A recent investigation by CryptoQuant sheds light on a key reason behind Bitcoin’s recent price plunge, which now seems to have found some stability.

Bitcoin initially surged to an impressive peak of $126,000 in early October 2025 and briefly steadied around $124,000 after a slight retreat. However, this calm was short-lived.

From that point onward, Bitcoin experienced a steady decline, ultimately bottoming out at $84,000 in December — representing a drop exceeding 32% over three months. Although there has been a modest rebound from the lows near $84,000, BTC remains nearly 30% below the previous level of $124,000 and currently trades close to $87,000.

This extended downturn occurred amid an overall bearish trend that dominated the cryptocurrency market from early October through December.

Whale Sell-Offs Played a Significant Role in Bitcoin’s Decline

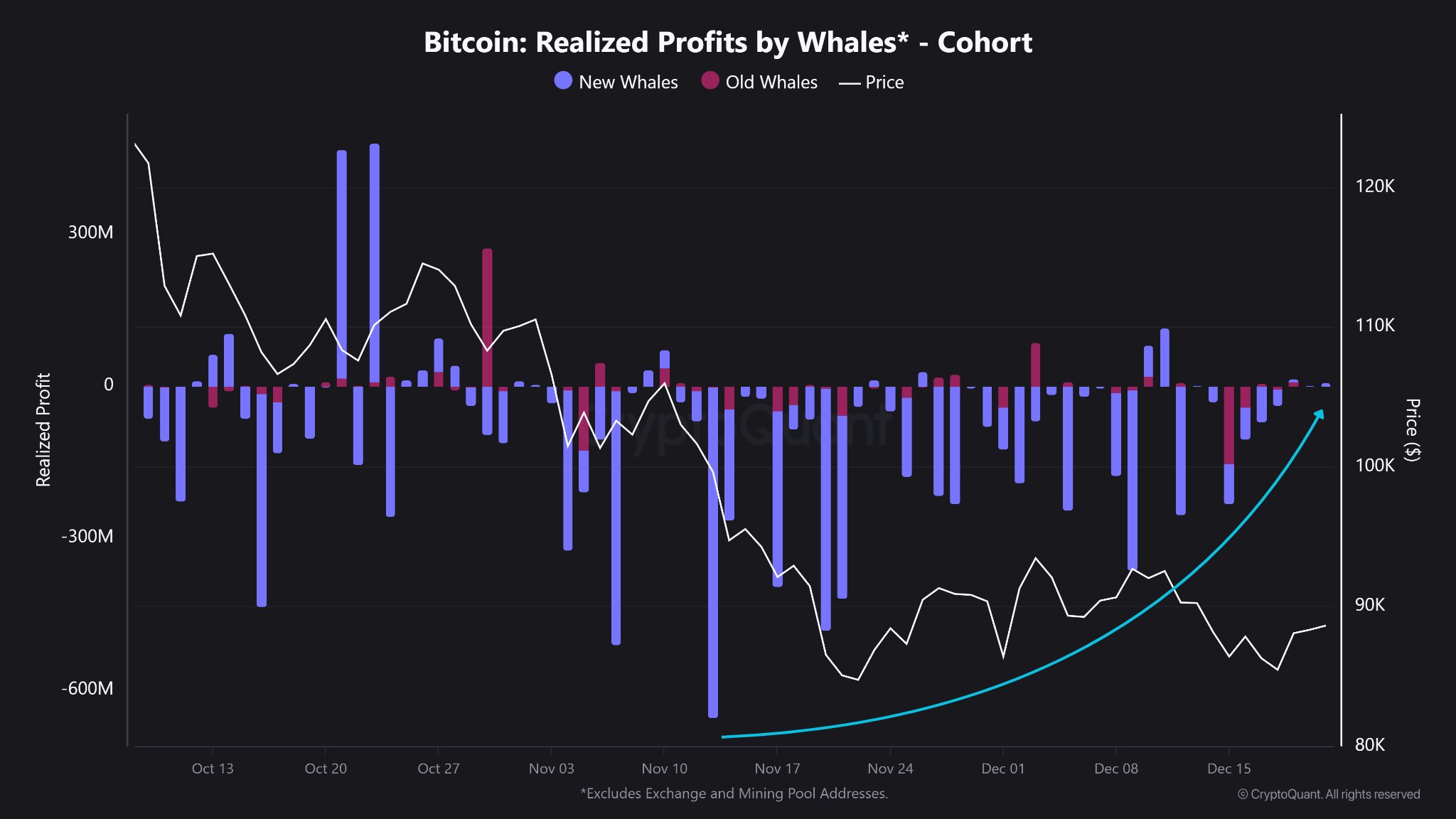

New on-chain insights have uncovered one important factor driving this downward movement. CryptoQuant’s latest data points to large holders—often referred to as whales—as key players behind Bitcoin’s fall from $124K down to $84K.

The analysis highlights that realized losses incurred by these newly active big investors were instrumental in pushing prices lower during this period.

As prices dropped sharply between those levels, losses recorded by these whales intensified their selling pressure on the market. After hitting the low point around $84K recently, these realized losses decreased substantially and leveled off—indicating reduced aggressive selling among large holders for now.

The chart shared by CryptoQuant illustrates how whale capitulation signs began emerging subtly in early October when combined profits and losses fluctuated between approximately $200 million and $100 million.

However, as Bitcoin continued weakening later that month, selling activity escalated dramatically. New whale investors led most of these selloffs, with daily realized profits sometimes soaring up to $400 million.

The Flattening of Whale Capitulation: Is Recovery Imminent?

The scenario shifted again come November. When $Bitcoin slipped below $100, sellers’ gains declined despite increasing pressure.

This indicated new whales were no longer locking in profits but rather absorbing growing losses instead.

This change triggered significant capitulation events with daily realized losses peaking near $600 million throughout November—a direct contributor identified with sharp price drops during this time frame according to CryptoQuant data.

Towards December, a marked reduction appeared in whale-driven selloffs as capitulation eased considerably. “”””””'s stabilization followed with prices consolidating roughly between $87K and $90K.””'';””;>

With diminished selling pressure from new whales currently observed,if major holders begin accumulating again it could pave way for further market stabilization or even recovery prospects.

nn

nn