Corporations around the globe are increasingly adopting Bitcoin treasury strategies. Inspired by Michael Saylor, the founder of Strategy (previously known as MicroStrategy), which holds the largest known Bitcoin reserve, many companies are now looking to emulate his approach and some even aim to surpass it.

Recently, Bitcoin Treasuries reported that publicly traded companies collectively hold over 1 million bitcoins, accounting for more than 5% of the total supply. This marks a significant milestone for an asset class that was predominantly owned by enthusiasts until recently.

BREAKING: Total #Bitcoin held by publicly traded companies globally just passed 1,000,000 BTC.

Nearly 5% of all the BTC that will ever be

pic.twitter.com/LVGGYbGBfQ

— BitcoinTreasuries.NET (@BTCtreasuries) September 4, 2025

The treasury strategy that has inspired numerous corporations was first introduced by Saylor as a solution to what he termed the “melting ice cube” dilemma in traditional finance. At that time, Strategy—a profitable software company rich in cash flow—was struggling with inflation while competing against industry giants like Microsoft. The company’s cash reserves were diminishing due to inflationary pressures exacerbated by monetary policies during the COVID-19 pandemic.

In an interview with Bitcoin Magazine, George Mekhail—the Managing Director of Bitcoin for Corporations—elaborated on this strategy: “It traces back to Saylor’s origin story; he assessed his balance sheet and recognized his cash reserves were depleting and could not keep pace with inflation merely through bonds.”

After evaluating various options including gold investments, Saylor concluded that implementing a bitcoin treasury strategy was essential if he wanted to avoid selling off the company or retiring prematurely. On August 11th, 2020, Strategy declared its intention to adopt a bitcoin standard.

The company made headlines when it announced it would buy out any shareholders who disagreed with its bitcoin-focused strategy at a premium price. Shortly thereafter on December 7th of that year, they proposed a private offering worth $400 million in convertible senior notes which ultimately garnered $650 million due in 2025 at an interest rate of just 0.750%. With this maneuvering tactic employed by MicroStrategy allowed them access over half a billion dollars at negative real interest rates aimed at acquiring what is considered “the hardest money” available today,” noted Dylan Leclair back in 2021; Leclair currently leads similar initiatives for Metaplanet—the Japanese counterpart of Strategy within U.S markets.

Fast forward to now—by mid-2025—and non-endemic firms are beginning their own transitions toward incorporating bitcoin into their treasuries according to Mekhail’s observations regarding corporations outside direct involvement within cryptocurrency sectors adapting these practices too.

The Challenge Ahead

While several businesses have reaped undeniable rewards from adopting this treasury approach thus far—not every corporation has experienced favorable outcomes; some even trade below their actual bitcoin holdings value! Alex Wals—the Membership Experience Lead at ‘Bitcoin For Corporations’ told us via interview how “Many entities operating under ‘bitcoin sphere’ seem reliant upon rapid market cap growth without solid foundations underneath them whereas others such as Fold & Murano prioritize sustainable operations generating genuine revenue but receive less attention despite potentially being better positioned long-term especially amid bearish trends.”

A case study example can be seen through Fold Holdings Inc., listed under NASDAQ: FLD—which astonished investors recently revealing its substantial holding totaling up-to1492 BTC placing itself among top thirty-five firms based solely on total accumulated Bitcoins! As an American financial service provider centered around cryptocurrency rewards/payments/savings solutions since inception back-in-2014—they went public earlier this year following merger activities alongside FTAC Emerald Acquisition Corp.. Despite standing out prominently amongst successful crypto-centric enterprises today—it’s Market Net Asset Value (MNAV) remains below one presently measuring only .916 indicating stocks trading lower than actual digital currency assets held!

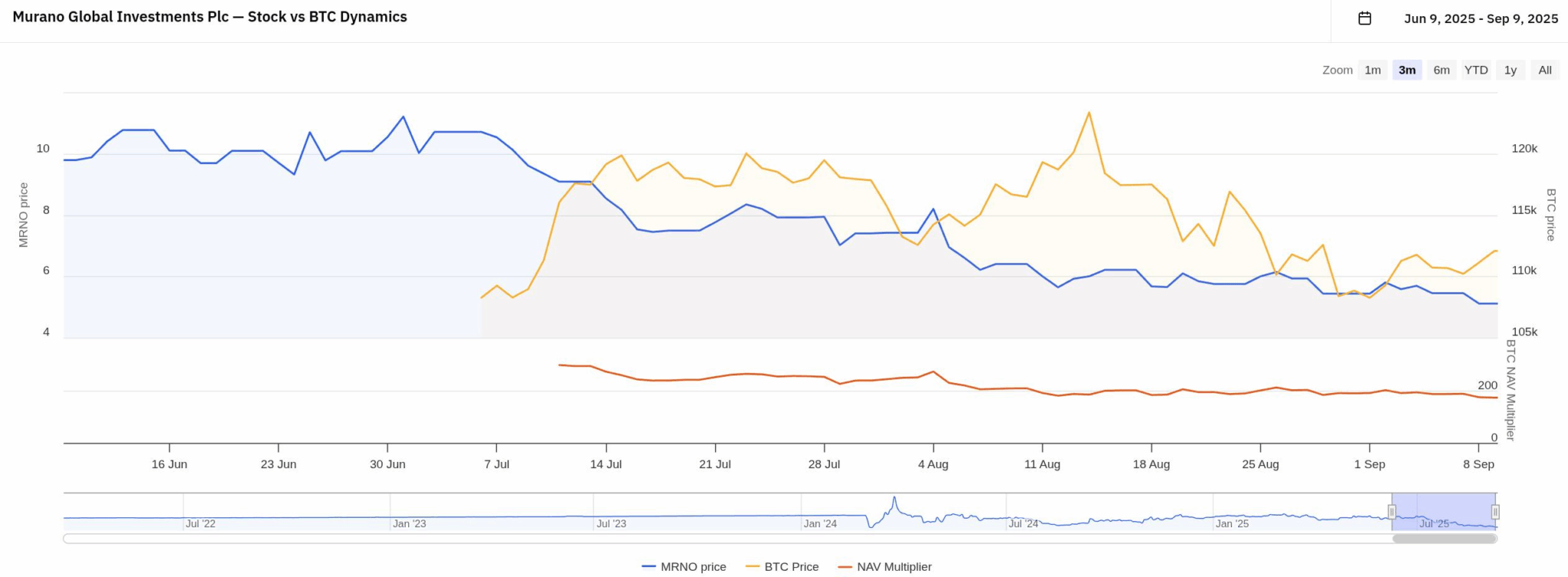

An equally intriguing scenario unfolds concerning Murano Global Investments PLC (NASDAQ: MRNO)—established way-back-in ’96 headquartered across London but focusing primarily within Mexico’s luxury hospitality sector developing high-profile properties such as Hyatt-operated Andaz resorts etc., boasting impressive annual revenues nearing730 million MXN (~$36M USD). Yet faced challenges resulting net losses amounting approximately3 billion MXN amidst expansion efforts underway…

This July marked pivotal change where they unveiled plans pivot towards building robust Treasury acquiring21BTC valued beyond $2M funded partly via operational cash flows coupled with$500M Standby Equity Purchase Agreement(S.E.P.A.) alongside joining ‘Bitcoin For Corporations’ initiative aiming accelerate corporate adoption further down road ahead!

Pursuing ambitious targets reaching10Billion dollar treasuries five years hence utilizing proceeds derived from ongoing purchases leveraging operational profits integrating crypto payments/rewards across hotel chains installing ATMs enhancing guest experiences while hedging against inflationary risks encountered along journey ahead…

Todays enterprise valuation hovers close near one Billion dollars however stock market capitalization falls short landing only432million according Yahoo Finance stats reflecting significant correction observed post-announcement dropping share prices from10.41 down towards5 .45 suggesting investor skepticism regarding firm direction transitioning towards embracing cryptocurrencies fully moving forward …

Differentiating Between Two Types Of Companies Adopting A Treasury Model

This disparity witnessed among emerging players venturing into establishing ‘bitcoin-treasury’ frameworks prompted analysts creating classification models dividing these entities into two distinct categories namely ‘pure-play’ accretive firms adhering strictly aligned strategies maximizing overall accumulation potential versus non-accretive sometimes peripheral participants simply adding btc onto balance sheets serving primarily store-value functions whilst optimizing other business metrics unrelated directly tied specifically towards crypto industries…

Mekhail elaborates further distinguishing between both broad classifications stating “Accretive organizations like Microstrategy garner maximum media attention owing volatility exhibited throughout stock performance leading speculations retail markets heavily influenced.” He added “Non-accretives still hold significance though; take Fold—they may not announce new acquisitions weekly because it’s not core focus area.”

Diving deeper analyzing prevailing sentiments surrounding investment evaluations conducted revealed investor interests appear concentrated elsewhere rather than solely assessing quantity present bitcoins residing balance sheets preferring alternative metrics surfacing lately such MNAV comparisons juxtaposing aggregate values existing btc holdings relative respective market caps per shares purchased yielding insights about potential returns associated each acquisition respectively…

“If valuations don’t reflect reasonable premiums compared MNAV broadly indicates shareholder beliefs doubting capabilities outperform spot pricing themselves perhaps stemming inability generate adequate cash flows funnelled directly toward btc accumulations coupled lack agility accessing capital markets swiftly raise equity/debt financing acquire additional coins increase ownership ratios accordingly,” Jain emphasized reiterating points raised during interviews conducted previously shared herein above highlighting importance education necessary enhance understanding corporate objectives aligning financial goals effectively…”

Navigating Investor Education & Opportunities Within Markets Today…

Companies striving elicit stronger responses marketplace after integrating cryptocurrencies successfully must engage actively targeted ongoing educational initiatives directed investors clearly articulating thesis surrounding rationale behind acquisitions emphasizing how leveraging benefits generated through consistent operational performances allow affordable access credit facilities enhancing overall profitability margins long term sustainability… Jain summarized succinctly emphasizing two critical components involved here namely obtaining intelligent credits plus ensuring robustness underlying businesses themselves remain intact avoiding distractions arising external factors disrupting progress achieved thus far…”

Investors meanwhile should closely examine select firms harboring longer-term perspectives related specifically focusing strategically incorporating digital currencies presenting lucrative opportunities awaiting discovery amidst evolving landscapes transforming rapidly around us daily basis influencing decision-making processes undertaken continually impacting future trajectories immensely… Mekhail reflected drawing experiences conversed previously highlighting once comprehension gained relating topics surrounding cryptos expectations naturally shift tending lean more favorably focused outlooks envisioning races akin gold rushes where speed becomes paramount essence driving success ultimately!”

Bitcoin Magazine is wholly owned by BTC Inc., which operates Bitcoin For Corporations, focusing on facilitating corporate adoption concerning matters involving cryptocurrencies encompassing diverse relationships forged established partnerships spanning multiple industries highlighted throughout article shared herein above…

This post titled “Saylor’s Innovative Approach Inspires Global Firms Toward Cryptocurrency Integration While Some Struggle To Realize Premiums!” originally appeared published first instance via publication channel referred above authored Juan Galt.”