According to Lee Hardman, a currency analyst at MUFG Bank, stablecoins are emerging as a more reliable form of currency compared to the unpredictable nature of cryptocurrencies like Bitcoin.

In his latest market analysis, Hardman pointed out that the increasing popularity of stablecoins is due to their functionality as digital cash alternatives.

Stablecoins differ from Bitcoin and other cryptocurrencies by maintaining a consistent value, typically pegged at a 1:1 ratio with major currencies such as the U.S. dollar, euro, or British pound; in some instances, they may also be linked to commodities like gold.

Tokens like $USDC and $USDT are designed specifically to mitigate the drastic price fluctuations that hinder Bitcoin’s effectiveness for everyday transactions. This stability has positioned them as essential components within cryptocurrency markets. Approximately 80% of all trades on centralized exchanges utilize stablecoins, underscoring their critical role in ensuring liquidity in crypto trading.

Main Highlights

MUFG Bank’s Lee Hardman asserts that stablecoins serve better than volatile Bitcoin when it comes to functioning as money.

Dollar-pegged tokens such as $USDT and $USDC now facilitate around 80% of trading activities on crypto exchanges.

The market capitalization for stablecoins has exceeded $310 billion; nearly all (99%) is associated with U.S. dollar-backed digital assets.

Hardman emphasizes that stablecoins effectively fulfill money’s three primary roles by providing price stability along with quick and affordable payment options.

The Dominance of Stablecoins in Crypto Liquidity

Hardman highlighted that Tether’s $USDT, remains the largest and most widely utilized stablecoin worldwide. It is tied directly to the U.S. dollar and supported by cash reserves alongside U.S. Treasury bills. The influence of $USDT, extends across Asia, Latin America, and various emerging markets where it dominates liquidity.

This token serves multiple purposes including savings accounts, cross-border remittances, decentralized finance (DeFi) activities while also acting as a foundational trading pair across various crypto platforms—accounting for over 70% of total trading volumes involving stablecoins.

Total Market Cap Exceeds $310 Billion

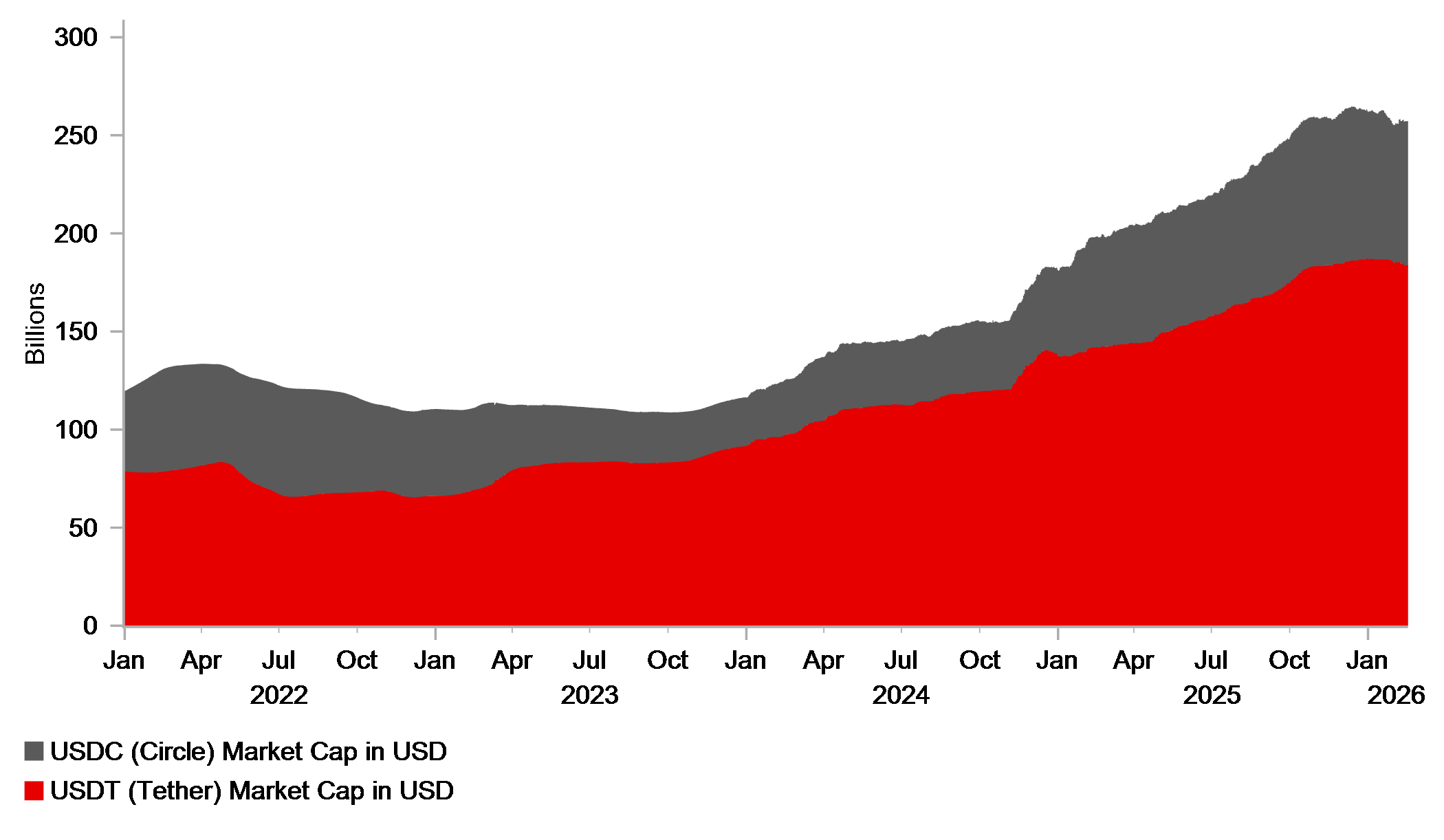

This year saw total market capitalization surpass approximately $310 billion—with almost all (99%) attributed to tokens pegged against the U.S. dollar.

$USDT – alone boasts an estimated market cap nearing $184 billion while$ USDC – hovers around $74 billion.

The share represented by these coins now stands at about 13%.

This figure is expected to increase over time according to Hardman’s projections which suggest potential growth within this sector could reach between $2 trillion up until $4 trillion come 2030.

Chart provided courtesy MUFG Bank

Satisfying Money’s Three Functions

Citing his research findings ,Hardman contends that unlike Bitcoin ,stable coins stand better equipped fulfilling what he terms “the three essential functions”of currency : serving both medium exchange unit account store value .

Their inherent price stability makes acceptance easier among merchants consumers alike minimizing risks involved during transaction processes .They enable instantaneous global payments operate continuously throughout day night typically carrying lower fees than traditional banking systems card networks .

Consequently ,stable coins have emerged preferred choice mediums exchanging within digital realms being extensively used lending collateral payment processing tasks .

Moreover ,Hardman noted appeal could intensify particularly high inflationary economies where access reliable forms linked dollars provides practical alternative weakening local currencies.