While advanced markets often delve into intricate financial instruments like ETFs and DeFi, Sub-Saharan Africa is showcasing the tangible impact of cryptocurrency. Here, Bitcoin and stablecoins are becoming essential resources for millions grappling with inflation and currency exchange limitations.

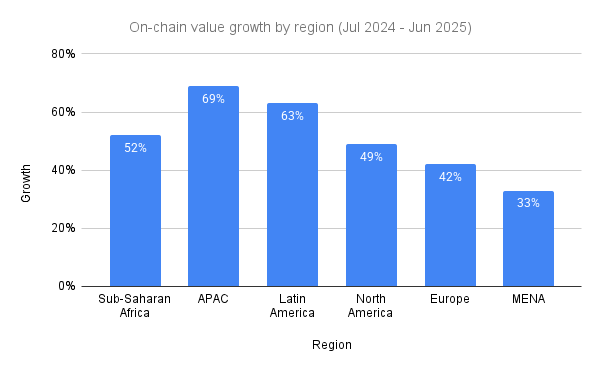

With a remarkable 52% increase in on-chain value over the last year, this region has climbed to the third position globally, trailing only behind Asia-Pacific (APAC) and Latin America. This narrative transcends mere capital movement; it serves as concrete evidence of how cryptocurrencies can fundamentally transform financial systems from their foundations.

Retail-driven expansion with Bitcoin at its center

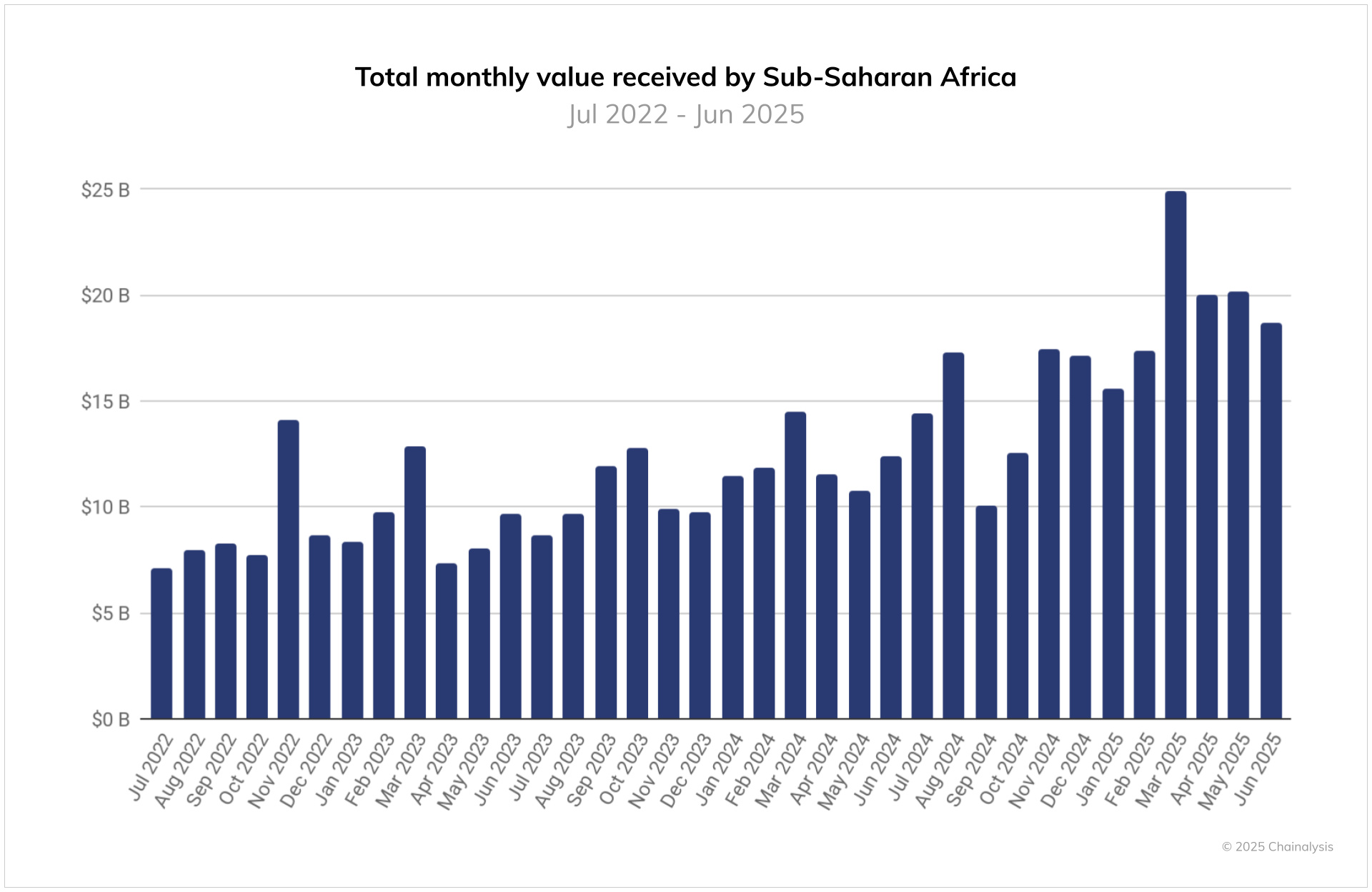

The latest Chainalysis report indicates that Sub-Saharan Africa (SSA) ranks as the third-fastest-growing cryptocurrency market worldwide. Between July 2024 and June 2025, on-chain transaction values skyrocketed by 52%, surpassing $205 billion. The primary catalyst for this growth is retail users—individuals utilizing crypto for everyday transactions, storing value, and hedging against inflation.

Monthly transaction value in Sub-Saharan Africa. Source: Chainalysis

Nigeria and South Africa stand out as key players within this landscape. Nigeria achieved an impressive on-chain transaction volume of $92.1 billion, primarily driven by citizens seeking alternatives amid soaring inflation rates and stringent foreign exchange regulations. Conversely, South Africa is pivoting towards institutional markets due to a clear regulatory environment that encourages participation from major banks like Absa—especially in cross-border payments and innovative product development.

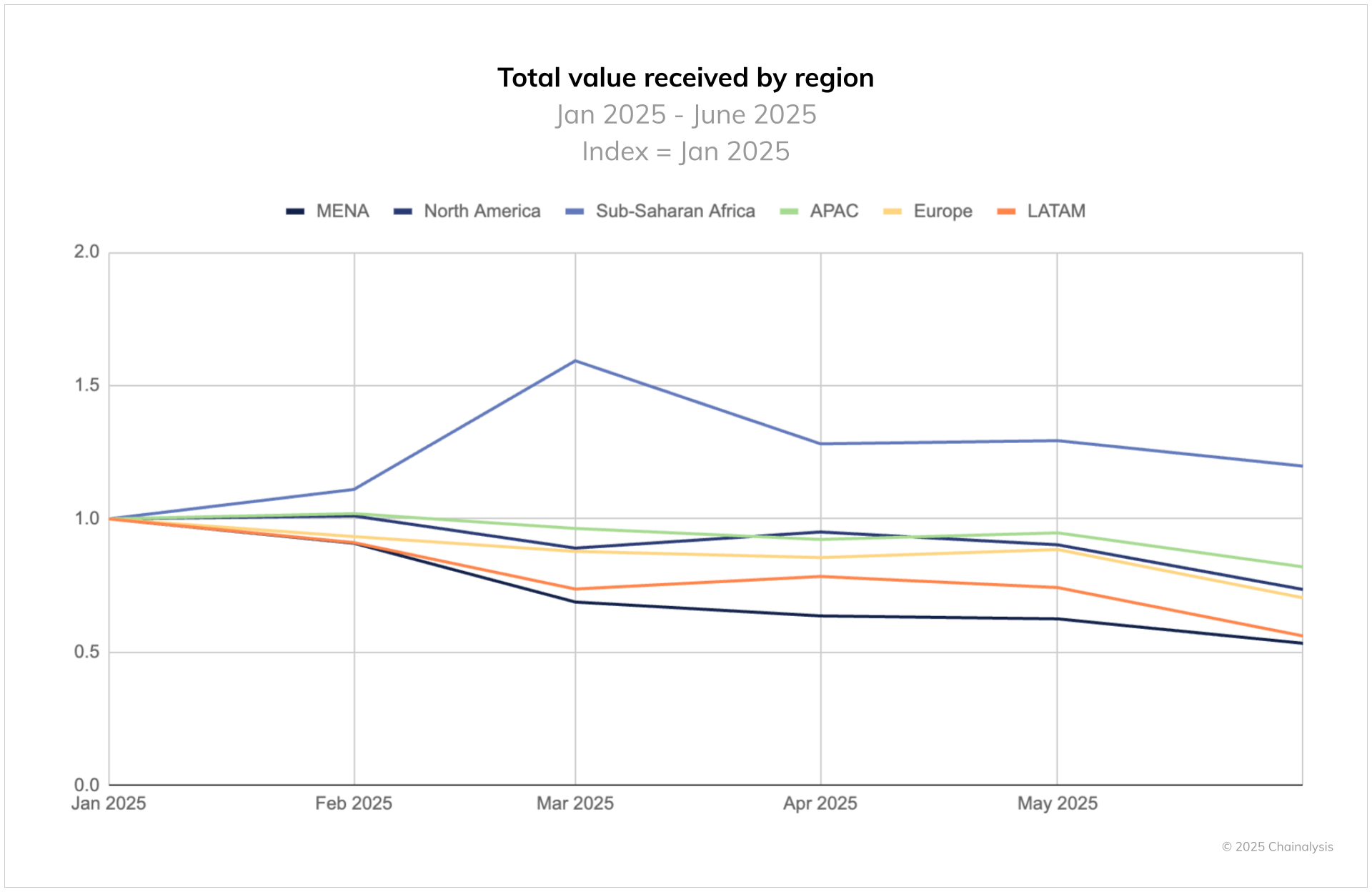

Total value by region. Source: Chainalysis

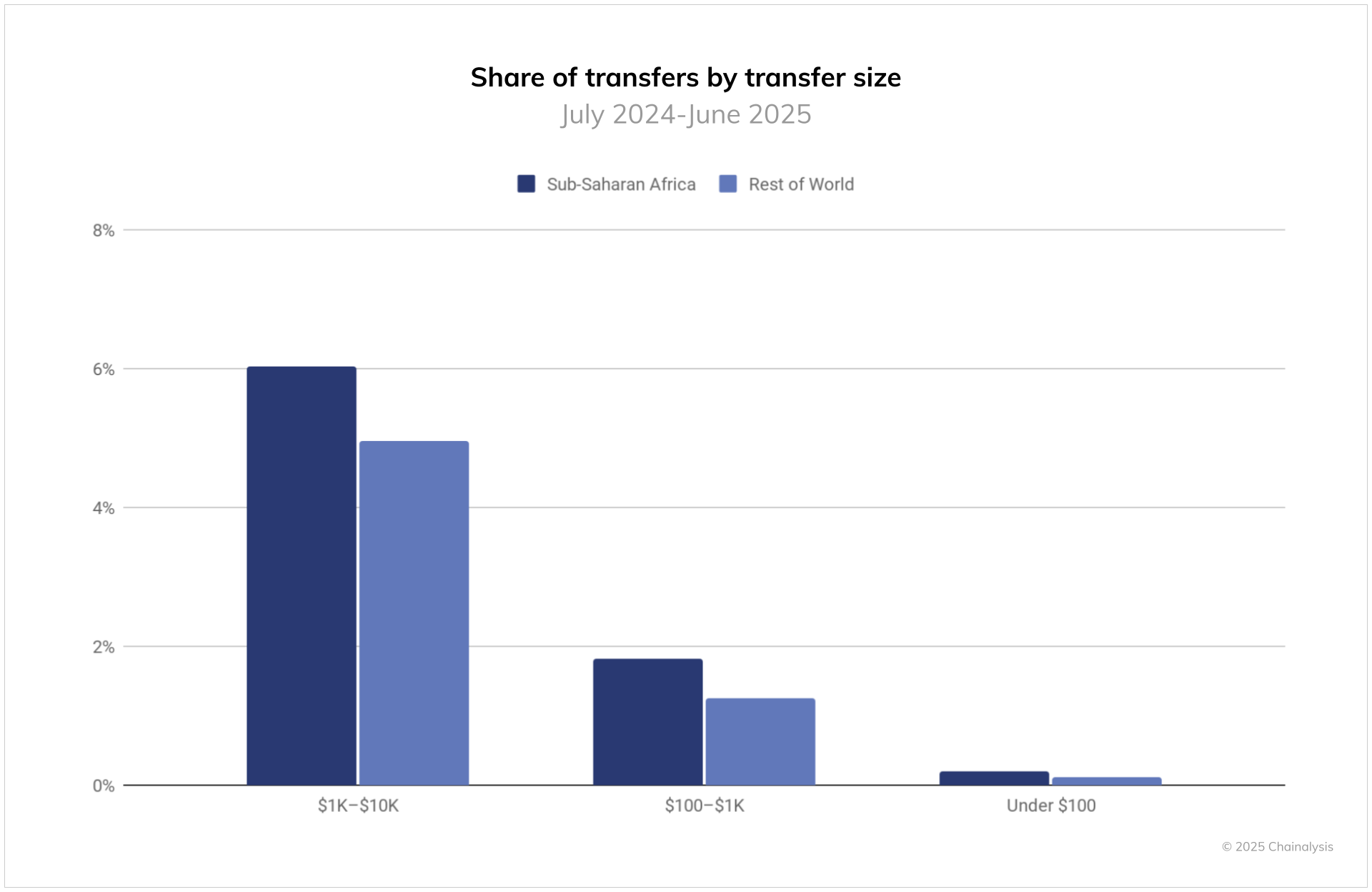

It’s no surprise that Bitcoin (BTC) reigns supreme in SSA as a form of “digital gold.” In Nigeria alone, Bitcoin constitutes approximately 89% of retail transaction values; meanwhile, South Africa reports a significant figure of 74%. Additionally, stablecoins—particularly USDT—are preferred for high-value transfers due to their effectiveness as substitutes for the U.S dollar.

Share of activity by transfer type in Nigeria & South Africa.

A regional comparison highlighting SSA’s practical utility

When placing SSA within the global context, an intriguing picture emerges. Data aggregated from Chainalysis reveals that Asia-Pacific (APAC) leads growth with an astonishing year-on-year increase of 69%, spurred largely by developments within DeFi sectors alongside substantial institutional investments flowing into markets such as Hong Kong, Singapore, and South Korea.

On-chain value growth by region.

Latin America also exhibits robust expansion at a rate of 63%, where cryptocurrencies are widely adopted for remittances and peer-to-peer payments—especially notable in Brazil and Mexico. In contrast to these regions focusing heavily on institutional involvement—with North America reaching $1.2 trillion driven mainly through ETFs—and Europe achieving $1 trillion through DeFi initiatives—the total capital flow remains smaller when compared to SSA’s unique strengths rooted deeply within real-world applications.

This distinction underscores how while APAC or North America may excel through sophisticated financial products or services designed primarily for institutions or affluent investors alike; it’s evident that SSA demonstrates how cryptocurrencies can effectively tackle fundamental economic issues—from safeguarding asset values against rising inflation rates down towards establishing efficient cross-border payment infrastructures tailored specifically towards emerging economies’ needs!

The case study surrounding SSA clearly illustrates not merely speculative investment opportunities but rather positions crypto technology firmly amongst pragmatic solutions aimed directly at improving living standards across developing nations! Looking forward into future prospects ahead—we anticipate continued advancements regarding regulatory frameworks which strike balances between fostering innovation whilst managing inherent risks could potentially elevate sub-sahara africa into becoming one leading hubs globally recognized when discussing genuine adoption trends associated around cryptographic currencies!

The post titled “Sub-Saharan Africa: A New Bright Spot on the Global Crypto Map,” originally appeared first on BeInCrypto.