In 2025, digital asset treasuries (DATs) broke into the mainstream, as publicly traded companies increasingly began treating cryptocurrencies as core balance-sheet assets, rather than just speculative or experimental.

The model, originally adopted by Michael Saylor’s Strategy in 2020, involves publicly traded companies, usually with non-crypto-related businesses, accumulating and holding cryptocurrency as a primary corporate treasury asset. This gives holders of the DAT company’s stock at least indirect exposure to cryptocurrency prices, without directly holding any crypto.

Strategy remains the largest player in the DAT sector in terms of the dollar value of its crypto holdings, with over $62 billion in BTC at the time of writing. It’s followed by Ethereum-focused DAT BitMine Immersion, chaired by Fundstrat’s Tom Lee, with about $13.47 billion in crypto holdings. The majority of Bitmine’s treasury is in ETH, but the firm holds a small amount of BTC on its balance sheet as well.

Other major players that emerged this year include ETH DAT companies SharpLink, chaired by Consensys founder Joe Lubin, and The Ether Machine, as well as Solana DAT Forward Industries.

Experiment to Trend

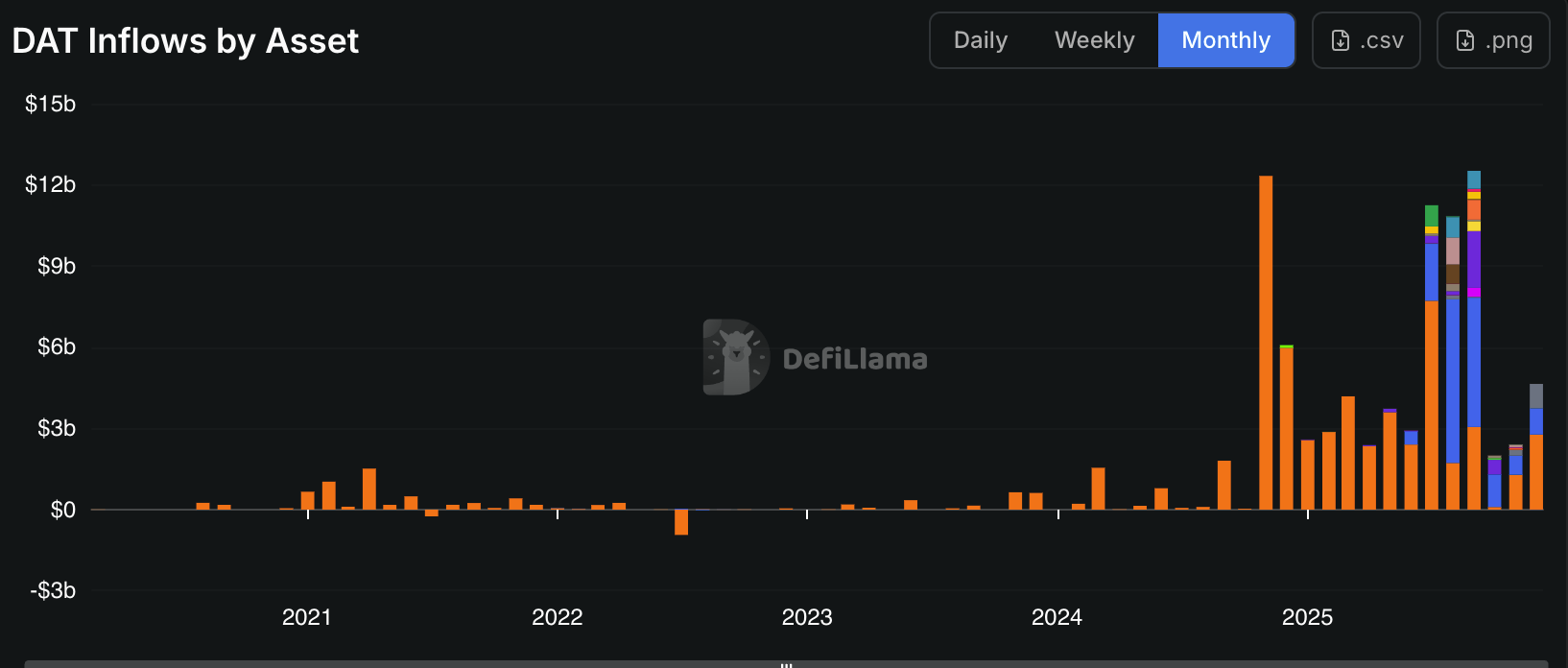

The shift from experiment to trend in 2025 was clear in the data: throughout the year, corporate treasury inflows into digital assets surged, with several months posting multi-billion-dollar net inflows, according to DefiLlama. August and September alone saw more than $23 billion flow into DATs.

Bitcoin (BTC) remained the dominant treasury asset most months, with monthly inflows frequently topping $1-2 billion, and reaching as high as $12 billion in November. Ethereum (ETH) also emerged as a major candidate, with companies stockpiling $6 billion and $4.7 billion in ETH in August and September, respectively. This was mainly driven by interest in staking yield and Ethereum’s role as core blockchain infrastructure.

While inflows slowed in October after the 10/10 market crash and record liquidations, DAT accumulation activity rebounded in November and December, suggesting that treasury buying had become more deliberate rather than just momentum-driven.

DAT inflows by crypto asset. Source: DefiLlama

By halfway through the year, companies were also beginning to diversify. Alongside BTC and ETH, firms began stockpiling smaller cap assets like Solana (SOL), XRP, Sui (SUI), Ethena (ENA), Hyperliquid (HYPE), and even FET.

This shift clearly suggests that what started as experimental evolved into a treasury model for many large institutions. This was supported by clearer regulation, easier access to capital, and growing confidence in digital assets as a real store of value.

“The 2025 DAT boom represents a bridging phenomenon,” said Marcin Kazmiercźak, co-founder of blockchain oracle provider RedStone. “It’s given institutional investors a path to crypto exposure through traditional securities – no custody headaches, regulatory clarity – while simultaneously mainstreaming the idea that cryptocurrencies belong on corporate balance sheets.”

Kazmierczak added that the broader economic backdrop also helped. Lower interest rates through mid-2025 made it cheaper for companies to borrow and build crypto treasuries, while an U.S. Securities and Exchange Commission (SEC) Division’s guidance on protocol staking and liquid staking, published in May and August respectively, removed a major regulatory hurdle for firms.

DAT Risks

Despite fast growth, DAT holdings are still highly concentrated. A small group of companies controls a large share of total assets, raising questions about risk and long-term durability.

“What’s remarkable isn’t just the velocity, but the legitimacy,” Kazmiercźak told The Defiant. “Over $15 billion was raised for DAT strategies in 2025 alone, and these companies now collectively manage north of $100 billion in crypto assets.”

Kazmierczak noted that crowding is already bringing closer scrutiny. Regulators, including the SEC, have begun asking tougher questions about disclosures, while investors are increasingly focused on which of the more than 200 DAT-focused companies could survive a market downturn.

“The winners will likely be the ones with discipline around token accumulation, proper management, and sustainable business models beyond treasury trading,” Kazmierczak said.

Beyond this, analysts warn that some treasury strategies also carry added risk. A report from Animoca earlier this year revealed that firms holding volatile or smaller altcoins may face liquidity problems and pressure from investors if token prices fall faster than their stock prices. Other analysts published similar reports about DAT risks starting in the summer, as new altcoin treasuries emerged and inflows into them increased.

In some cases, companies have seen their shares jump after announcing crypto treasury plans, and smaller cap tokens tend to also surge on DAT annoucements as traders speculate on supply leaving circulation.

The Strategy Effect

No company shows both the upside and risks of DATs more clearly than Strategy. The firm, which was formerly-known as MicroStrategy, is generally known as the pioneer of the modern DAT model.

Starting in 2020, the enterprise software company steadily converted its balance sheet into Bitcoin. By the end of 2025, Strategy held about 671,270 BTC, worth roughly $59 billion. It bought those coins at a total cost of about $50.3 billion, or roughly $75,000 per Bitcoin.

Today, Strategy controls around 3.2% of Bitcoin’s total supply, worth over $62 billion, and holds well over half of all Bitcoin owned by public companies. That scale highlights how concentrated DATs still are.

“DATs exploded this cycle, pioneered by MicroStrategy as it transitioned from a software company into a levered Bitcoin holding vehicle,” said Ethan Buchman, CEO of Cycles. “They emerged as a form of regulatory arbitrage, giving investors crypto exposure through traditional securities.”

But Buchman warned that the model faces limits, and with spot crypto exchange-traded funds (ETFs) becoming increasingly available, he believes DATs face a tougher long-term test.

“ETFs are a superior product and should eventually make DATs unnecessary,” Buchman said. He also cautioned that public treasury companies can attract speculation instead of long-term value creation.

What Comes Next

As we enter the new year, the next stage of DATs is already beginning to form. Industry leaders say companies will need to move beyond simply stockpiling crypto assets.

That next step includes earning yield through staking, improving risk controls, and offering clearer reporting around custody and accounting. It also means using digital assets for real business needs, such as payments, settlement, and liquidity management.

“The next leap is turning treasuries into active yield producing engines that compound tokens per share, the digital version of modern treasury management,” said Maja Vujinovic, CEO and co-founder of Digital Assets at FG Nexus.

Whether DATs become a lasting corporate finance tool, or fade as ETFs and tokenized funds grow, will depend on how well companies adapt, experts say.