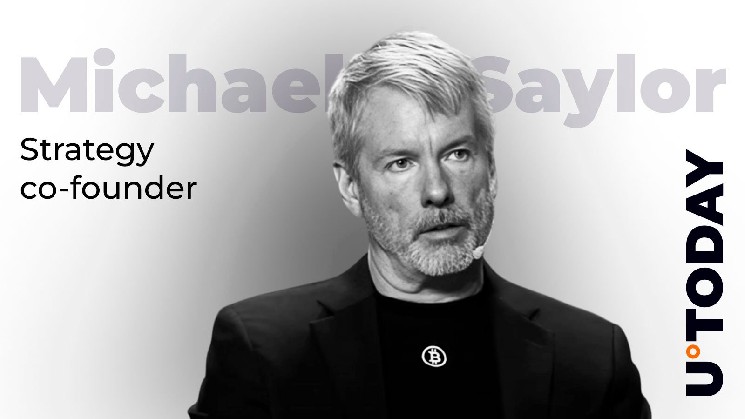

Michael Saylor, co-founder of Strategy, attributes the current selling pressure in the market to seasoned Bitcoin investors.

During a recent podcast discussion, he stated, “At this moment, I believe that the selling activity is primarily driven by crypto veterans who have held substantial wealth for an extended period.”

He further noted that the market is currently absorbing these coins and establishing a support base.

“Wealthy in Bitcoin but cash-poor”

In his podcast remarks, Saylor elaborated on why long-term Bitcoin holders are beginning to liquidate their assets.

He explained that many individuals possess significant amounts of Bitcoin but lack access to loans against it. Consequently, when they find themselves affluent in Bitcoin yet lacking cash reserves—essentially “Bitcoin rich but fiat poor”—they feel compelled to sell some of their holdings.

Saylor likened this situation to employees at a successful startup who suddenly become wealthy through stock options yet cannot leverage those assets for loans; thus they resort to selling them off.

However, he emphasized that this does not indicate a loss of faith in the cryptocurrency itself.

“They simply have practical needs like funding their children’s education or purchasing homes; they desire financial stability,” Saylor remarked.

Diminishing volatility

Saylor argues that when veteran Bitcoin holders sell as needed, it actually serves as a stabilizing force for BTC by reducing its volatility.

This stabilization could encourage institutional investors to engage more confidently with BTC.

‘It’s essential for volatility levels to drop so major institutions feel secure entering this market on a larger scale,’ Saylor clarified.