A market analyst known as CoinNiel, who operates under a pseudonym, has provided intriguing predictions regarding Bitcoin’s trajectory by examining various indicators from the current market cycle. The leading cryptocurrency is currently trading at approximately $69,000 after making its third attempt to break through the $70,000 resistance level in February.

Bitcoin seems to be in a phase of consolidation following a significant sell-off that occurred in late January and early February when prices fell to around $60,000.

Understanding Bitcoin’s Market Signals

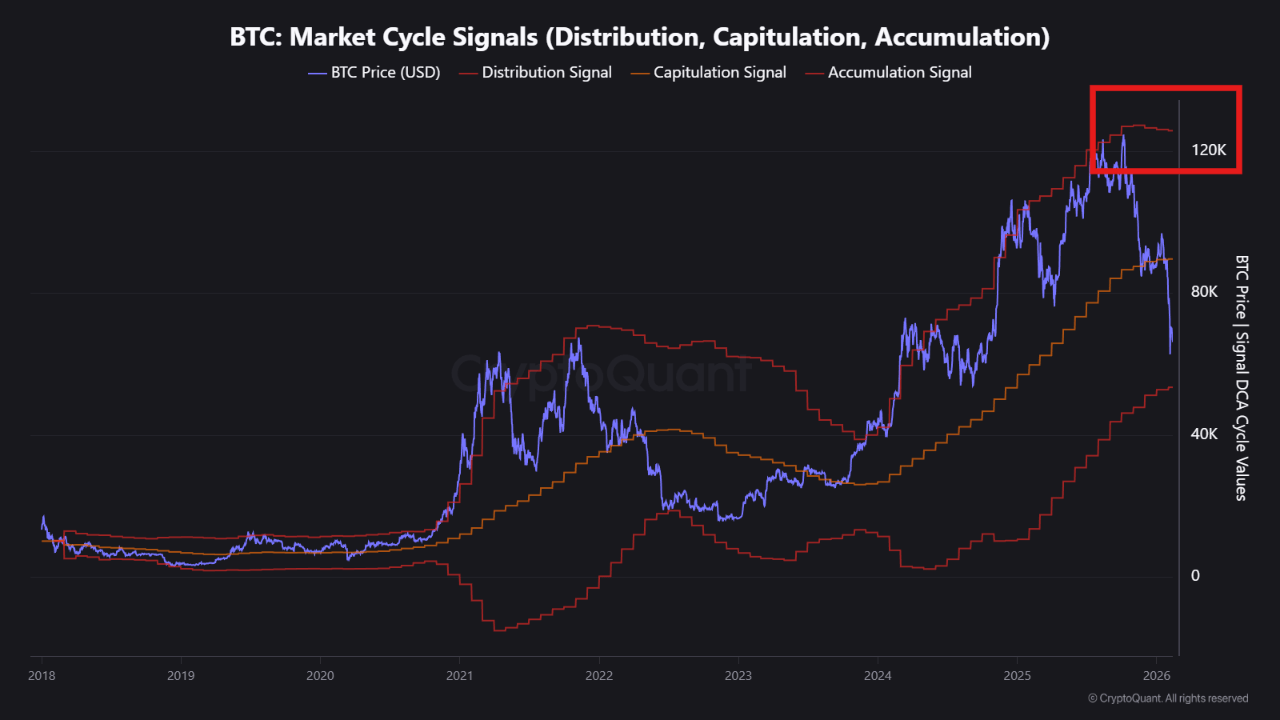

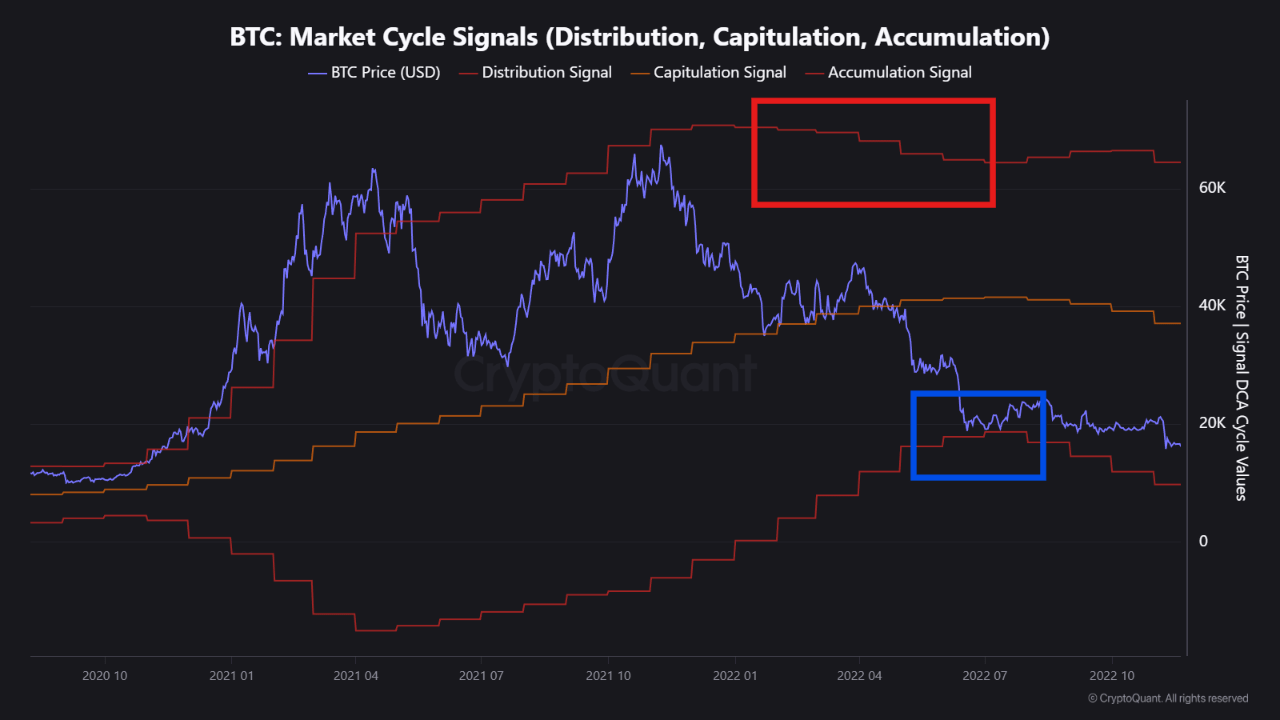

In a post dated February 14, CoinNiel draws parallels between the current market dynamics and those observed during the third halving cycle by evaluating key metrics such as distribution patterns, capitulation events, and accumulation trends. Notably, he points out that the Distribution Signal—which reflects selling activity among institutional investors—is currently on a downward trend. While this might initially seem positive due to reduced selling pressure, it also suggests that large holders are less active in this fragile market environment.

CoinNiel notes that this gradual decrease in the Distribution Signal mirrors what was seen during the third halving cycle after reaching a double top formation. Additionally, throughout this period of decline for Bitcoin’s price coincided with an increase in both Capitulation Signals (indicating panic selling) and Accumulation Signals (reflecting buying behavior from institutional players).

Interestingly enough, it wasn’t until Bitcoin reached $15,000—marking the bottom of that particular cycle—that we saw alignment between price levels and Accumulation Signals beginning their downward trend. This indicated that smart money had completed their absorption phase from panic sellers as stability returned to set up for potential recovery.

The current Accumulation Signal stands at around $54,000 while Bitcoin’s price hovers near $69,000. Historical trends suggest these signals typically align at lower price points within cycles; hence there remains potential for upward movement.

CoinNiel anticipates that both price levels and Accumulation Signals will likely surpass $60k; however timing remains uncertain. It is only after these signals converge that we can expect some stabilization within Bitcoin’s market ahead of any reversal attempts.

An Overview of Current Bitcoin Prices

As of now ,Bitcoin is priced at approximately $68 ,974 following an increase of 5 .14% over just one day .Conversely ,the daily trading volume has decreased by 9 .6%, amounting to about$41 .68 billion .On monthly charts,Bitcoin shows considerable losses totaling29 .25%, which illustrates its negative performance throughout this timeframe.CryptoQuant,a prominent analytics platform,predicts further declines ahead with targets hovering around$55 ,000—a level last encountered back in2024 .

Featured image from Shutterstock; chart sourced from Tradingview.com