Lightspark, a startup focused on the Bitcoin Lightning Network and founded by former Meta executive David Marcus—who previously led the development of Meta’s Libra cryptocurrency—is advocating for using BTC as a means of everyday payment rather than merely as a long-term investment.

On Wednesday, February 18th, Lightspark announced a partnership with Cross River Bank, an FDIC-insured bank known for its crypto-friendly approach. This collaboration aims to enable round-the-clock settlement of Bitcoin transactions within the U.S. banking infrastructure.

Cross River Bank has established itself as an essential financial partner for many crypto companies in the United States. It offers banking services to notable firms like Circle and Coinbase, especially supporting card programs and stablecoin-related operations.

Through this partnership, Lightspark will handle transaction processing on the Lightning Network while Cross River will manage fiat settlements via faster payment platforms such as FedNow. The joint effort focuses on business-to-business (B2B), cross-border payments, and retail transactions where instant settlement significantly enhances cash flow management.

Lightning Network Usage Surpasses Locked Value

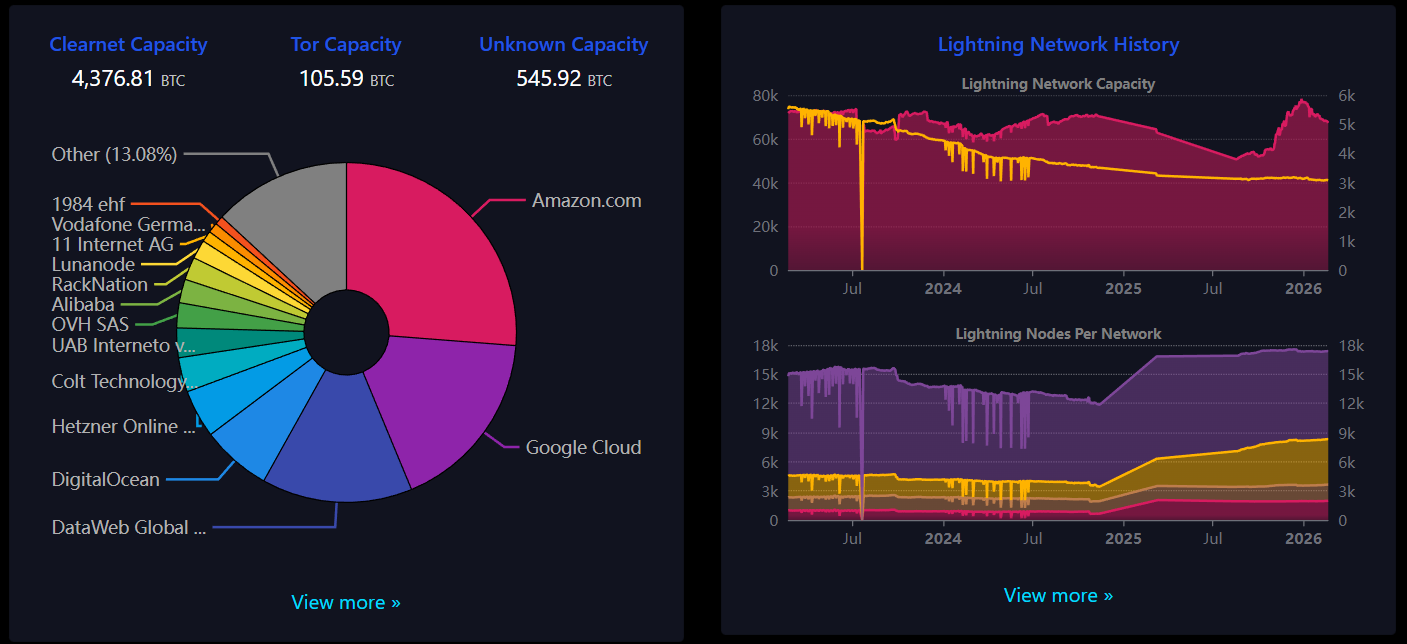

The Lightning Network has experienced robust yet inconsistent growth so far. Its total network capacity reached record levels toward late 2025 but slightly declined by mid-February this year. According to DefiLlama data, total value locked (TVL) currently hovers around $338 million—a figure likely affected by recent downward trends in Bitcoin’s price.

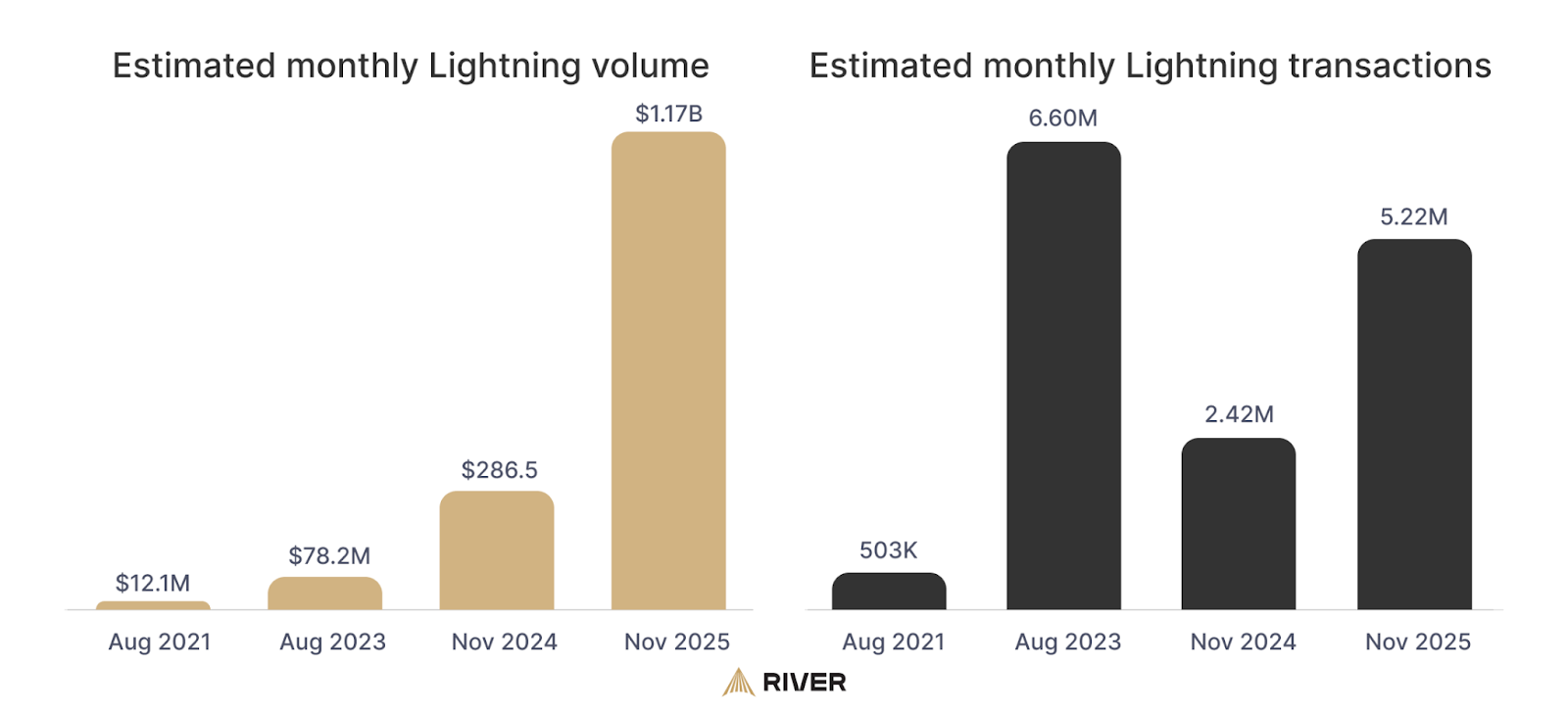

Although TVL remains modest compared to Ethereum Layer 2 solutions, Sam Wouters—the marketing director at Bitcoin infrastructure company River—reports that in November 2025 alone the network processed approximately $1.17 billion across more than 5.2 million transactions. The average transaction value on Lightning was about $223 during that period.

Nevertheless, Wouters pointed out that currently “the predominant use case for Lightning payments is transferring funds between exchanges,” underscoring how much further development is needed before it becomes widely adopted for retail payments.

Mempool.space data also reveals increasing centralization within network infrastructure: over 40% of all Lightning nodes are hosted by just two providers—Amazon Web Services and Google Cloud—with Amazon alone powering more than one-quarter of these nodes.