SpaceX is preparing for a potential public offering that could value the company at approximately $1.5 trillion, which would make it one of the largest IPOs ever, according to Bloomberg.

If this plan comes to fruition, investors will be purchasing shares not only in aerospace technology but also in a firm holding thousands of bitcoins and notable for using dogecoin to finance a lunar mission.

A report from Bloomberg on Tuesday evening revealed that Elon Musk’s company is advancing with its initial public offering strategy, aiming to raise well over $30 billion. The target valuation stands near $1.5 trillion with an anticipated market debut sometime between mid and late 2026.

At such an immense scale, even minor asset allocations become significant.

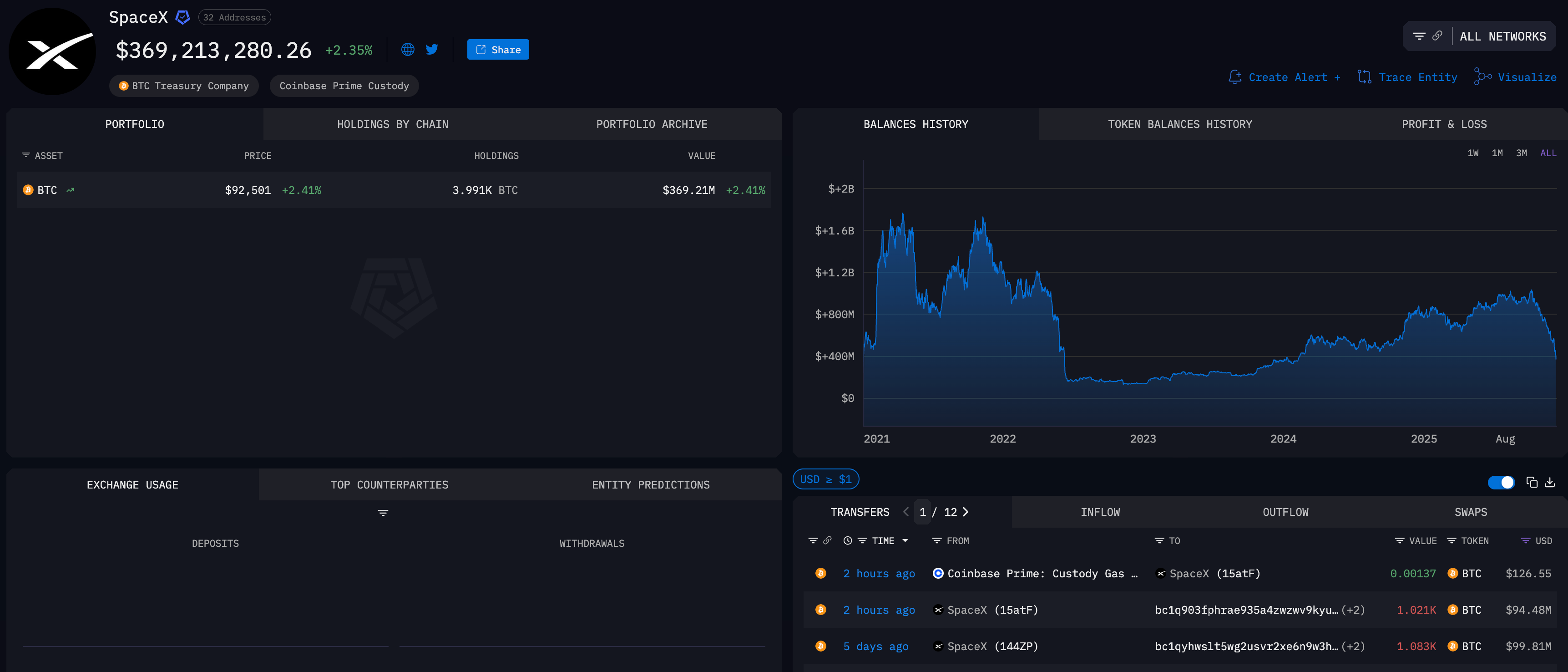

Blockchain analytics provider Arkham Intelligence tracks wallets linked to known entities and identifies a cluster associated with “SpaceX” containing roughly 3,991 BTC. At current bitcoin prices around $92,500 per coin, this equates to nearly $369 million in digital assets.

The wallets are reportedly managed through Coinbase Prime custody services. Historical balance data indicates fluctuations over recent years—surging during the bullish period of 2021–2022 before dipping and gradually recovering throughout 2024 and into 2025.

Recent blockchain activity observed by Arkham shows substantial internal transfers on Bitcoin’s main network layer: two transactions exceeding 1,000 BTC each within the last week plus smaller movements between Coinbase Prime accounts within the same wallet group.

It should be emphasized these transfers likely represent internal reallocations rather than external purchases or sales.

The IPO remains more than a year away and depends heavily on favorable market conditions; however, Musk’s close ties with cryptocurrency continue to heighten interest around every announcement related to SpaceX.

Musk has long influenced dogecoin’s popularity—from sharing memes that impact its price movements to enabling SpaceX’s acceptance of DOGE tokens for their historic DOGE-1 Moon mission funding.

His ventures were among early adopters of institutional bitcoin holdings as well—Tesla notably reported owning over 11,000 BTC at one point on its financial statements tied to renewable energy initiatives.

An upcoming SpaceX public listing would provide fresh capital resources aimed at expanding Starlink satellite internet services along with developing advanced space-based data centers rich in semiconductor technology—potentially increasing Musk’s footprint across AI-driven technologies intersecting crypto infrastructure domains too.

Meanwhile, preliminary insights from prediction platform Polymarket reveal rising optimism about SpaceX surpassing a $1 trillion valuation upon going public—with traders assigning about a 67% chance this milestone will be reached as of early Wednesday trading sessions.