Oklahoma has proposed new legislation that would enable state workers, contractors, private enterprises, and residents to receive payments in bitcoin.

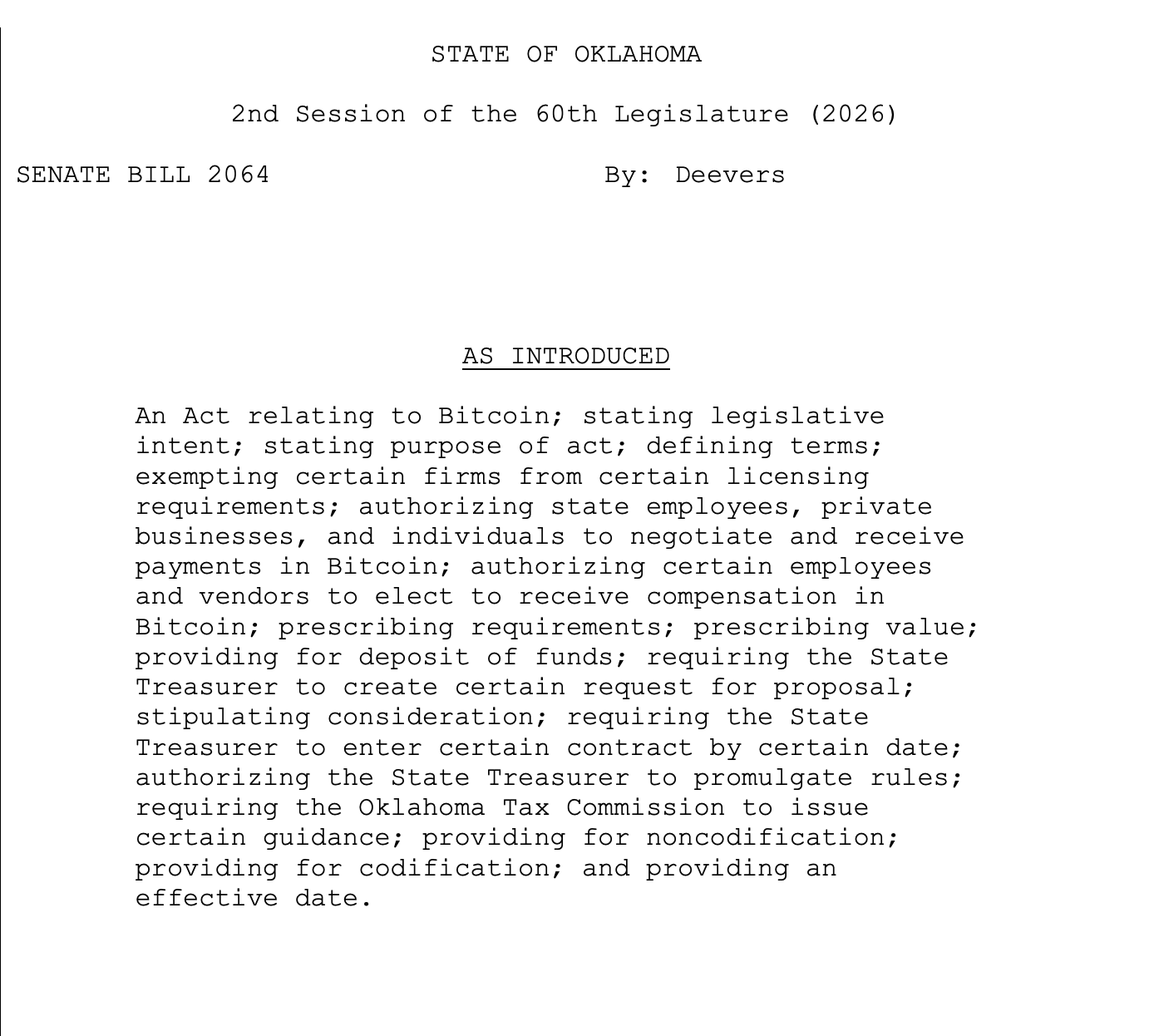

The bill, known as Senate Bill 2064 and introduced by Senator Dusty Deevers during the 2026 legislative session, aims to create a legal structure for using bitcoin as a form of payment and compensation without declaring it official legal tender.

This legislation clarifies that it does not violate the U.S. Constitution’s restrictions on states issuing currency or recognizing anything other than gold and silver as legal tender. Instead, it treats bitcoin as a financial asset functioning within current laws.

If passed, Oklahoma state employees could choose to have their salaries paid in bitcoin based on its market value either at the start of their pay period or at payment time.

Employees would be able to change their preferred payment method each pay cycle and opt for compensation in bitcoin, U.S. dollars, or a mix of both currencies.

Payments could be sent directly into wallets controlled by employees themselves or into third-party custodial accounts designated by them.

The bill also permits vendors working with the state government to select receiving payments in bitcoin per transaction. The value would reflect market prices at transaction time unless otherwise agreed upon contractually.

Beyond government payrolls and contracts, this law encourages private businesses and individuals throughout Oklahoma to voluntarily negotiate transactions using bitcoin as an accepted medium of exchange across the local economy.

BREAKING: Oklahoma unveils legislation allowing public sector staffers, businesses, and citizens to accept Bitcoin payments

pic.twitter.com/2HjQr4PVLM

The bill includes measures designed to ease regulatory burdens on companies operating exclusively with digital assets. Businesses dealing solely in cryptocurrencies without converting them into U.S. dollars will be exempt from money transmitter licensing requirements under Oklahoma law according to SB 2064’s text.

The legislation instructs the State Treasurer’s office to solicit proposals from digital asset firms capable of managing bitcoin transactions for both employees and vendors involved with state operations.

When choosing a service provider, considerations must include fees charged, speed of processing transactions, cybersecurity protocols implemented by providers,

custody options available for funds held digitally,

and compliance with any applicable licenses issued within Oklahoma.

The Treasurer is expected

to finalize an agreement no later than January 1st,

2027

, while also having authority

to establish rules necessary for administering this program effectively.

Earlier efforts date back

to January 2025 when Senator Deevers presented similar proposals under what was called “Bitcoin Freedom Act” (SB 325). That initiative sought voluntary acceptance frameworks enabling workers,

vendors,and businesses alike — a regulated environment fostering cryptocurrency use statewide.

<h2> ;Oklahoma’s Bitcoin Integration Mirrors Other States’</h2> ;

This legislative development follows precedents set by states such as New Hampshire &amp;amp;amp;amp;amp;t Texas exploring integration strategies linking Bitcoin directly with public finance systems.

New Hampshire pioneered America’s first Strategic Bitcoin Reserve statute allowing up <sup> ;5%</sup> ;&'s worth holdings among high-value digital assets plus authorization toward municipal bonds backed via BTC.

Texas meanwhile has matched laws alongside practical steps including creating its own Strategic Bitcoin Reserve fund along purchasing roughly $5 million through first-ever US State-sponsored BTC ETF acquisition framing these moves both hedges against economic instability plus modernization drives aimed at fiscal governance improvements.

If enacted SB 2064 becomes effective November 1st ,&';26 positioning Oklahoma amongst emerging few American jurisdictions actively embedding cryptocurrency mechanisms within governmental remuneration workflows.&';

<P> ;Additionally ,the Tax Commission will need issue clear guidance concerning taxation related specifically toward digital assets received via wages/payments no later than January first ,2027 helping resolve longstanding uncertainties faced by employers/employees alike regarding crypto income treatment .

<P& ;gt This article titled &ldquo Oklahom Introduces Bill Allowing State Employees Vendors To Be Paid In Bitcoin&rdquo originally appeared on Bitcoin Magazine authored Micah Zimmerman . </P& ;gt