Bitcoin enthusiasts based in the United States might feel like they’re caught in a recurring pattern: waking up to see bitcoin performing well, only to watch its value decline during U.S. market hours.

This perception is actually grounded in reality.

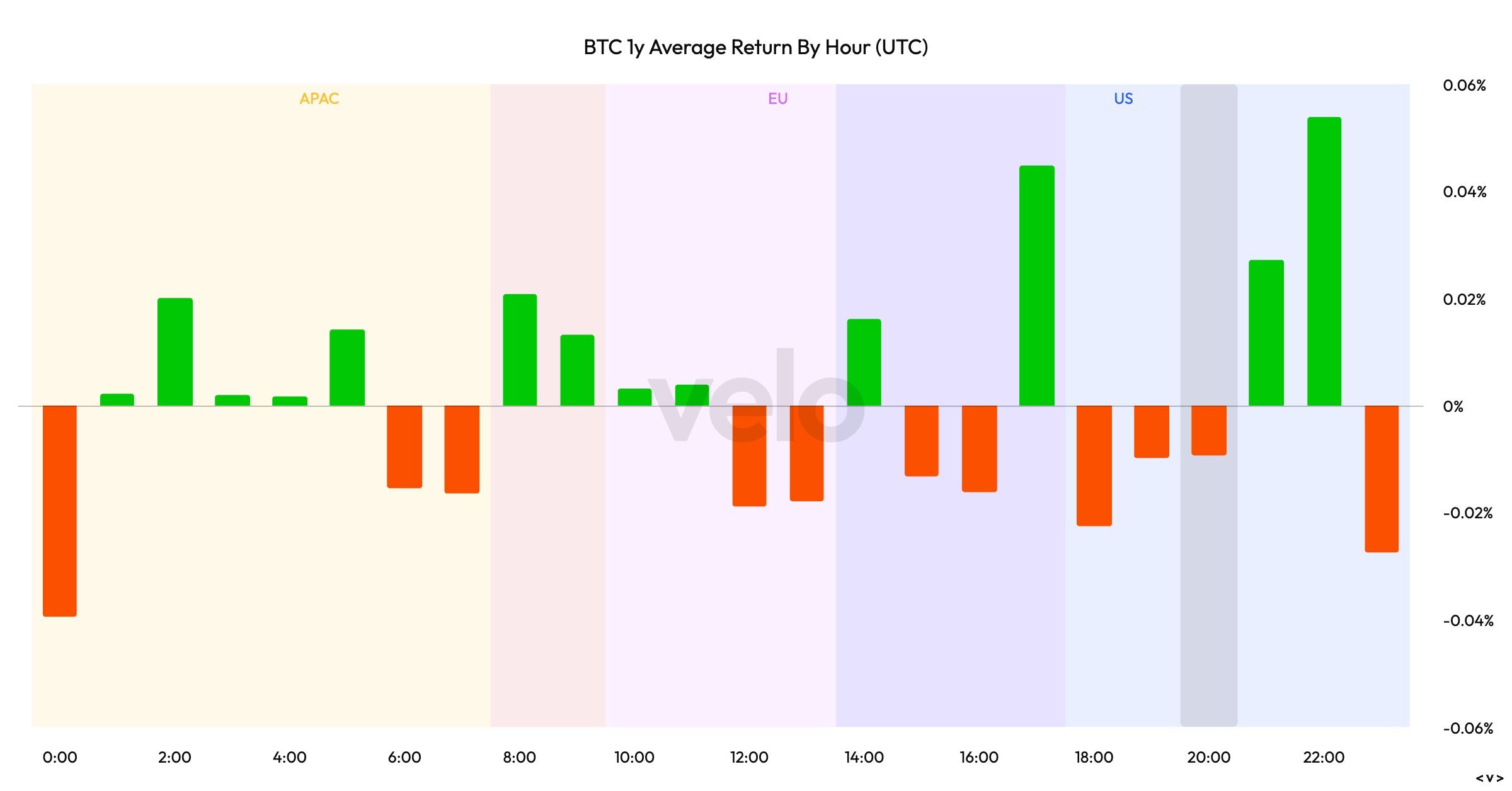

According to data from the crypto analytics platform Velo.xyz, over the last twelve months, bitcoin tends to gain value when traditional U.S. stock markets are closed and lose ground when those markets are open.

Eric Balchunas of Bloomberg noted that this trend of stronger bitcoin performance outside U.S. trading hours has continued into 2024. He suggested that this could be influenced by spot ETFs or derivatives positioning affecting price movements.

Capitalizing on this insight, Nicholas Financial Corporation—a boutique wealth management firm—has submitted an application with the U.S. Securities and Exchange Commission (SEC) for a unique bitcoin ETF designed specifically for overnight holdings.

The proposed fund, named Nicholas Bitcoin and Treasuries AfterDark ETF (NGTH), plans to purchase bitcoin at 4 p.m. Eastern Time after U.S. markets close and sell it by 9:30 a.m., just before trading resumes the next day. During daytime hours when markets are active, it would shift investments into short-term U.S. Treasury securities aiming both to protect capital and earn yield.

Additionally, Nicholas Financial has filed for another product called the Nicholas Bitcoin Tail ETF (BHGD).

If approved by regulators, these ETFs would introduce an innovative approach within the expanding landscape of bitcoin investment options by incorporating time-of-day as a strategic element in asset management.