As Bitcoin (BTC) remains within a tight trading range, the upcoming interest rate decision from the Federal Reserve (FED) is anticipated to spark an upward movement in prices.

It appears almost certain that the FED will implement a reduction in interest rates this September, with market expectations indicating a 91.8% probability of a 25 basis point cut and an 8.2% chance for a more significant reduction of 50 basis points.

While some analysts believe that any potential rate cut has already been factored into current market prices, others contend that such action by the FED could lead to the anticipated price increase.

The eagerly awaited decision from the FED coincided with new data regarding the US Producer Price Index (PPI), which plays a crucial role in guiding their monetary policy decisions.

The released data includes:

Core Producer Price Index (Monthly): Reported at -0.1%, compared to an expectation of 0.3%, down from last month’s figure of 0.9%

Core Producer Price Index (Annual): Reported at 2.8%, below expectations of 3.5%, and down from last month’s reading of 3.7%

Producer Price Index (Monthly): Reported at -0.1%, against an expected rise of 0.3%, previously recorded at +0.9%

Producer Price Index (Annual): Recorded at 2.6%, aligning with expectations but unchanged from last month’s figure

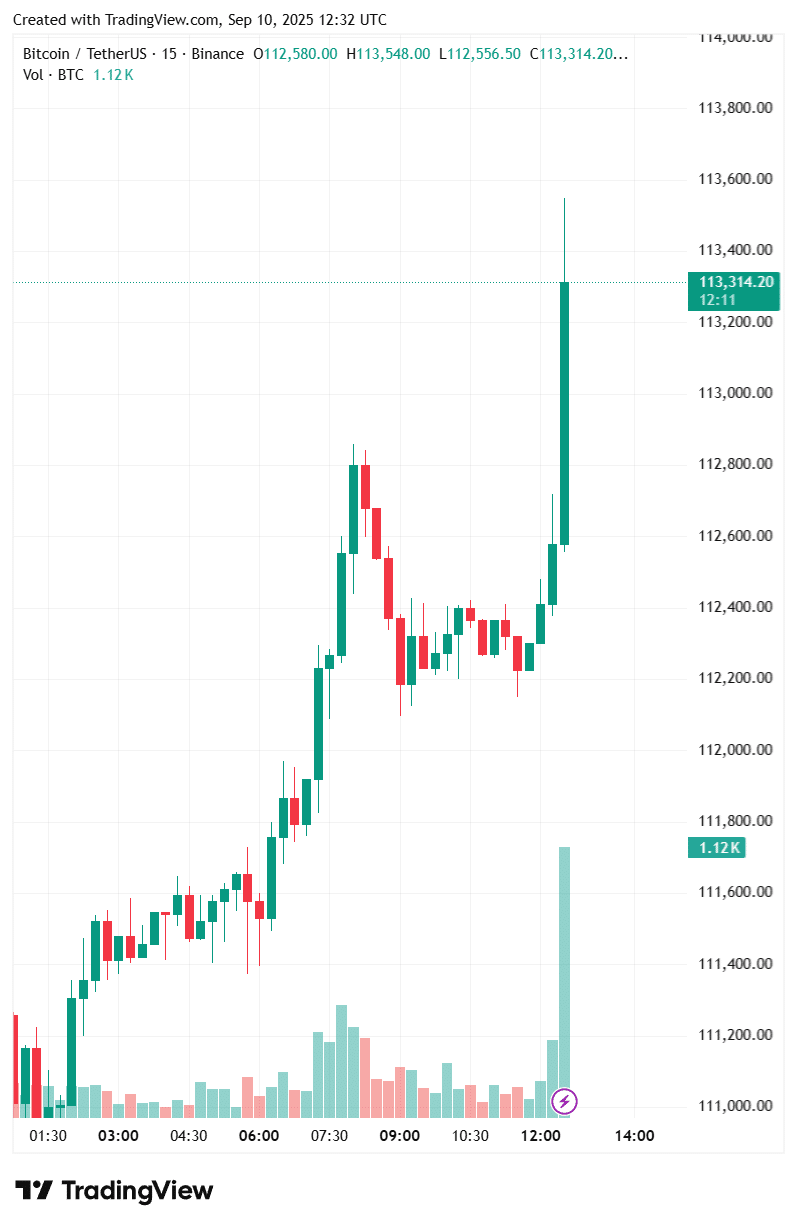

The initial response from Bitcoin following the PPI announcement was as follows:

*This content does not constitute investment advice.