Today, Bitcoin experienced a decline as on-chain analytics revealed that major investors are reallocating their funds towards gold-backed assets instead of cryptocurrencies.

This shift occurs as traditional safe-haven investments reach unprecedented highs, causing the digital asset market to falter.

Essential Insights

Bitcoin’s value dipped as large investors redirected their resources into tokenized gold during a time of record-breaking gains in precious metals.

A significant investor acquired millions in XAUT while both gold and silver achieved new all-time peaks amid ongoing macroeconomic uncertainties.

The price of BTC hovered around $88,653, indicating cautious sentiment among investors who prefer lower-volatility alternatives for hedging purposes.

Peter Schiff has reiterated his criticisms of Bitcoin, pointing out its underperformance compared to gold since 2021.

Investors Shifting Focus from Bitcoin to Gold

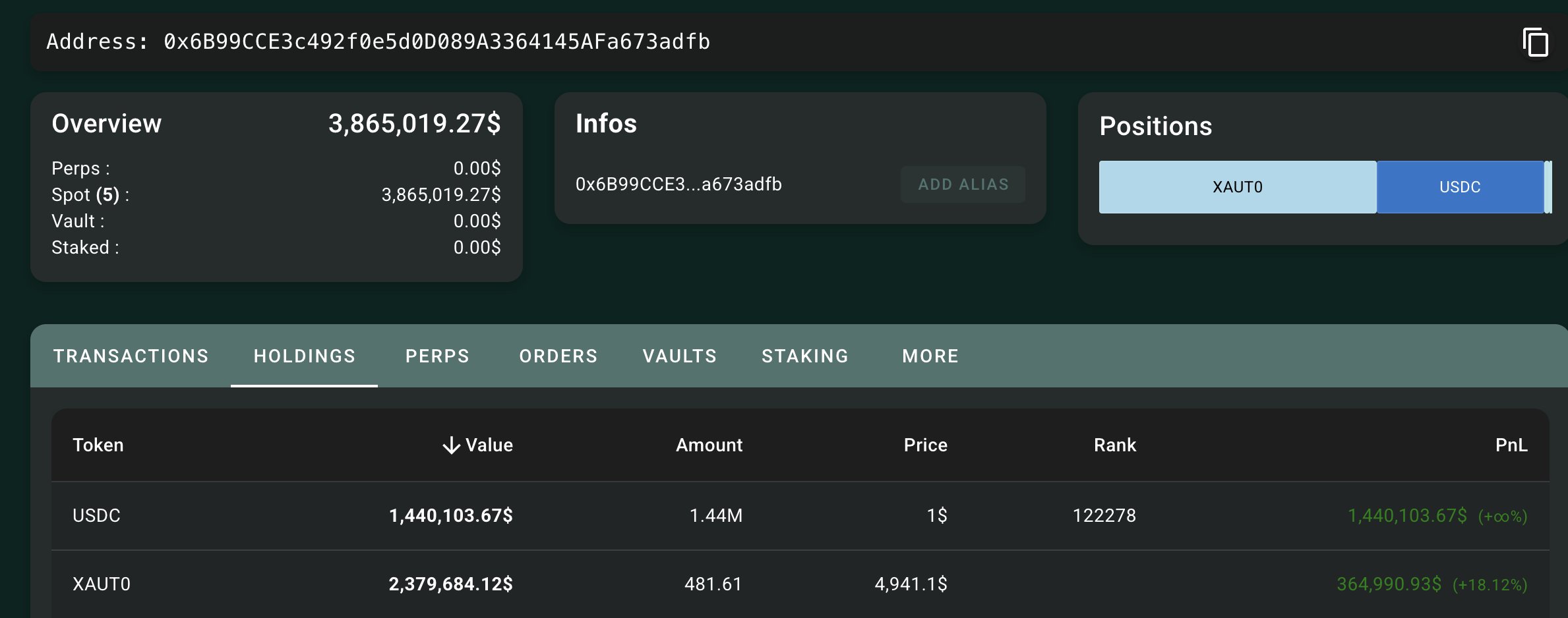

A recent tweet from blockchain analytics platform Lookonchain pointed out a whale address that is actively purchasing tokenized gold instead of Bitcoin. The data shows that this whale deposited $1.53 million in USDC into Hyperliquid to acquire XAUT, which is backed by physical gold and issued by Tether.

This follows an earlier acquisition where the address bought 481.6 XAUT valued at approximately $2.38 million. Currently, it still holds about $1.44 million in USDC, suggesting further investments in gold may be forthcoming.

This capital rotation coincides with a robust rally in precious metals; recently, the price of gold soared to $4,967 per ounce while silver climbed to $99.24—both reaching new historical highs amidst increased macroeconomic uncertainty.

The growing strength of these metals seems to be drawing investment away from riskier assets like cryptocurrencies.

Bitcoin Struggling for Momentum

Indeed , Bitcoin has found it challenging to regain its upward momentum . As it stands , BTC is trading at approximately 88 , 653 dollars , reflecting a decline close to one percent today and nearly thirty percent below its previous cycle peak .

This price movement indicates investor reluctance as markets grapple with inflation concerns , monetary policy expectations , and the allure of more stable stores of value .

The disparity between whale activities favoring gold over Bitcoin’s weaker performance underscores a short-term shift in market sentiment . While long-term holders still consider BTC as digital equivalent for gold , current on-chain trends imply some major players are opting for traditional hedges given intensifying macro pressures .

Peter Schiff Reiterates Critique on Bitcoin

In light of Gold ‘s remarkable performance recently economist Peter Schiff has renewed his critique regarding bitcoin asserting that investors might be overlooking opportunities while precious metals soar toward record levels.

In posts made today on social media platform X he stated how both Gold & Silver provide stronger signals amidst today’s economic volatility whereas Bitcoins have failed keeping up pace.

He also mentioned how since November 2021 Bitcoins have depreciated over fifty percent when evaluated against Gold

Schiff posited that true risk lies within opportunity costs faced by those holding onto bitcoins tied up within an asset showing lesser returns compared with conventional stores such values He further challenged narratives labeling bitcoins “digital-gold” claiming failures seen during periods monetary stress weaken arguments supporting them acting effectively hedge.While acknowledging early gains witnessed through bit coin’s rise Schif maintained stance stating both GOLD SILVER remain safer havens especially considering rising debts currency pressures alongside broader uncertainties present across markets./S PAN/>