Bitcoin has experienced ongoing volatility recently, causing investors to redirect their liquidity away from attempting to catch its next price surge and instead explore other areas within the cryptocurrency market.

More specifically, market participants are gradually moving their focus from Bitcoin toward assets that provide consistent returns. This shift is leading liquidity away from purely speculative trading and into sectors with tangible utility, highlighting lending tokens as attractive options.

Key Highlights

The persistent fluctuations in Bitcoin’s price have prompted a migration of liquidity towards alternative market segments.

This movement favors assets offering practical value rather than speculative gains, placing lending tokens under increased attention.

Bitcoin’s recent price swings were dramatic: it plunged to $60,005 on February 6 before rebounding sharply the same day to $72,000.

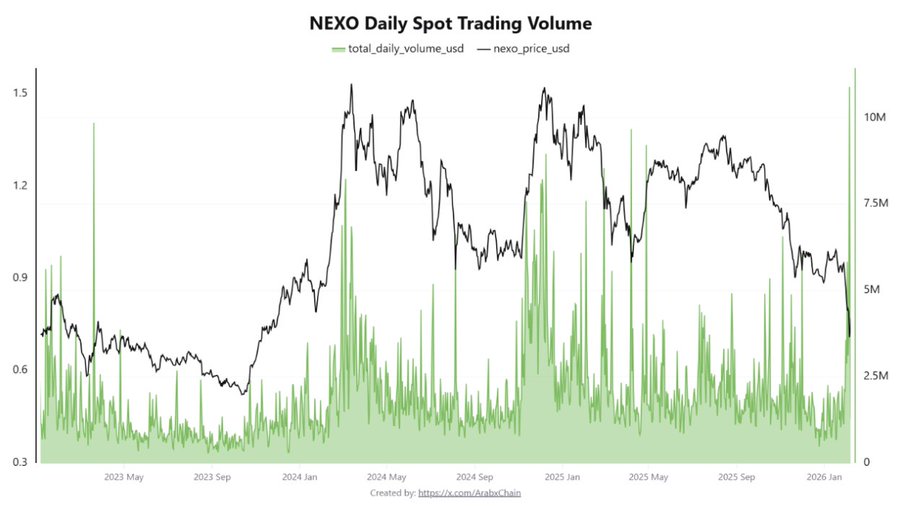

NEXO—a platform branding itself as a leading digital asset wealth manager—recently achieved approximately $10.9 million in daily trading volume, marking an all-time high for the token.

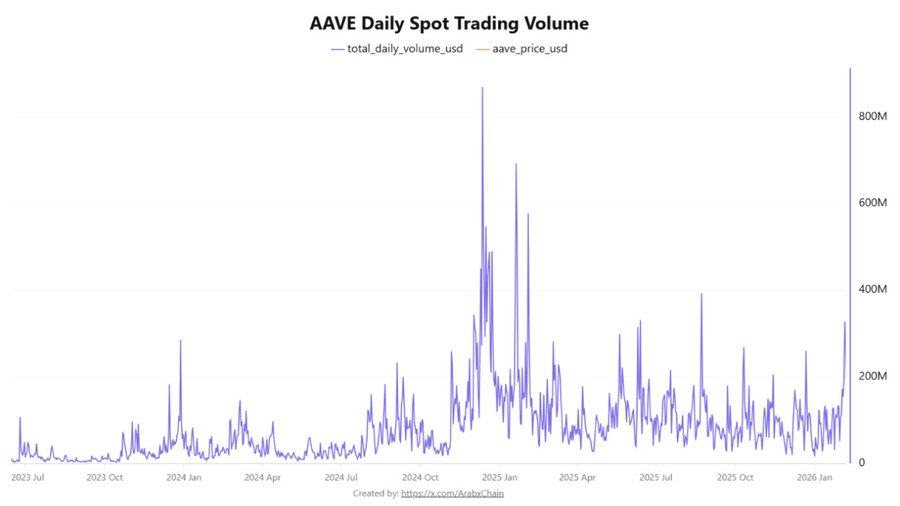

The decentralized lending protocol Aave also witnessed heightened activity with daily volumes rising close to $327.8 million.

The simultaneous spike in Bitcoin volatility alongside growth in lending services suggests that some capital is shifting toward assets emphasizing operational functionality or yield generation rather than pure speculation.

How Bitcoin Volatility Is Steering Liquidity Elsewhere

An analysis by Arab Chain—one of CryptoQuant’s verified contributors—highlighted significant intraday swings for Bitcoin. On February 6 alone, BTC dropped steeply before bouncing back strongly within hours. More recently, prices have settled between roughly $60K and $72K indicating consolidation rather than clear directional momentum.

This uncertainty at the top of the crypto hierarchy has influenced broader markets which are now experiencing erratic movements themselves. As traders face this indecision surrounding BTC’s trajectory, many adopt more cautious strategies by lowering risk exposure and seeking alternative avenues for profit beyond simple price appreciation.

Lending Tokens Like NEXO & Aave Gain Momentum

The report points out a noticeable pivot towards major lending platforms amid this environment. NEXO recorded historic highs in daily trading volume near $10.9 million according to Arab Chain data — signaling increased engagement with its ecosystem either through collateral use or liquidity management functions tied to its token economy.

CoinMarketCap data confirms NEXO’s current daily volume stands around $11.66 million — up 32% over 24 hours — contributing positively toward its price which climbed approximately 4.5% reaching about $0.842 during this period.

Aave has similarly experienced surges in activity with volumes increasing up to roughly $327.8 million initially and climbing further past $456 million according to CoinMarketCap metrics despite a slight dip of 3% over one day.

This elevated interest surpasses recent averages suggesting both retail investors and institutions may be favoring decentralized lending protocols while overall market sentiment remains unsettled.

Conclusion

The combined evidence indicates that ongoing fluctuations in Bitcoin prices coincide with growing demand for lending-related services — reflecting a partial reallocation of funds from dominant cryptocurrencies into sub-sectors focused on operational efficiency or yield opportunities rather than mere speculation.