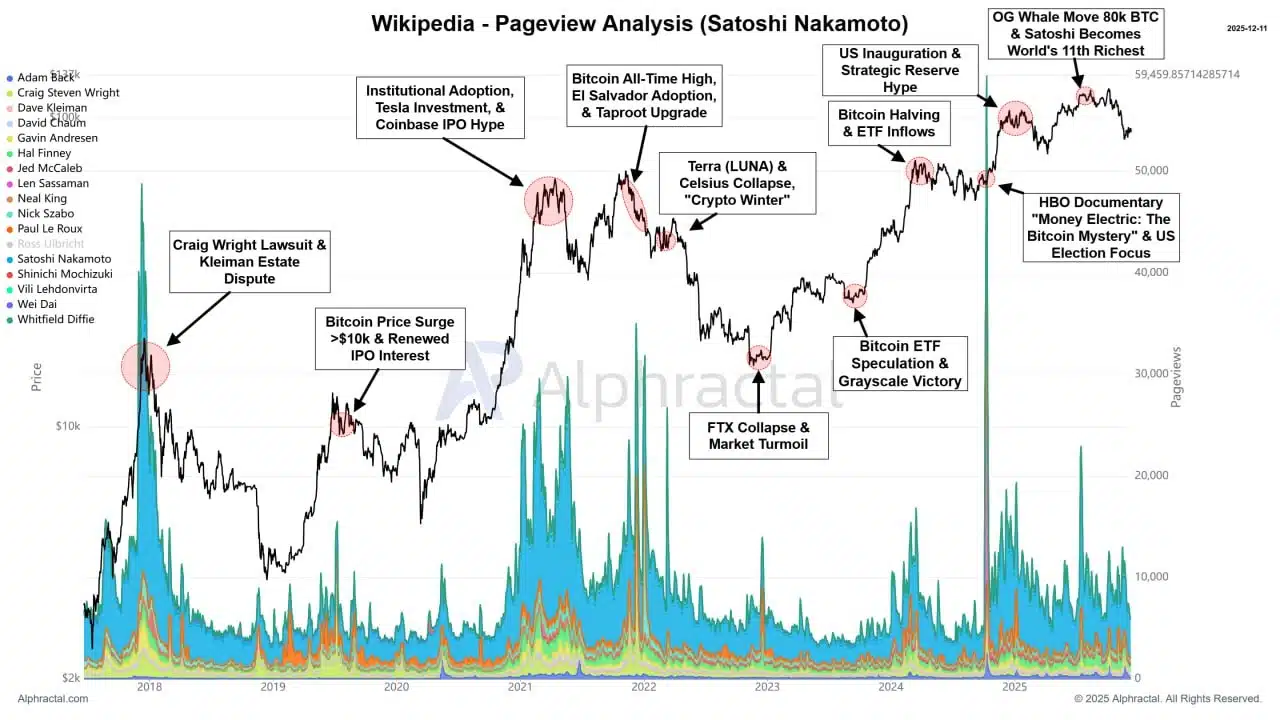

Alphractal, a firm specializing in cryptocurrency analytics, recently released an insightful study exploring the connection between public interest in Bitcoin’s mysterious creator, Satoshi Nakamoto, and the fluctuations within market cycles.

The researchers analyzed Wikipedia page view statistics alongside Bitcoin price trends to uncover a less commonly examined metric reflecting investor sentiment. Their findings highlighted a notable correlation between spikes in attention toward Satoshi Nakamoto and key turning points in the market.

According to Alphractal’s report, heightened search activity related to Satoshi often emerges during bullish phases and tends to serve as a “bearish indicator.” These sudden surges usually align with moments when market optimism reaches its zenith and upward momentum begins fading. The study pointed out specific instances such as the legal controversies of 2018 and increased institutional involvement throughout 2021 as clear examples of this phenomenon.

Conversely, their research also identified scenarios where rising interest signaled positive developments. After periods of price consolidation following significant downturns, sharp increases in searches for Satoshi have historically marked potential bottoms and suggested that capitulation was concluding. The panic triggered by the FTX collapse was cited as one of the most striking cases illustrating this pattern.

The year 2025 introduced an intriguing twist to these dynamics. Speculations about a US Strategic Reserve initiative combined with movements involving approximately 80,000 BTC from dormant wallets reignited global curiosity about Nakamoto. This surge propelled him into rankings among the world’s top eleven wealthiest individuals—adding complexity to how price cycles interact with collective knowledge-seeking behavior.

In its current evaluation, Alphractal observed that recent interest levels surrounding Satoshi have dropped considerably. Whether this decline reflects widespread “market indifference” or hints at an emerging new narrative remains uncertain. The analysts cautioned investors that similar quiet phases historically preceded significant shifts and encouraged vigilance regarding these subtle signals moving forward.

*Please note: This content does not constitute financial advice.*