The outlook for Bitcoin’s price continues to attract close attention as experts debate whether the leading cryptocurrency can still reach the ambitious target of $140,000. Considering Bitcoin’s recent decline and volatile movements, many remain doubtful about such a sharp rise happening anytime soon. Nevertheless, some analysts emphasize the importance of the global M2 Money Supply, noting its historical connection with Bitcoin’s value and its potential to drive a significant upward trend.

Recently, fresh conversations have surfaced within the crypto community regarding how Bitcoin’s price correlates with changes in global M2 Money Supply. A well-known anonymous analyst called ‘MoneyLord’ has forecasted an impressive surge toward $140,000 based on this monetary data. Despite skepticism from some quarters questioning whether M2 still holds predictive power over Bitcoin’s future performance, MoneyLord insists that it remains a crucial indicator.

Global M2 Money Supply as a Catalyst for $140K Bitcoin

MoneyLord explains that any recent divergence between Bitcoin prices and M2 figures should not be interpreted as evidence against their relationship but rather attributed to intense market manipulation and growing pressures within worldwide financial systems. In his detailed analysis shared on platform X (formerly Twitter), he argued that absent these disruptions—such as major institutional failures—Bitcoin would have continued mirroring global liquidity expansion closely.

Related Reading: Is It More Profitable To Hold Bitcoin For The Short-Term? 2025 Numbers Are Here

The analyst suggests that shocks like these temporarily hindered BTC’s growth trajectory, contributing to its slowdown and price drop seen recently. However, now that market conditions are showing signs of stabilization, he believes Bitcoin is likely to realign with trends in global money supply again — potentially igniting fresh bullish momentum.

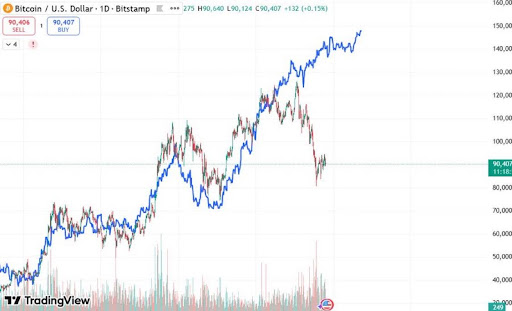

This viewpoint frames current market behavior not as a failed cycle but rather as delayed synchronization between BTC prices and liquidity metrics. According to MoneyLord’s projections illustrated by accompanying charts where rising blue lines represent increasing global liquidity levels approaching predicted values — if bitcoin catches up accordingly — it could surpass $140K sooner than anticipated by many investors.

Currently trading near $90,000 after dropping more than 6% this month alone means reaching $140K demands at least around 55% appreciation from present levels—a milestone exceeding previous all-time highs above $126K by over 10%.

Bitcoin Demonstrates Strength Amid Market Downturns

Crypto expert Don observes that despite severe sell-offs causing widespread liquidations among traders recently shaking confidence across markets — bitcoin has shown resilience by bouncing back strongly afterward. He points out bulls have reclaimed vital support zones helping restore optimism while BTC trades inside an ascending triangle pattern known for signaling potential breakouts ahead.

The technical chart reveals resistance near approximately $94,324 forming one boundary of this triangle while support lies close around roughly $89,241 at its base level – indicating consolidation phases possibly building momentum before next directional moves occur in price action.

Featured image courtesy Pixabay & chart sourced from Tradingview.com