At first glance, Bitcoin’s price appears stagnant. Over the last 24 hours, it has barely shifted, showing a minor decline of just 0.2%. Even when looking at the weekly chart, Bitcoin’s movement is minimal, with an increase of approximately 0.7%. The market seems subdued, and many traders describe this as a period of range-bound trading.

However, beneath this calm exterior lie several indicators suggesting that Bitcoin (BTC) is not as weak as it might seem. Momentum is gradually shifting in favor of buyers; sellers are losing their grip, and major holders continue to quietly adjust their positions. These combined factors help explain why optimistic forecasts from experts like Tom Lee remain valid despite the absence of a breakout so far.

Subtle Improvements in Momentum and Volume Indicators

The daily chart reveals that Bitcoin consistently respects the $90,100 support level. This area has served as a solid foundation amid recent volatility by preventing deeper declines even though upward momentum remains limited.

A particularly revealing early indicator comes from On-Balance Volume (OBV), which measures whether volume flows into or out of an asset—helping to uncover hidden buying or selling pressure.

Between December 9 and December 11, while Bitcoin’s price formed lower highs, OBV made higher highs—a divergence indicating increased buyer activity despite struggling prices beneath the surface.

If you want more insights like these on tokens and markets, subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter.

This signal grew stronger between December 10 and December 12 when Bitcoin hit lower lows but OBV traced higher lows—again signaling weakening selling pressure despite downward price moves.

Together these two OBV divergences reinforce each other rather than contradicting—they suggest that selling momentum is fading rather than intensifying. While this doesn’t guarantee an imminent breakout yet, such patterns often precede one.

Accumulation by Holders and Whales Despite Price Stagnation

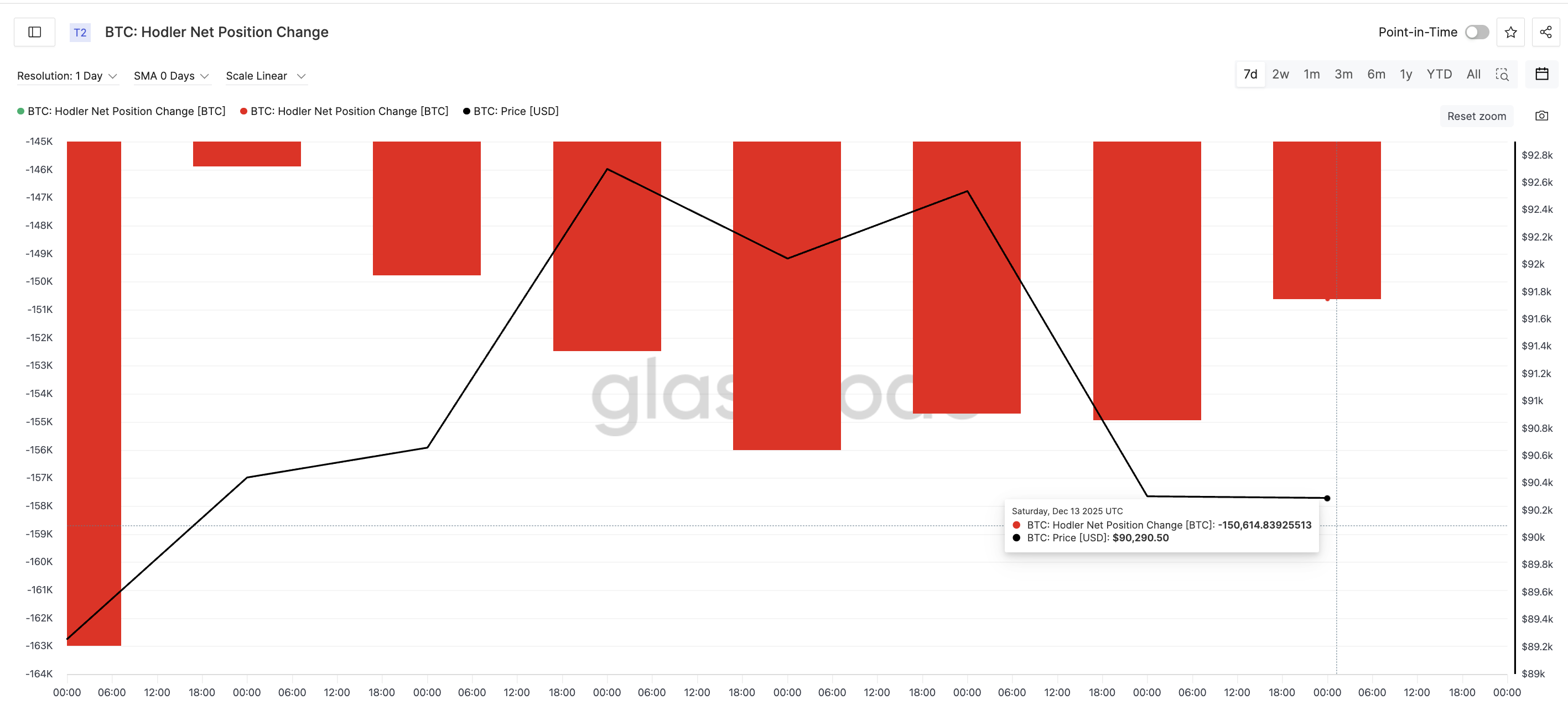

Momentum indicators alone don’t tell the full story; on-chain data provides additional confirmation. The Holder Net Position Change metric tracks whether long-term holders are increasing or decreasing their BTC holdings: negative values indicate net sales while smaller negatives point toward easing sell-offs.

On December 10th long-term holders sold about 155,999 BTC but by December 13th this dropped to roughly150,614 BTC—a decrease in selling pressure around3.4%

This change may seem modest but carries significance: instead of panic-selling during sideways trading ranges, holders are reducing sales as prices stabilize—a behavior typical during consolidation phases rather than breakdowns.

The clearest sign comes from whales—the number holding at least1,000 BTC remains near its six-month peak. This usually reflects large-scale investors with long-term horizons.

Since late October, while bitcoin corrected then moved sideways, whale entities have steadily accumulated coins creating a notable divergence: a weakening price accompanied by growing whale holdings — something they rarely do without strong conviction behind it.

JUST IN: Tom ;Lee, says Bi;t;c,o,i,n h,a,s l,i,k,e,l,y b,o,t,t,o,m,e,d ,a,n,d c,o,u,l,d b,r,e,a,k t,h,e ,4 y,e,a,r c,y,c,l,e ,a,n,d h,i,t $180,,000 b,y t,h e e n d o f J,a,n u,a r y . p i,c.t w i t.c o m/NuFAltmFm8</ p &g t ;n<u2014 T h e u20BFitcoin Therapist (@TheBTCTherapist) D e c ember13 ,2025

These projections aren’t driven by short-lived candle patterns but rely on reduced sell-offs,&amp;; improving volume dynamics along with consistent whale accumulation . Yet for now,BTC must validate these assumptions through clear price action .

Key Price Levels That Will Determine If Bulls Regain Control

For bullish signals to translate into meaningful moves,BTC needs decisive confirmation via closing prices above critical resistance points .

The pivotal threshold remains at $94&comma600 ; surpassing which would represent roughly a five percent gain from current levels breaking out above compression zones signaling renewed buyer dominance over short term trends .

Beyond $94&comma600 lies resistance near $99&comma800 ; sustained strength here could pave way towards targets around $107&comma500 provided broader market conditions cooperate — potentially igniting catalysts needed for ambitious forecasts like Tom Lee’s projected$180&comma000 target mentioned earlier .

If insteadBTC falls below support near$90&period00 then next safety nets appear closebyaround$89&period200 followedby key levelat$87&period500 breaking belowthesewould invalidateshorttermbullishbiasesandlikely trigger furtherdownside risk.

The original article titled “3 Reasons Why Bullish Bitcoin Price Predictions Still Hold” was first published on BeInCrypto.