The price of Bitcoin (BTC) dropped below $105,000 on Friday, bringing back memories of past capitulation phases where discouraged traders marked the beginning of significant reversals.

Despite the prevailing negative sentiment in headlines, some seasoned analysts suggest that October’s downturn might be laying the groundwork for another remarkable recovery.

October’s Decline Prompts Accumulation—Resonances with Previous Cycles

Some traders are comparing today’s market conditions to late 2020 when Bitcoin was valued around $12,000—significantly lower than its previous all-time high—before it surged by 170% within a single quarter.

“It felt lifeless. Everyone shifted to equities, SPACs, GME. Crypto seemed hopeless… then an extraordinary outperformance occurred. None of this price movement can deceive me,” one investor remarked.

On-chain data supports this viewpoint. Glassnode reports robust net accumulation among smaller Bitcoin holders (1–1,000 BTC) since early October despite prices dropping from $118,000 to $108,000.

The platform’s Trend AccumulationScore indicates renewed confidence from retail and mid-sized wallets while large holders have paused their distribution activities.

Smaller BTC holders are stepping up.

Strong accumulation is underway among small to mid-sized cohorts (1–1000 BTC), while large holders have slowed distribution signaling renewed confidence despite recent shakeout. pic.twitter.com/LYFeGjrc3k— glassnode (@glassnode) October 16, 2025

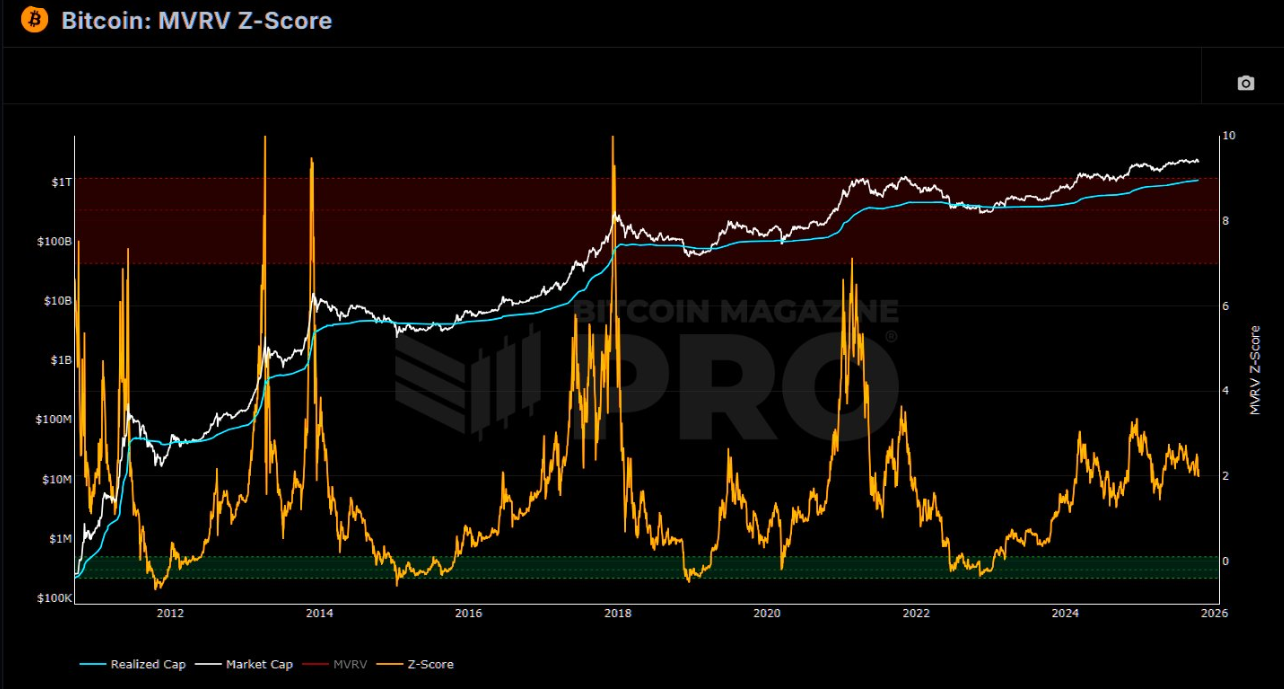

Meanwhile, Stockmoney Lizards notes that Bitcoin’s MVRV Z-Score—a metric comparing market value to realized value—is near 2.15, a zone historically linked with accumulation rather than euphoria.

“The pattern is crystal clear… Below 2 means pain city for holders—smart money accumulates. We’re far from overheating, plenty of runway left,” they wrote.

Bitcoin MVRV Z Score Source: Stockmoney Lizards on X

Analyst Axel Adler identifies $106,000–$107,000 as Bitcoin’s crucial support range warning that losing this level could trigger a retest at $100,000 where the yearly moving average lies.

If this base holds “the market structure remains bullish,” Adler asserts

The main support zone is currently concentrated in the $106K–107K range(SHTM – Realized Price – SMA200D).Lossing this zone will lead to testing at$100K where yearly moving average(SMA365D) passes.As long as base holds ; ;market structure remains bullish.pic.twitter.com / D9PWhViCs

— Axel 💎🙌Adler Jr(@AxelAdlerJr )October17 ; ;2025Sweeping Changes and Cyclic Exhaustion

However macro voices like CredibleCrypto caution against ignoring bigger picture.He points out Bitcoins entire16-year history has overlapped with equities own16-year bull cycle both potentially nearing exhaustion .

“Crypto will enter its first secular bear market simultaneously traditional equities may face theirs ,”they said predicting devastation across board . “

That scenario contrasts sharply view analyst Miles Deutscher who maintains Bitcoins digital gold narrative eventually decouple risk assets . “

In short term ,BTC behaves risk asset(been case entire year ).This trend correct until proven otherwise.But I believe longer term digital gold narrative prove true.And when happens ceiling now much higher..https://t.co/XB4bxyAqJH”</ P

— Miles Deutscher(@milesdeutscher )October17 ; ;2025 "</ BLOCKQUOTE</h

<P Quant-based forecaster Timothy Peterson adds nuance debate.His AI model still gives bitcoin75 % chance finishing october above114 K arguing even bad scenario50 % upside here."</P

$114 K )bitcoin.pic.twitter.com/pjFFhpIQb”</P

— Timothy Peterson(@nsquaredvalue )October16 ; ;2025"</BLOCKQUOTEP Notably just about two weeks left end october bitcoin trading105232 down over4 % last24 hours."</P

IMG DECODING ASYNC SRC HTTPS CNEWS24 RU UPLOADS46C44554181AF038E43215554B03D588143D91 SIZE1622736 ALT BITCOIN PRICE PERFORMANCE SOURCE BEINCRYPTO"

Cycle analysts echo optimism.Trader Cyclop calculates bitcoins prior bull markets each lasted roughly1064 days placing current cycle within90 days potential peak november december25."

BLOCKQUOTE

P Entering bull markets most dangerous yet rewarding stage warned Winners average winners losers average losers.""

BLOCKQUOTEP Meanwhile JDK Analysis dismisses bearish victory laps premature reminding followers every prior bull cycle lengthened time."BLOCKQUOTEP DIRLTR Sentiments low Emotional unstable bears already taking victory laps Reduced volatility shorter cycles When every past bull cycle no matter how look got longer Nah tops NOT yet Short-term pain might not over though NFA #Bitcoin BTC pic.twitter.com/s6HmYHj7Nz BLOCKQUOTEP

H Technicals Tighten Bulls Defense H

P Technically bitcoin clings200-day EMA investor Lark Davis calls bull-bear line.Failure hold open path toward100 K support bounce validate accumulation thesis."

BLOCKQUOTEP Clinging onto day EMA This bulls need get shit together defend line Failure could see us testing k support wrote Davis.""

P With chain data flashing strength beneath surface traders split between despair determination bitcoins lull shaping pivotal inflection point."

P However conviction markets smallest buyers determine whether pause breakdown quiet parabolic run."

Post Market Outlook October Accumulation Hints Historic Bottom appeared BeInCrypto."