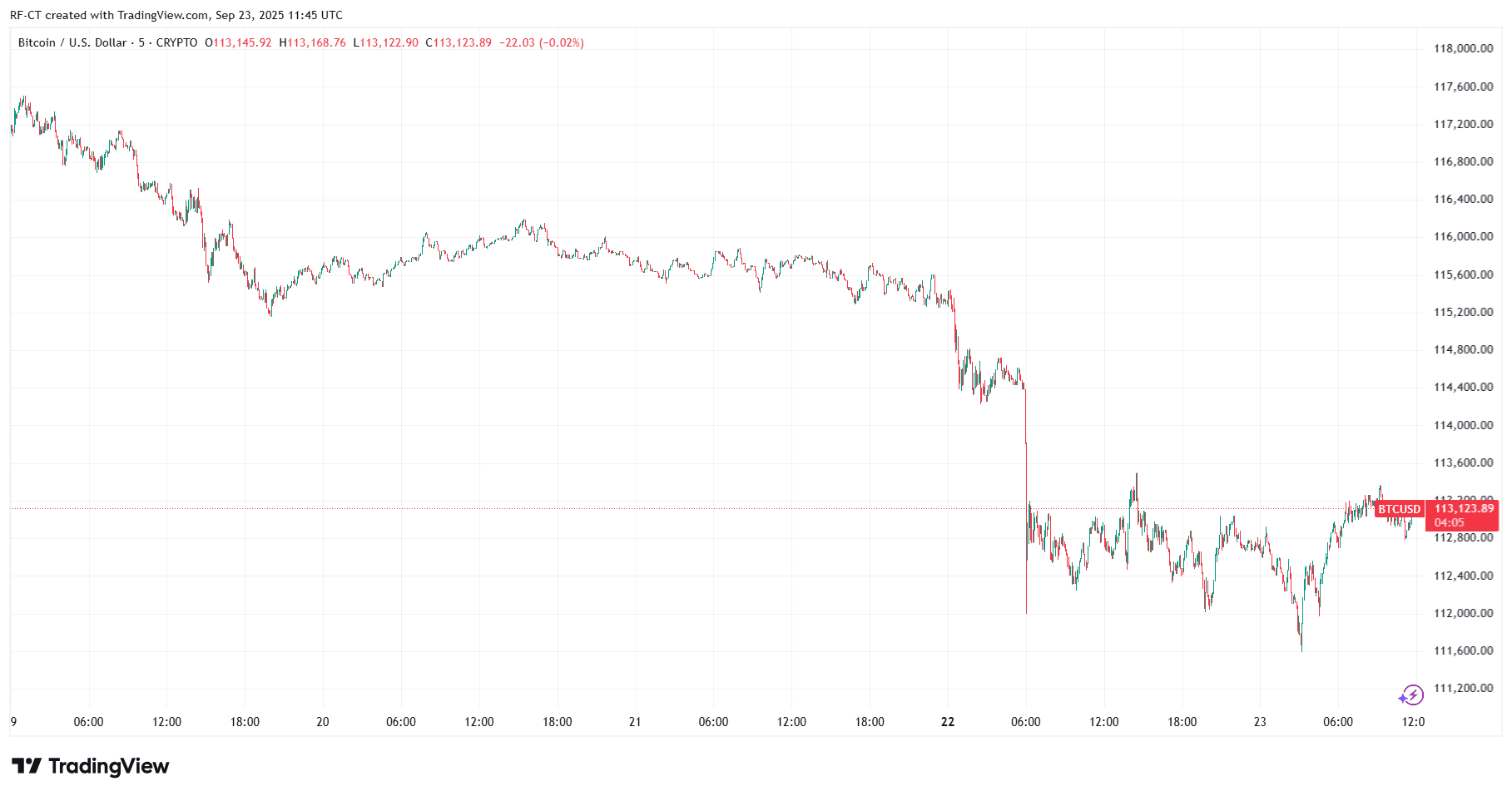

ETF Withdrawals Indicate Bearish Trends

Recent figures show that spot ETFs related to Bitcoin experienced withdrawals totaling $363 million. The involvement of financial giants such as BlackRock and Fidelity has sparked worries about their faith in Bitcoin at its current valuation.

Historically speaking, ETF withdrawals tend to exert downward pressure on prices. If this pattern persists, there’s a risk that Bitcoin could fall below its crucial $110,000 support level—potentially triggering sell-offs and pushing it towards the $100K–105K range.

This pessimistic outlook suggests that in the near term at least; we might witness more corrections rather than upward movements from Bitcoin.

The Gold Surge & The Concept of A Supercycle For Bitcoins

Despite selling pressures being present within markets today – optimists are pointing towards gold’s latest rally as evidence supporting further growth opportunities ahead! After breaking out from prolonged consolidation periods recently seen across various asset classes including precious metals like Gold itself… Analysts now believe similar patterns may emerge soon enough within cryptocurrencies too!

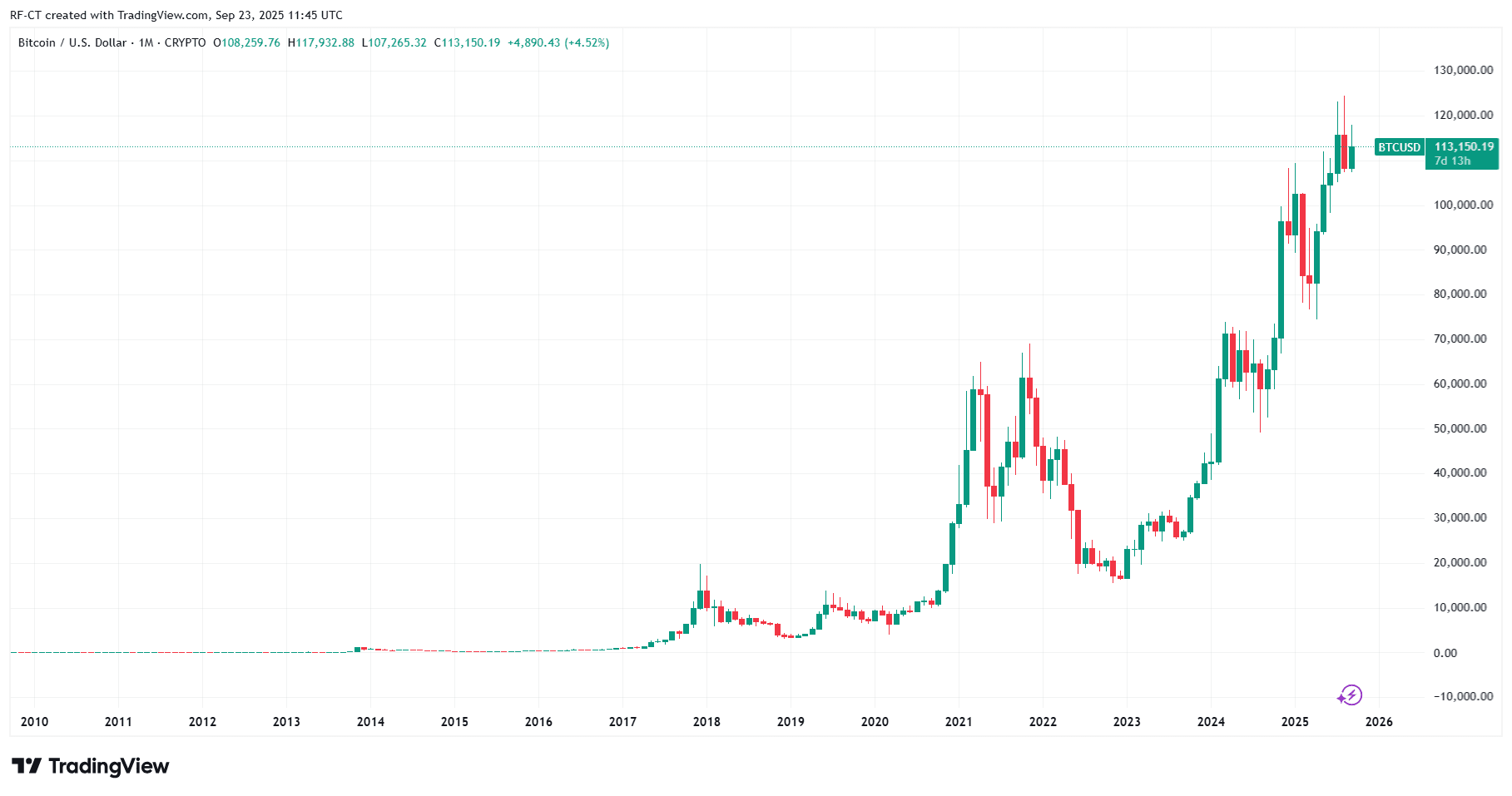

Bitcoin could potentially surpass price points between approximately 124k USD up until reaching heights exceeding even beyond those levels altogether eventually culminating into what many refer commonly known nowadays simply put: “The Super Cycle Thesis”. This theory posits long-term adoption rates alongside approval processes regarding exchange-traded funds combined scarcity driven factors resulting post-halving events ultimately driving values higher despite temporary setbacks along way.

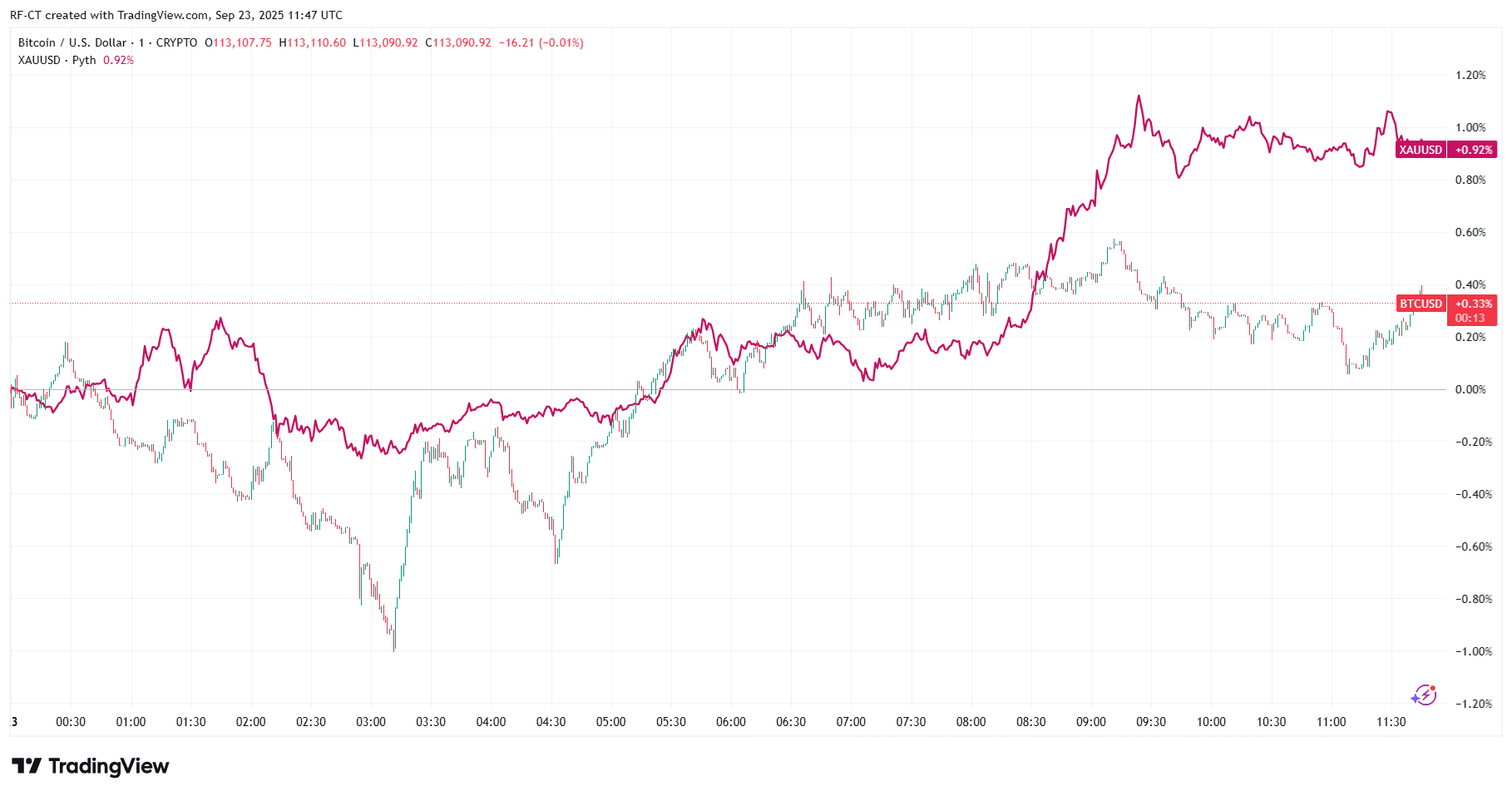

By TradingView – BTCUSD vs XAUUSD_2025-09-23 (1D)

Crisis or Climb? Deciphering What’s Next For Cryptocurrency Markets…

While no one can predict exact outcomes when dealing volatile assets like digital currencies there remain three possible scenarios unfolding over coming months:

Crash Scenario: Accelerated ETF outflows → Drop below critical threshold ($110k) → Further decline approaching lower bounds ($100k).

Bullish Breakout: Surpassing key resistance point (~$124k) followed closely thereafter substantial gains mirroring previous trends observed elsewhere namely Gold leading charge upwards toward new highs beyond current expectations!

Sideways Range Movement Continuing Consolidation Phase Between Support Levels (~$110-$124K): Awaiting stronger macroeconomic indicators/institutional catalysts before making decisive moves either direction ultimately determining fate entire sector moving forward…

For traders/investors alike monitoring developments around aforementioned benchmarks becomes paramount ensuring they stay informed prepared whatever happens next!

By TradingView – BTCUSD_2025-09-23 (5D)

A Final Word: Is A Crash Imminent?

Ultimately whether not bitcoins experience significant downturns depends largely upon balance forces acting against each other right now namely bearish sentiment stemming primarily large-scale institutional selloffs versus bullish optimism fueled partly by similarities drawn between recent performance metrics shared amongst different commodities including precious metals themselves…

Short-term fluctuations certainly pose risks but longer narratives continue holding strong suggesting perhaps brighter days lie ahead yet again soon enough regardless outcome awaits us all eventually nonetheless! As always uncertainty remains constant companion journey navigating ever-changing world finance technology innovation together hand-in-hand shaping future generations come.

By   ;Trading View & #45 ;BTC USD _20 25& #45 ;9& #45 ;23 All