The established “four-year law” of Bitcoin might be experiencing its first significant deviation. Even with unprecedented investments flowing into spot ETFs and an increase in corporate reserves, the market is no longer synchronizing with the halving cycle.

Rather, factors such as liquidity shocks, allocations from sovereign wealth funds, and the expansion of derivatives are becoming the new foundations for price determination. This evolution prompts a crucial inquiry for 2026: can institutions continue to depend on historical cycle strategies, or do they need to entirely redefine their approach?

Has the cycle finally come undone?

With these new influences taking charge, it’s not about whether the previous cycles still hold relevance but rather if they have been supplanted altogether. BeInCrypto engaged James Check—Co-Founder and on-chain analyst at Checkonchain Analytics and former Lead On-Chain Analyst at Glassnode—to explore this concept.

For years now, Bitcoin investors have regarded the four-year halving cycle as a fundamental truth. However, this pattern is currently facing its most challenging examination yet. In September 2025 alone, CoinShares recorded $1.9 billion in ETF inflows—almost half directed towards Bitcoin—while Glassnode identified a critical price range between $108K–$114K that could determine future trends. Concurrently, CryptoQuant noted that exchange inflows plummeted to historic lows even as Bitcoin reached new all-time highs.

ETF inflows: genuine demand or mere reshuffling?

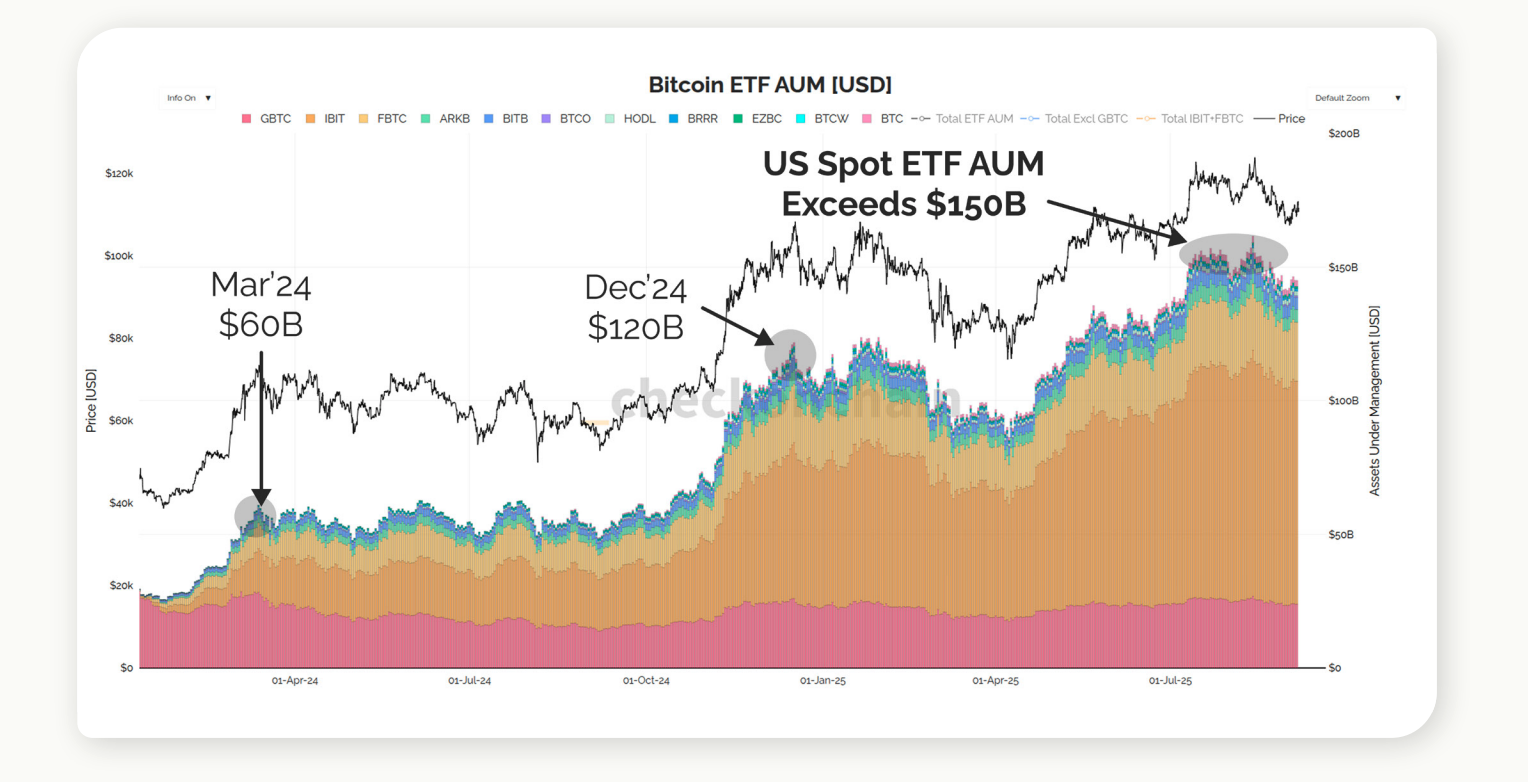

The ETF inflows observed in September indicated strong demand; however, it remains essential for investors to discern whether this influx represents fresh capital or merely existing holders reallocating from products like GBTC. This distinction significantly impacts how much foundational support underpins any rally.

Source: Checkonchain

“Some holders are definitely transitioning from on-chain holdings into ETFs; that’s happening without question. However, it’s not indicative of most… The actual demand has been phenomenal—a massive influx amounting to tens of billions of dollars is coming into play alongside substantial sell-side activity.”

James highlighted that ETFs have already absorbed approximately $60 billion in total investments thus far. Market data reveals that this figure pales compared to monthly profit-taking realized by long-term holders ranging between $30 billion and $100 billion—explaining why prices haven’t surged as rapidly as one might expect based solely on ETF interest.

Exchange flows: meaningful signals or mere noise?

According to CryptoQuant’s analysis during Bitcoin’s peak in 2025 prices showed record low exchange inflows which could suggest structural scarcity at first glance; however James cautioned against placing too much emphasis on these figures.

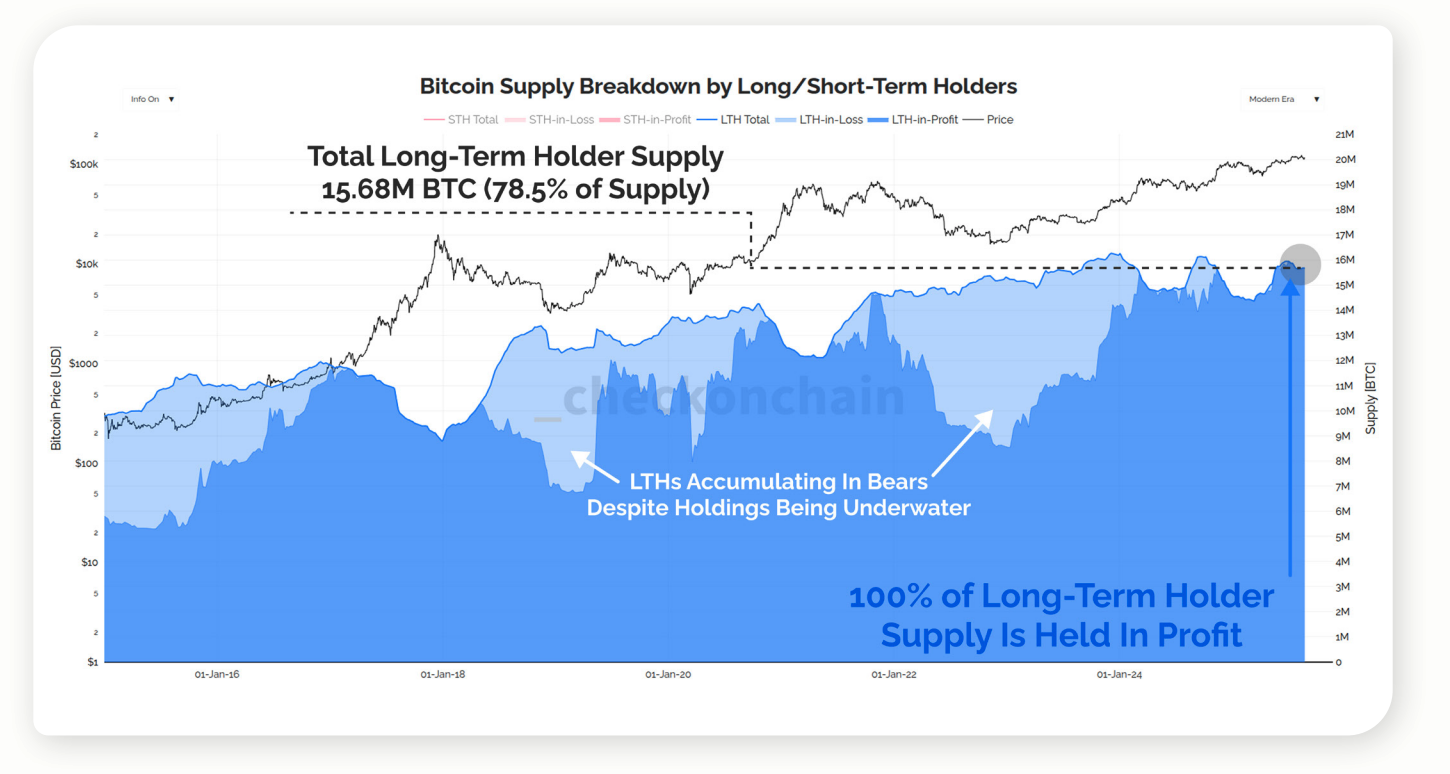

Source: Checkonchain

“I rarely utilize exchange data because I find it lacks utility… Exchanges hold around 3.4 million Bitcoins but many data providers fail to account for all wallet addresses due to its complexity.”

This analysis corroborates limitations within those metrics noting long-term holder supply—which currently stands at approximately 15.68 million BTC (about 78% of circulating supply) —is more dependable than exchange balances when gauging scarcity levels.

Aren’t miners still influential over market movements?

Perviously mining was often viewed through a lens highlighting downside risks; yet now with treasury flows dominating discussions their impact may be less significant than commonly perceived.

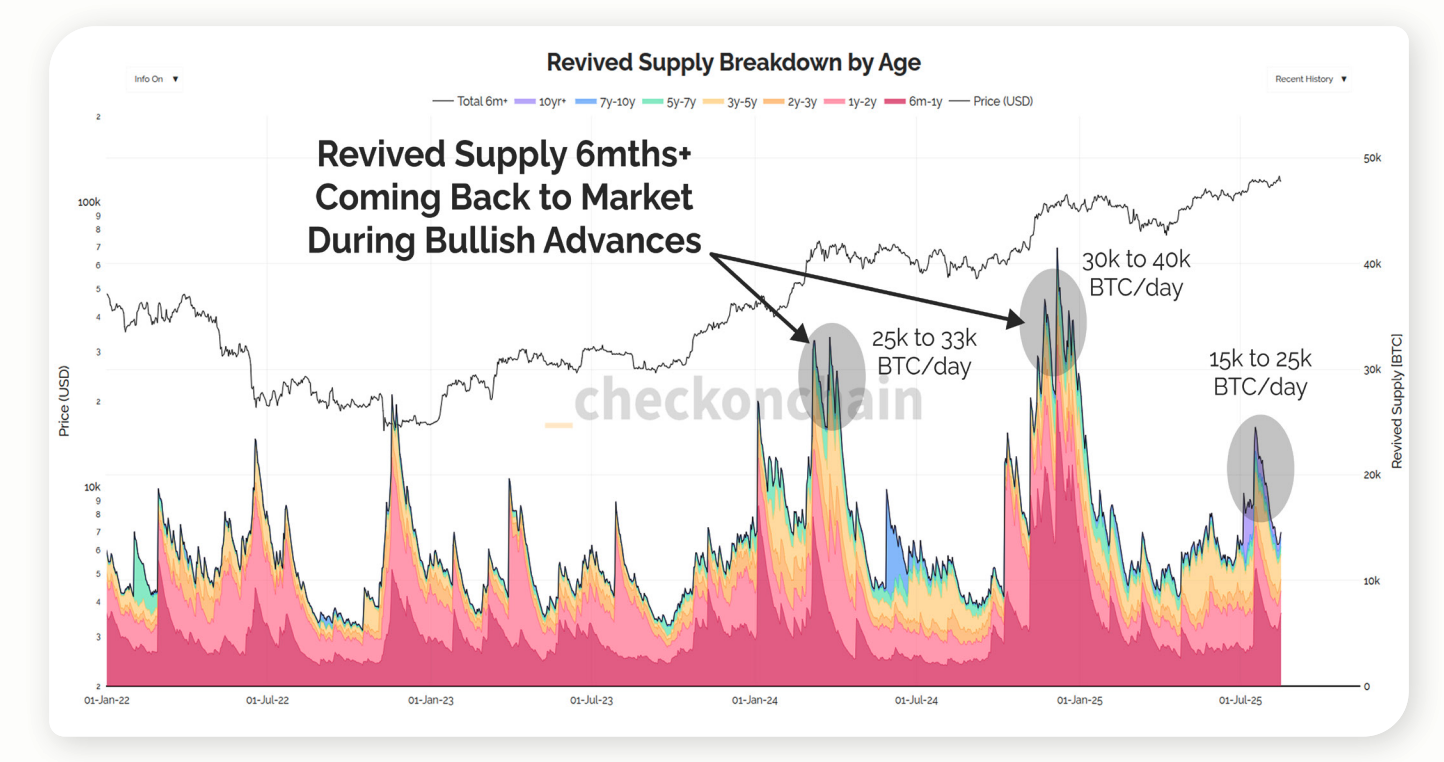

Source :Checkonchain

“When analyzing selling pressure within bitcoin network ,the sell side appears minuscule compared old hand selling & ETF flow . So I’d argue halving cycles no longer matter ,and haven’t mattered over several past cycles .That narrative seems defunct.”

Miners produce roughly450 BTC daily which pales against revived supplies originating from long-term holders potentially reaching10k-40kBTC daily during peak rallies .This disparity underscores why miner contributions don’t dictate current market structure anymore.

Transitioning From Cycles To Liquidity Regimes

When asked ifBitcoin continues adheringtoitsfour-yearcycleorhas shiftedtowardsaliquidity-driven regime ,James pointed out key structural changes regarding adoption patterns.

Source :Checkonchain

“Two pivotal moments stand out within bitcoin’s journey ;the2017all-time high & late2020intoearly20201 markeda transition wherebitcoin matured significantly . Nowadaysit responds moretoexternal conditionsratherthan vice versa.”

Supporting analyses indicate volatility compression alongwith riseofETFs&derivativeshave transitionedBitcoinintoanindex-like rolewithin global markets whileliquidityconditions—nothalvings—now dictate pace moving forward.

<H

H

H

<H

H