The perceived threat of quantum computing to Bitcoin is frequently regarded as a distant concern. However, a closer examination reveals that its effects may already be manifesting.

Recent studies and movements within financial institutions indicate that the urgency surrounding this issue might be accelerating more rapidly than anticipated.

Quantum Computing’s Impact on Bitcoin—Not What You Think

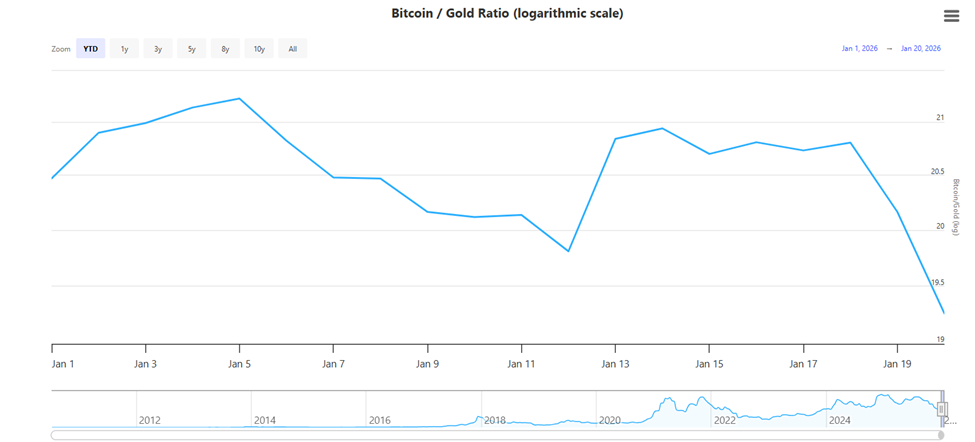

The recent decline in Bitcoin’s performance compared to gold has caught the attention of institutional investors. This downturn isn’t attributed to conventional market dynamics but rather to risks posed by quantum computing (QC) that could potentially jeopardize its cryptographic foundations.

Strategists are beginning to view these threats as serious considerations, prompting shifts in portfolio strategies and sparking discussions about the long-term viability of Bitcoin’s security measures.

A report from BeInCrypto highlighted Jefferies strategist Christopher Wood’s decision to eliminate a 10% allocation in Bitcoin from his flagship “Greed & Fear” model portfolio, redirecting those funds towards physical gold and mining stocks.

Wood expressed worries that advancements in quantum computing could render Bitcoin’s Elliptic Curve Digital Signature Algorithm (ECDSA) keys vulnerable, thereby undermining its value retention narrative.

“Financial advisors take note of this type of research and tend to keep client allocations minimal or nonexistent because they see quantum computing as an existential risk. It will continue to weigh heavily on BTC until solutions are found,” remarked batsoupyum, a well-known user on X.

This caution is supported by research; a study from Chaincode Labs predicts that between 20-50% of active Bitcoin addresses may be susceptible to future quantum attacks due to reused public keys. Approximately 6.26 million BTC, valued at around $650 billion-$750 billion, could be at risk.

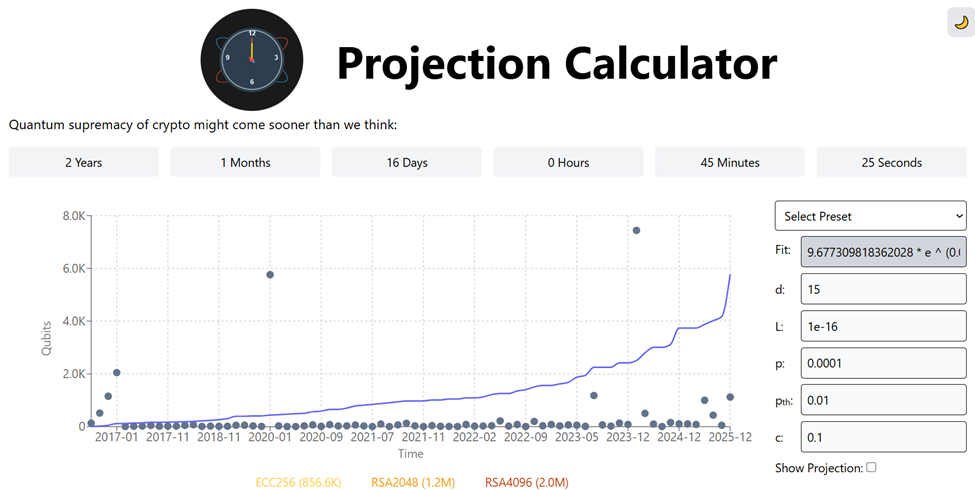

Additonally, data from the Projection Calculator illustrates this imminent danger by showcasing exponential growth trends in quantum hardware capabilities over time.

The rapid increase in qubit counts for quantum machines—especially following Google’s projected milestones for 2025—makes it increasingly likely that cryptographically relevant quantum computers (CRQCs) will become reality sooner than later.

The decentralized nature of Bitcoin exacerbates these challenges. Unlike traditional banks capable of mandating upgrades through centralized governance structures, any changes within the Bitcoin network must occur through consensus across its distributed framework.

No formal risk management committee exists; there is no authority with the power or mandate for immediate action when needed most urgently!

“I used to dismiss concerns regarding QC risks affecting Bitcoin as exaggerated; I no longer hold such views,” Jamie Coutts commented. “The typical counterargument suggests QC hasn’t been an issue historically—and if it becomes one now then all financial systems face dire consequences anyway… [Bitcoin] can technically undergo upgrades but achieving consensus requires slow coordination across decentralized networks where no single entity can dictate ‘we’re making changes now.'”

A Growing Concern: Quantum Computing Risk Looms Over Institutional Interest In BTC

This apprehension has begun reflecting itself within market behaviors too! Year-to-date figures show Bitcoins underperformance against Gold has dropped down by approximately six-and-a-half percent during twenty-sixteen while Gold surged fifty-five percent upwards! The current BTC/gold ratio standing at nineteen-point-two-six aligns closely with advisor hesitations regarding investment strategies moving forward!

Divergence among institutional responses further highlights varying perspectives toward potential risks involved here: While Wood opted for reduced exposure levels altogether Harvard reportedly increased their holdings significantly – nearly two hundred forty percent!

Harvard ramped up bitcoin investments during Q3 rising dramatically from $117m ot $443m alongside boosting gold ETF allocations substantially ($102m -> $235m).

Consider this carefully – Harvard chose not only debasement trades but allocated twice more into bitcoin relative compared with gold.Simiarly Morgan Stanley began advising clients managing wealth portfolios suggesting allocations reaching four percent towards digital assets whereas Bank Of America permits ranges between one-fourth percentages.

This demonstrates support isn’t disappearing entirely—it simply manifests differently based upon distinct assessments concerning associated hazards ahead! Still some experts believe overall likelihood remains low yet impact substantial should things go awry especially David Duong who cites two main threats emerging namely ECDSA key breaches along SHA-256 targeting which underpins proof-of-work mechanisms utilized by bitcoins infrastructure today…

.Pockets vulnerable include legacy Pay-to-Public-Key scripts certain multisignature wallets exposed Taproot setups—all requiring careful address hygiene practices avoiding reuse transferring coins onto safer options resistant against impending quantumn assaults being deemed critical mitigation strategies necessary going forth!!

.

NIST finalized post-quantum cryptography standards back last year providing guidance pathways safeguarding future endeavors however adoption complexities persist surrounding bitcoins architecture hindering swift transitions taking place effectively thus far… Charles Hoskinson warns premature implementations might drastically reduce efficiency whilst DARPA indicates meaningful threats surfacing possibly occurring sometime next decade(s)..

Yet rapid advancements indicated via projection charts suggest timelines may accelerate particularly if AI integrations compress developments occurring rapidly hereafter!! .

This ongoing dialogue regarding quantumn computational questions shifted away mere theoretical realms becoming tangible impacts felt throughout portfolios presently observed today… Bitcoins lagging performance reflects not solely cyclical fluctuations rather growing weight existential uncertainties shaping capital allocation decisions forcing networks confront unprecedented technical challenges unlike anything faced previously before!!!

.

Until fully coordinated efforts yield successful outcomes resulting ultimately establishing resilient upgrade protocols against quantumn threats present realities continue weighing heavily upon btc’s neck indeed real challenge lies ahead!!!

.

The article titled “Quantum Computing Is Already Hitting Bitcoin—Here’s How” originally appeared first published via BeInCrypto website ! ”*