SWIFT, known as the Society for Worldwide Interbank Financial Telecommunication, is set to develop its newly announced blockchain payment settlement system on Ethereum’s layer 2 solution, Linea. This was confirmed by Consensys CEO Joe Lubin.

Earlier this week, SWIFT disclosed its collaboration with Consensys and over 30 traditional financial institutions to create a round-the-clock real-time cryptocurrency payment infrastructure. Although there was much speculation about Linea being the chosen platform, it wasn’t officially named until later.

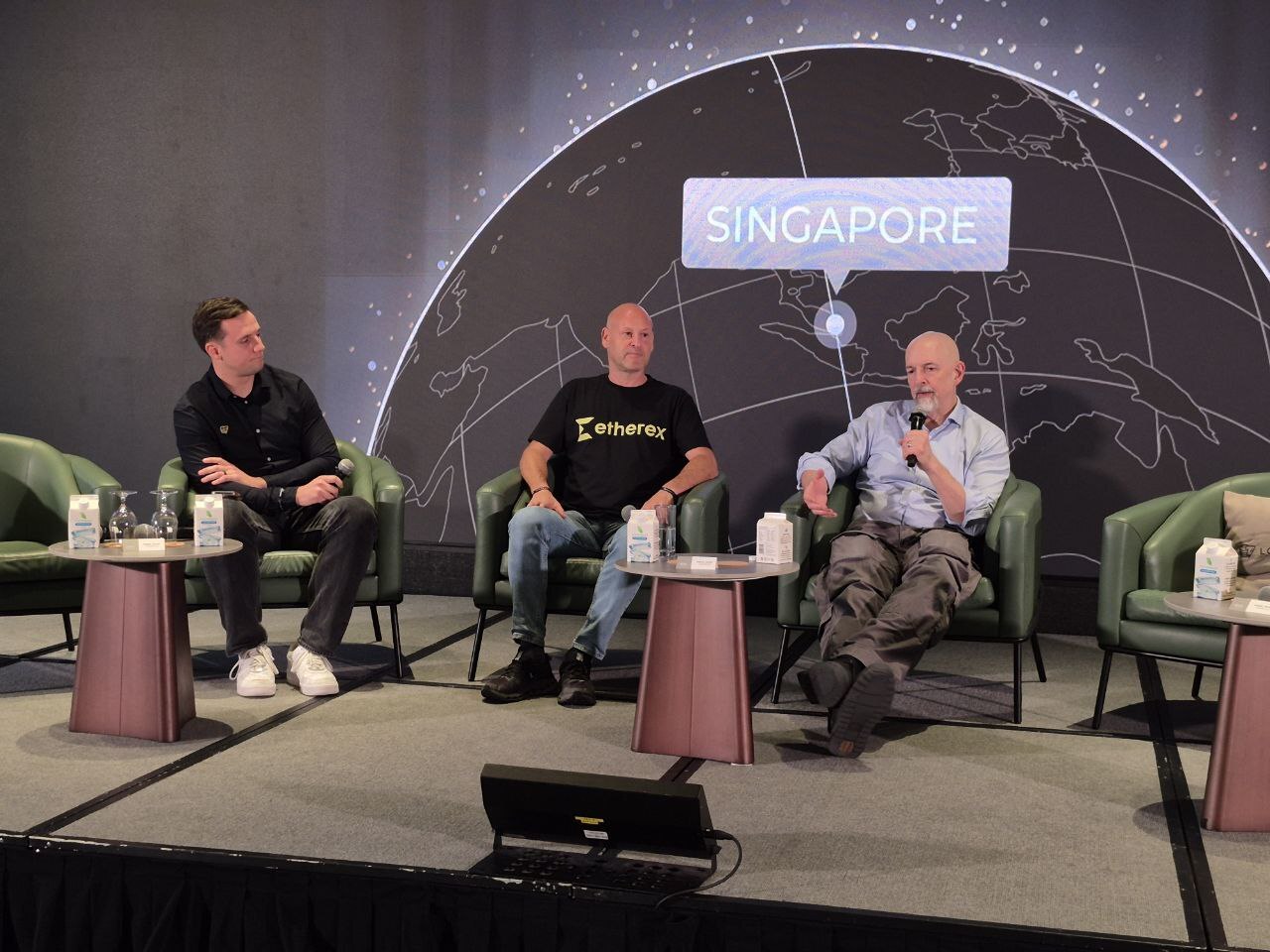

The confirmation came from Lubin during a conversation with Cointelegraph’s Gareth Jenkinson at the Token2049 event in Singapore. He noted that when SWIFT’s CEO Javier Pérez-Tasso addressed the banking community about this development, he did not specifically mention Linea. According to Lubin, SWIFT needed to gradually introduce this significant update which received positive feedback.

“The general reaction seemed appreciative,” remarked Lubin. “It’s high time we merge DeFi and TradFi into one cohesive stream.”

Cointelegraph’s Gareth Jenkinson alongside Joe Lubin and Neal Stephenson of Snow Crash fame. Source: Cointelegraph

Linea is an innovative layer 2 scaling solution developed by Consensys that utilizes zk-EVM rollup technology to handle approximately 1.5 transactions per second at significantly reduced costs compared to Ethereum fees.

This platform has secured $2.27 billion in total value locked (TVL), ranking fourth among Ethereum layer 2 solutions according to L2BEAT data — following Arbitrum One, Base Chain and OP Mainnet.

The potential impact of SWIFT entering blockchain payments is substantial given its management of around $150 trillion in global payments annually through conventional banking systems.

Major banks are joining

Banks such as Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank are participating in trials for SWIFT’s new blockchain-based payment system on Linea.

This move could challenge Ripple’s XRP Ledger which currently stands out as one of few bank-oriented blockchain payment systems available today.

A transformative step forward

The decision by SWIFT marks an anticipated shift towards utilizing blockchains’ benefits like instant settlements without intermediaries while minimizing costs & errors associated with traditional methods.

User-generated possibilities envisioned through Linea

LUBIN EMPHASIZED LINEA’S POTENTIAL BEYOND JUST PAYMENTS BY DESCRIBING IT AS A PLATFORM WHERE CONTENT CAN BE CREATED IN A USER-GENERATED MANNER.

<EM>RELATED:</EM><EM>‘STABLECOIN DUOPOLY ENDING’ AS USDT,&NBSP;&NBSP;&NBSP;&NBSP;&USDC DOMINANCE FALLS TO 84%</EM&Gt

“WE ENVISION COMMUNITIES BUILDING INFRASTRUCTURE AND APPS FROM THE GROUND UP ON LINEA,” SAID LUBIN,&NBSP;&EXPLAINING THAT ETHEREUM’S TRUSTLESS SETTLEMENT LAYER ENABLES THIS BOTTOM-UP APPROACH—CONTRASTED WITH TRADITIONAL TOP-DOWN GOVERNMENT OR BANK STRUCTURES.&Nbsp;

Decentralized autonomous organizations (DAOs) have been experimenting with running entities sans centralized leadership using smart contracts or decentralized voting mechanisms but achieving large-scale success remains elusive thus far.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?