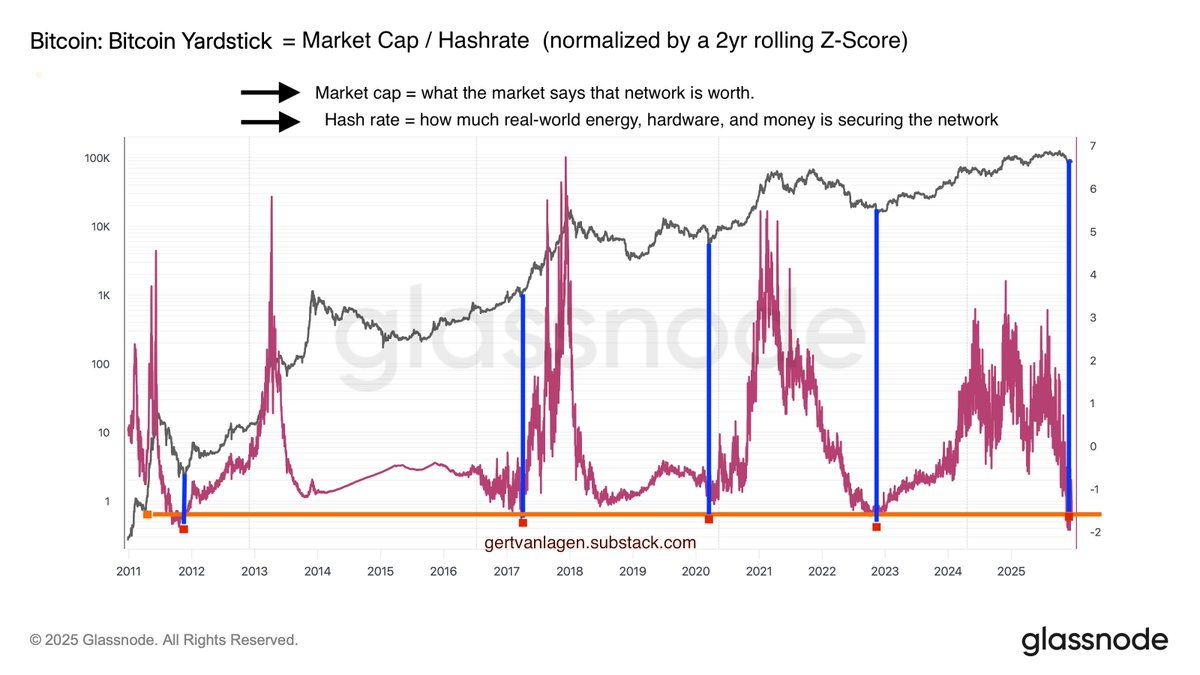

Bitcoin appears to be on the verge of a significant turning point, one of the most critical in recent years. The BTC Yardstick, a prominent valuation tool, currently indicates that Bitcoin is -1.6 standard deviations below its long-term average. This suggests that the leading cryptocurrency is experiencing its most substantial undervaluation since the lows seen during the bear market of 2022.

This particular valuation level has historically aligned with major cycle bottoms observed in previous years—specifically in 2011, 2017, 2020, and again in 2022.

BTC Yardstick Indicates Severe Undervaluation

The BTC Yardstick evaluates Bitcoin’s market price relative to the costs and energy required to maintain its network security. This encompasses expenses related to mining infrastructure and operational costs.

“With BTC Yardstick at –1.6σ = Bitcoin is incredibly undervalued. Similar instances occurred during: the low of the bear market in 2022, bottoming out from COVID crash in 2020, pre-blow-off base in 2017, and bear market bottom back in 2011… All these instances were marked by significant accumulation… indicating that we had already hit rock bottom!” stated analyst Gert van Lagen.

Whale Accumulation Reaches Unprecedented Levels

In tandem with this undervaluation signal comes an extraordinary surge in accumulation activity among large holders. Over just thirty days, Bitcoin whales have acquired a staggering total of 269,822 BTC valued at around $23.3 billion—a record monthly accumulation not seen since before this decade began according to Glassnode data.

BITCOIN’S BIGGEST MONTHLY ACCUMULATION IN THIRTEEN YEARS

Whales purchased an impressive total of 269,822 BTC for about $23.3 billion within just thirty days.

– Glassnode Data pic.twitter.com/6FPfhFhfh4

— Kashif Raza (@simplykashif) December 18th ,2025

“This marks our largest accumulation period over thirteen years! The traditional four-year cycle seems obsolete; we are entering into a Supercycle,” commented crypto analyst Kyle Chasse.

The majority of these purchases were made by wallets containing between one hundred and one thousand Bitcoins each—indicating that both affluent individuals and smaller institutions are gearing up for what could be an impending rebound within the market.

Market Sentiment Following Minor Corrections Presents New Opportunities

Despite witnessing record levels of accumulation alongside notable undervaluation metrics this year so far; Bitcoin’s price has been under pressure recently as per Bloomberg ETF analyst Eric Balchunas who noted that losses have been relatively minor compared to earlier gains experienced by investors throughout prior periods .

I understand it feels discouraging right now but remember: last year alone saw an astonishing rise totaling over468%(!!) across two preceding years prior! That’s equivalentto138% annually which is eight times higher than US stocks! We’ve merely given backa fractionof those … https://t.co/oQ4EuUt64A

— Eric Balchunas (@EricBalchunas) December18th ,2025

The introductionof spot ETFsforBitcoinin early twenty-four contributed significantly towards pushing pricesupward reachingrecord highs close t o$69Kbackin March twenty-four .

Overall,Bitcoin yielded155 .42 % returnsduringtwo-thousand-twenty-threeand121 .05 %the followingyearbefore experiencingan approximate declineofseven percentyear-to-date.This trend implies current dipsmay simply represent natural correctionsfollowingexceptionalperformanceachievedearlieron.

Analysts emphasize how rallies often initiate not amidst high hopes but rather when investors grow weary or frustrated instead.

“We’re no longer fearful; we’re exhausted.Tired from waiting.Tired from believing.Yet remember,manymarketrallies commence when sentiments dip low—notwhen optimism reigns supreme,” wroteanalystAshCrypto.

The combinationofhistoricallylowvaluations,massivewhaleaccumulations,anddecliningleveragepointtowardspotentialcyclicalinflexionpointsapproachingforBitcoinsoon enough.

While exacttimingremainsuncertain,such indicatorshighlightuniquepotentialopportunitiesavailablelongterminvestorsnowadays!

The article titled “What Does a Perfectly Accurate Historical Indicator Signal for Bitcoin This December?” was originally published on BeInCrypto.