Litecoin (LTC), a cryptocurrency often dubbed “digital silver,” is striving to reclaim its past prestige. While the network’s core strengths and utility remain robust, its market value does not currently mirror these intrinsic qualities.

There are several indicators suggesting that Litecoin’s momentum is on an upswing as we approach the year’s end.

Insights into Transaction Values, Potential Litecoin ETF, and More

Nate Geraci, a seasoned expert in the field, has noted that the US Securities and Exchange Commission (SEC) is poised to deliver final verdicts on applications for spot crypto ETFs in the near future.

The application for a Canary Litecoin ETF stands at the forefront. A decision regarding this will be made by October 2nd. Following this will be determinations concerning other cryptocurrencies like SOL, DOGE, XRP, ADA, and HBAR.

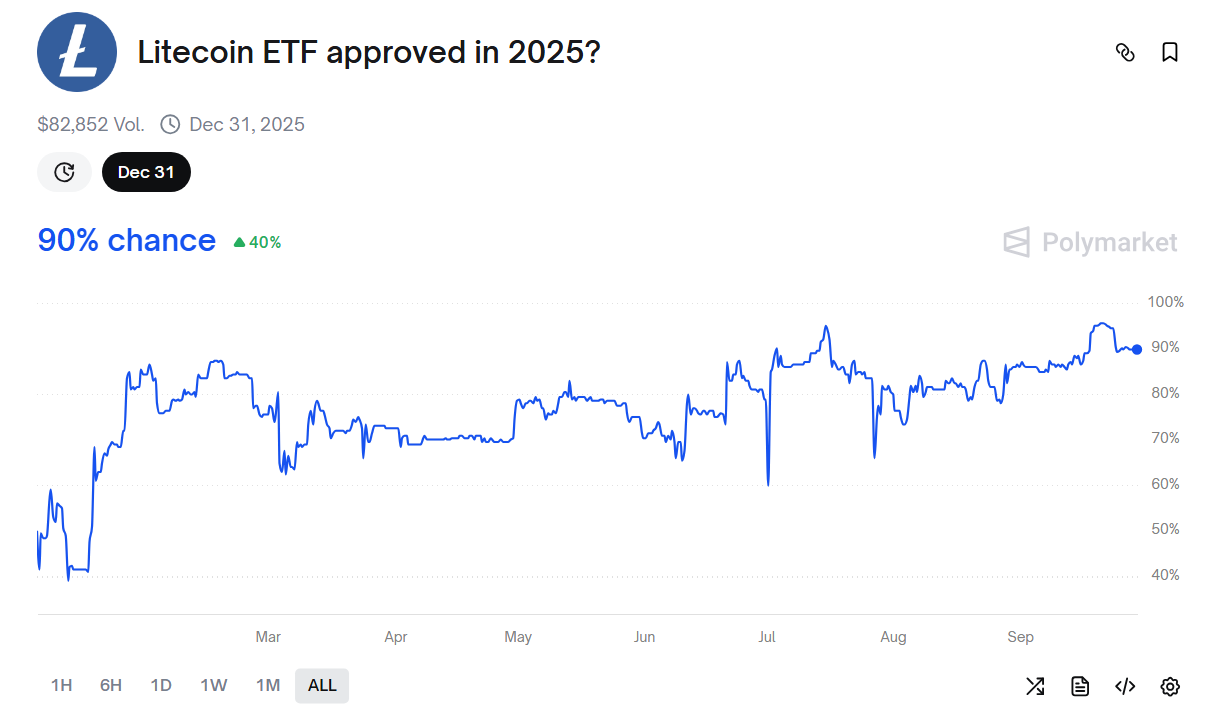

The prediction platform Polymarket currently assigns a 90% likelihood of regulatory approval for a Litecoin ETF by 2025. This outcome enjoys significant confidence from investors.

Litecoin ETF Approval Possibility in 2025. Source: Polymarket

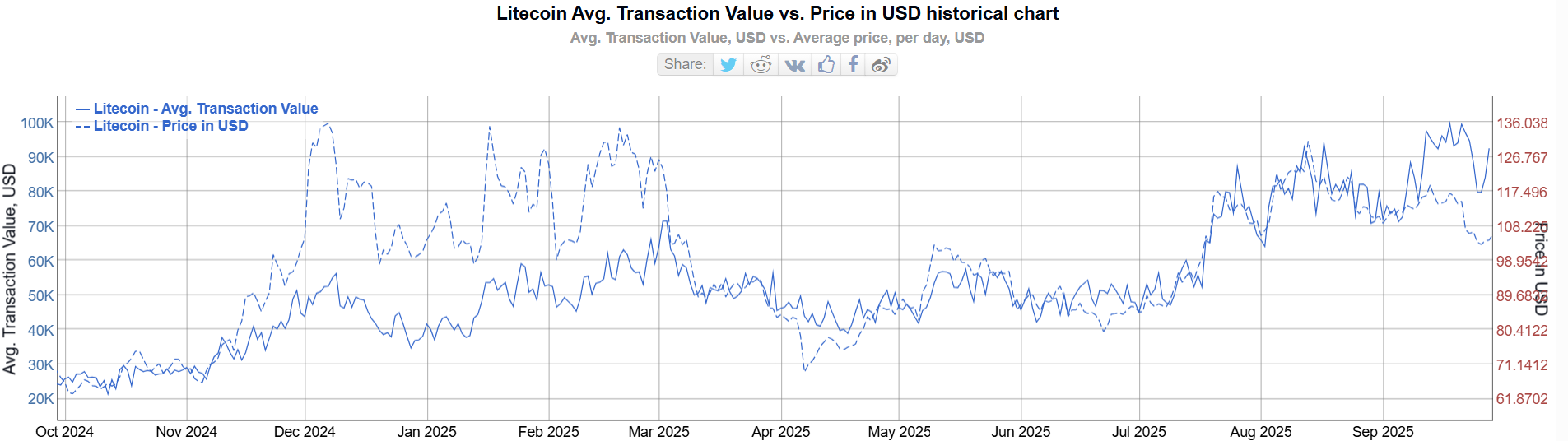

Moreover, there has been an increase in Litecoin’s average transaction value over two years—a clear indication of heightened large-scale transactions within its network.

According to BitInfoCharts data, average transaction values surged from $25,000 at late-2023 levels to nearly $100,000 by September 2025—quadrupling previous figures and marking their highest point in two years.

Average LTC Transaction Value. Source: Bitinfocharts

This uptick is particularly notable given that LTC’s price remained steady around $100 without reaching new peaks—suggesting increased movement across its network through either payment or accumulation activities.

Share of Supply Distribution of Wallet Addresses Holding Between 10,000and 100,0

Santiment data supports this theory—with wallet addresses holding between 1, & ;#50;, & ;#51;,& ;#52;. The CoinGate report reveals how dominant it remains among consumer payments processed via their platform—from January through August alone representing over thirteen percent compared against Bitcoin twenty-three percent share followed closely behind Tether USD Token capturing twenty-one point two percent respectively.

Lite coin ’ s Dominance Consumer Payments Coingate

Coin Gate reports state,” Lite coin payments remain consistent throughout each year showing higher usage whenever competing assets face challenges rather than being seen merely marginal alternative proven capable capturing meaningful shares when circumstances change signifying resilience user trust.”

These encouraging signs adoption lead many analysts argue undervalued relative utility delivered networks.

<P However fierce competition persists amongst other cryptocurrencies such Ethereum Solana Ripple Stellar Lumens all solidifying roles within decentralized finance global payment ecosystems hence offering strong alternatives investor portfolios beyond just focusing solely upon investing into lite coins themselves alone…!Analyst Master predicts,” lite coins least fifty times undervalued actually more once prices go vertical catch next wave adoption likely sending another tenfold increase resulting five hundred times under valuation current levels!”

The post From buzz surrounding potential ETFs increasing activity across networks why might lead fourth quarter appeared first BeInCrypto…