RippleX has recently unveiled its updated XRPL Institutional DeFi roadmap, focusing on compliance, lending, and privacy to attract regulated players onto the blockchain.

As Ripple’s developer and innovation arm, RippleX supports the XRPL ecosystem by funding projects and developing features such as tokenization and DeFi tools.

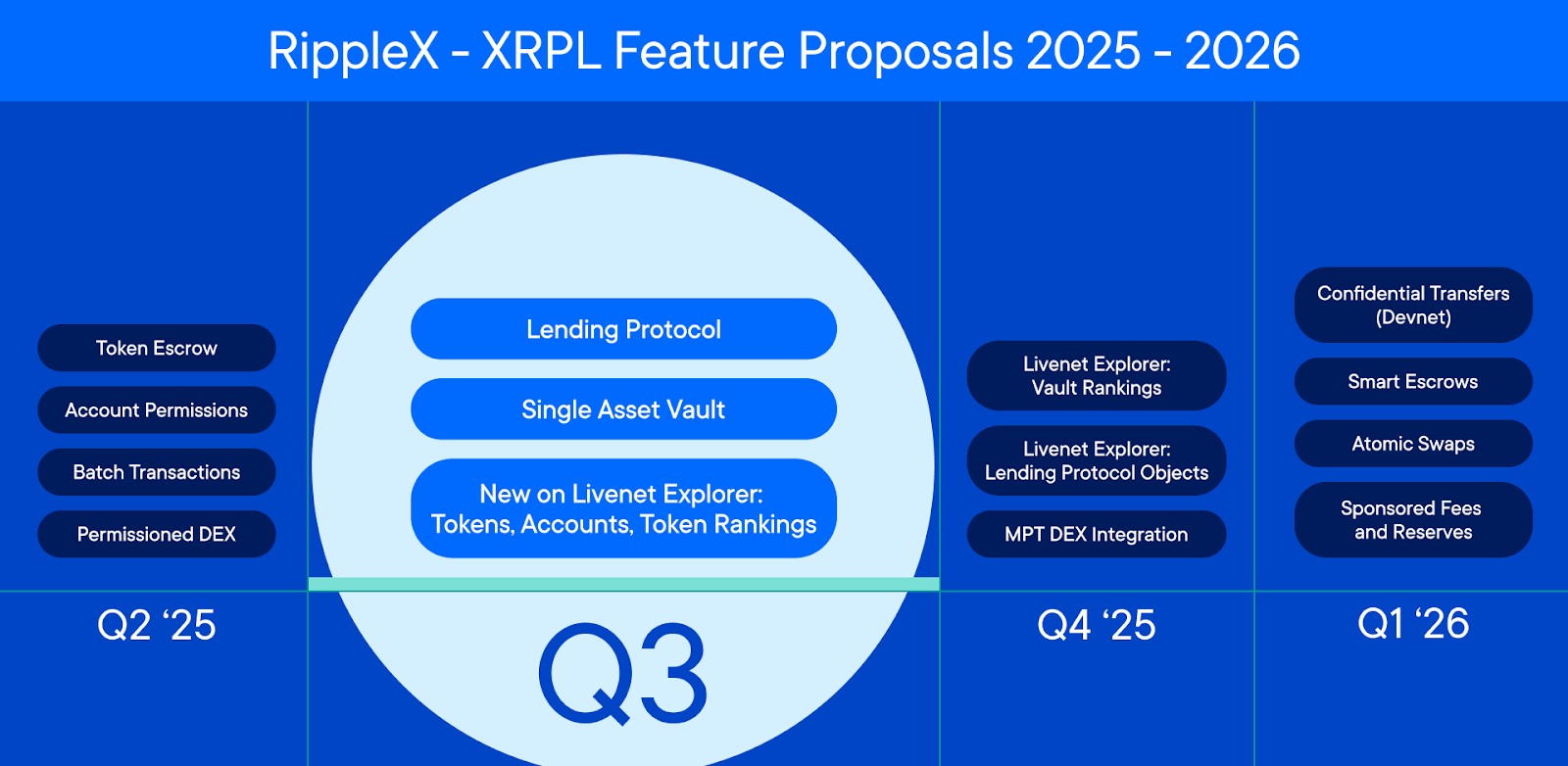

Roadmap Highlights

The roadmap emphasizes three key pillars for growth. Firstly, compliance features like Credentials and Deep Freeze are already operational. Secondly, a native lending protocol is set to launch with XRPL Version 3.0.0 later this year.

Additionally, zero-knowledge proof (ZKP) integrations are in progress to enable confidential transactions while meeting regulatory requirements. RippleX anticipates the introduction of confidential Multi-Purpose Tokens (MPTs) in early 2026.

RippleX XRPL Roadmap. Source: RippleX

The XRPL has achieved over $1 billion in monthly stablecoin volume, positioning itself among the top 10 chains for real-world asset activity. This milestone indicates rapid scaling of institutional DeFi according to RippleX.

“This momentum underscores XRPL’s evolution into a leading blockchain for real-world finance… What began as an ambitious vision for regulated on-chain finance is now rapidly becoming industry standard,” shared RippleX in a press release with BeInCrypto.

This trend aligns with the increasing adoption of digital assets in mainstream markets such as tokenization initiatives by government bodies like the US Department of Commerce putting macroeconomic data on blockchains like GDP and PCE Indexes mentioned by BeInCrypto earlier this year…

The Challenge Ahead

Ethereum remains dominant in DeFi along with its Layer 2 solutions; however Solana and Avalanche are also making strides towards tokenization and institutional acceptance…

…

…

…

…

…

…