Richard Teng, the CEO of Binance, reignited discussions about Bitcoin by describing it as the digital gold of our time — a comparison often made in recent years.

This time, Michael Saylor, whose company has famously turned its financial reserves into a substantial Bitcoin holding, simply replied with one word: “Yes.”

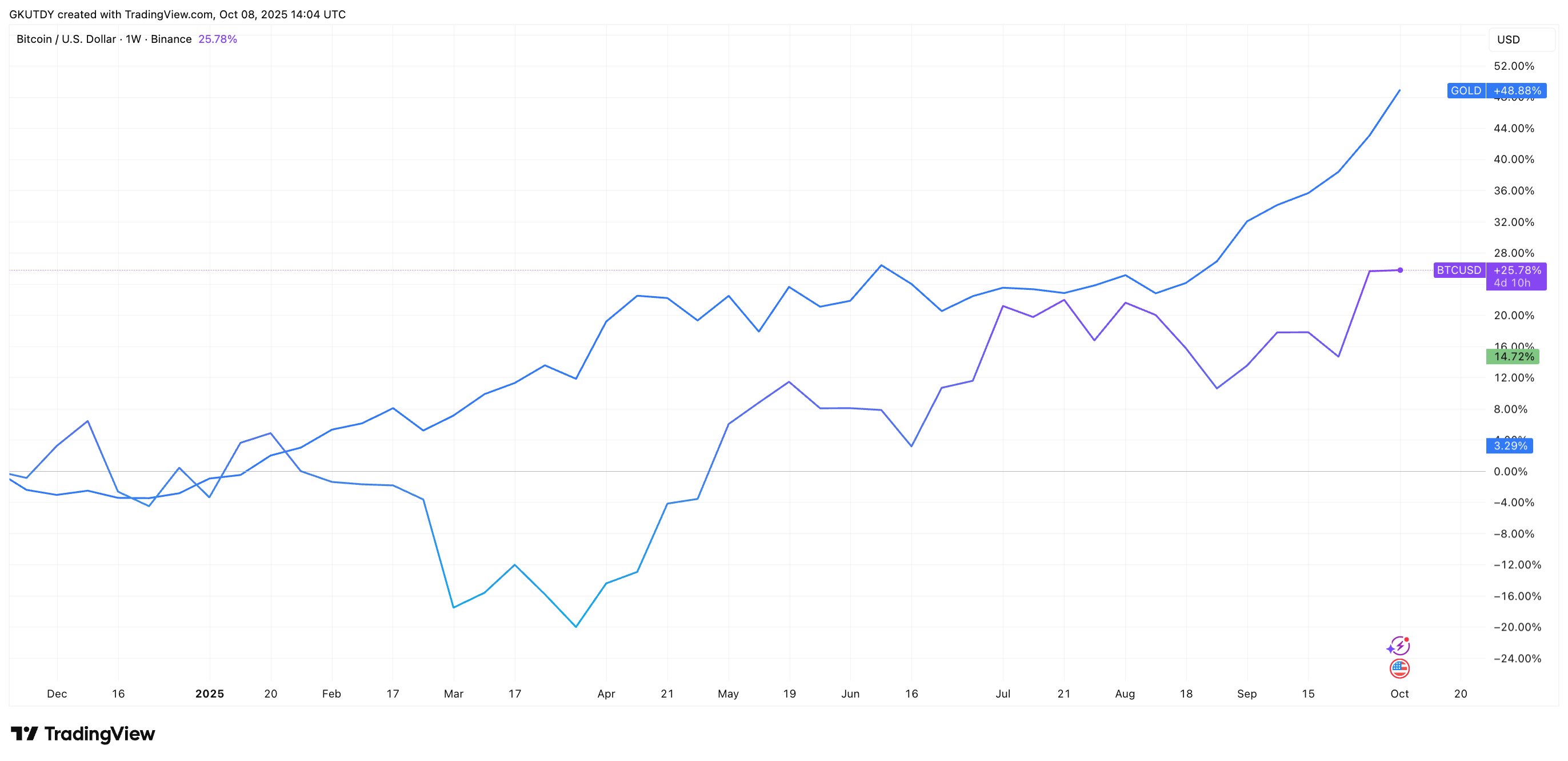

That brief affirmation signifies more than just agreement between two major figures in the crypto world. It is supported by a BTC-to-gold ratio chart showing that one Bitcoin is equivalent to roughly 30 ounces of gold. Although this is down from an earlier peak of 37 this year, it remains significantly above mid-2023 levels.

Yes

— Michael Saylor (@saylor) October 8, 2025

For investors and traders, this chart offers insights beyond mere slogans: it illustrates how cryptocurrency maintains its value compared to traditional wealth stores like gold, even after market corrections have lowered its price by thousands.

The Original Gold Outshines Its Digital Counterpart

The performance data for 2025 paints a different picture. Traditional gold has unexpectedly outperformed expectations with an increase of around 54%, while Bitcoin’s growth stands at approximately 30%. Thus, those who adhered strictly to the “digital gold” narrative might find that conventional metal still holds sway.

Saylor’s succinct “Yes” underscores his belief in Bitcoin’s cultural status as definitive digital gold, regardless of monthly performance fluctuations. His $78.9 billion investment serves as testament to his conviction that BTC embodies what he considers modern-day bullion.

Thus, when Teng makes such declarations and Saylor concurs, their message transcends short-term market trends:

;;Bitcoin has already evolved from being seen merely as speculative into becoming recognized widely as digital replacement for physical precious metals —a transformation not needing any further validation through new charts or data points.