The value of Bitcoin has dropped by nearly 2% in the past day and is approximately 3% lower than its peak yesterday. At first glance, the price movement seems rather uneventful.

Yet, beneath the surface—particularly when examining on-chain data—there have been notable changes for the first time in close to three months. Additionally, another significant shift occurred this week. While these developments don’t guarantee a surge as we approach 2026, they could represent initial signs of an upcoming upward trend.

A Shift in Momentum Emerges but Requires Confirmation

Two distinct indicators have surfaced simultaneously. Although independent from each other, their timing is crucial.

The first indicator is On-Balance Volume (OBV), which gauges buying and selling pressure through trading volume. Between December 21 and December 26, Bitcoin’s price moved upward; however, OBV did not mirror this rise and instead formed lower highs—a bearish divergence signaling weak volume support behind the price increase. This explains why Bitcoin failed to break resistance on December 26 (evidenced by a long wick), as there wasn’t sufficient volume backing that slight price gain.

If you want more insights like these on tokens, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter.

This week saw OBV break above its descending trendline connecting those previous lower highs—a breakout hinting at growing buying momentum. However, confirmation awaits until OBV surpasses a higher high above 1.58 million units traded; only then might Bitcoin’s price respond positively—which hasn’t occurred yet.

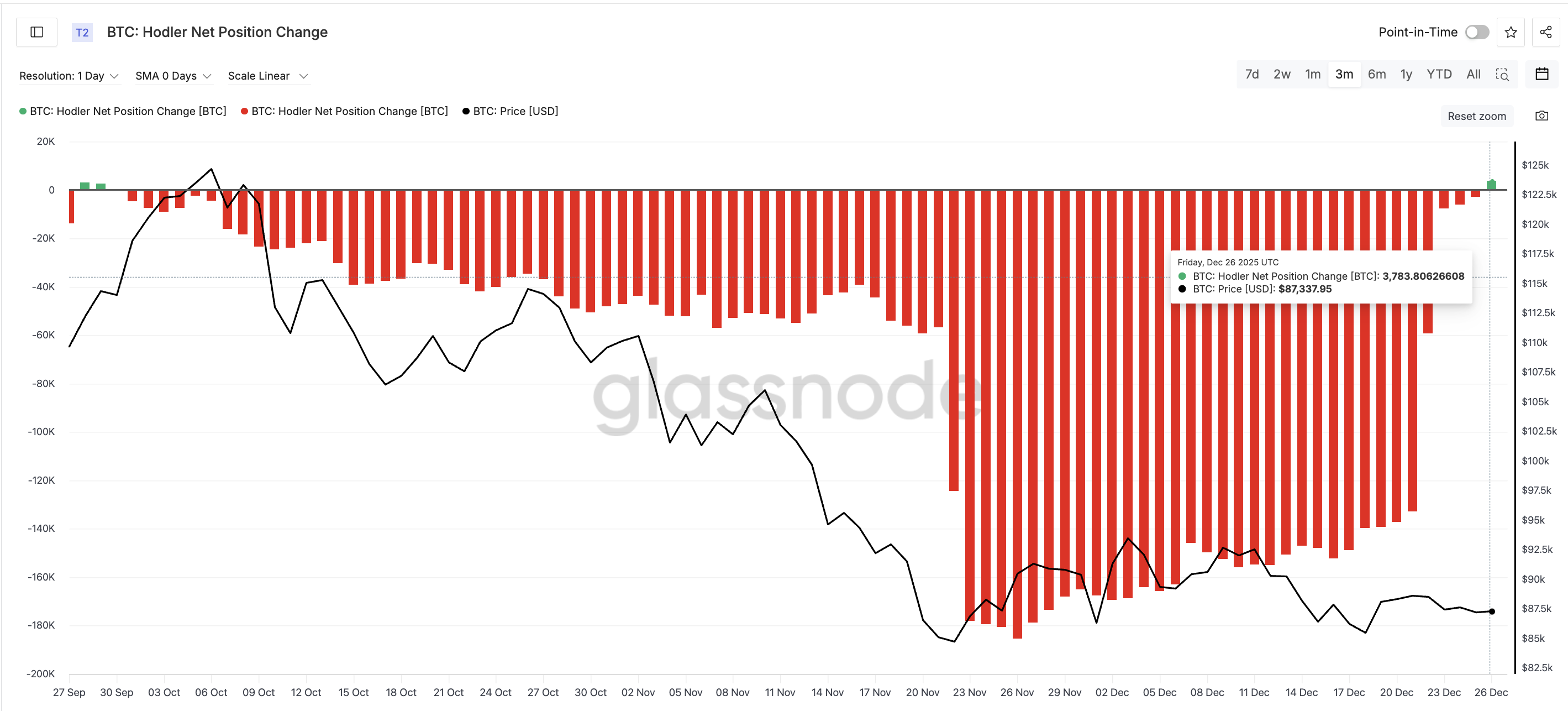

The second signal comes from monitoring changes in long-term holder positions—wallets holding coins for over 155 days—the slowest-moving market participants.

On December 26th, this metric turned positive for the first time since late September as long-term holders accumulated an additional 3,783.8 BTC coins. These investors don’t chase short-term gains but buy based on strong conviction—and it marks nearly three months since such conviction was last evident.

A sustainable relief rally requires both signals working together: continued follow-through from OBV alongside ongoing accumulation by hodlers; one without the other won’t suffice.

Key Price Levels That Will Shape Year-End or Early-2026 Outcomes

Bitcoin still faces critical hurdles ahead—the true narrative lies within specific price zones that must be overcome or defended effectively.

The $90,840 mark remains elusive after nearly two weeks of unsuccessful attempts to reclaim it following rejection on December 12th—it continues acting as strong resistance preventing lasting upward moves so far; until surpassed decisively every bounce appears temporary at best.

If breached convincingly above $90,840 then immediate relief rally targets emerge near $97,190—the level where BTC last dipped below mid-November before further declines began;

beyond that point lie subsequent resistance areas around $101,710 and then $107,470 respectively should bullish momentum persist strongly enough to reach them over time.

On support side ,$86 ,915 level has held firm since Dec19 .A breakdown here could open way down toward $80 ,560 zone .Given typically low liquidity during year-end periods ,this downside risk increases slightly .However,based upon how long -term holders are positioning themselves currently,the possibility remains intact for bitcoin prices attempting relief rallies back toward or beyond prior resistance near$90 ,840 provided$86 ,910 support holds steady.

This analysis was originally published by BeInCrypto under title &ldquo ;Is Bitcoin Price Headed for a Relief Rally? Charts Have The Answer&rdquo ;.