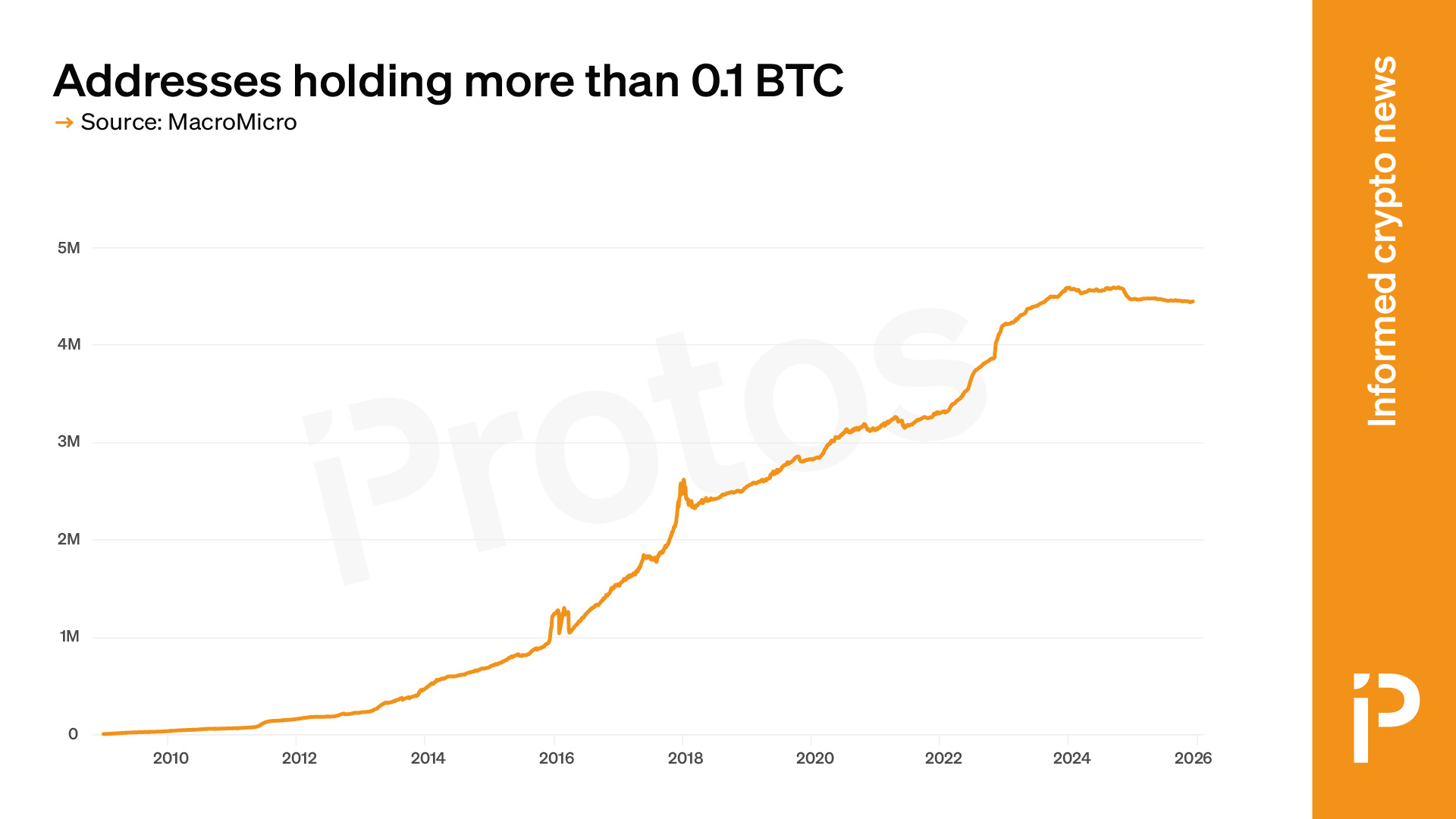

Since Bitcoin’s inception in 2009, the count of unique addresses holding more than 0.1 BTC consistently grew each year up until 2023.

However, this trend has reversed over the last two years, with a noticeable reduction in such addresses.

Specifically, from December 8, 2023, the number dropped from 4,548,107 to 4,443,541.

A review of this data reveals a steady increase in unique addresses over time—despite occasional short-term dips—reaching its peak at the end of 2023.

The figure remained stable for much of early 2024 before declining to a significant two-year low today.

This represents a decline of approximately 2.3%, which is notably larger than the smaller drop (0.7%) seen among addresses holding just one-tenth that amount (0.01 BTC). This suggests investors have become less inclined to keep larger sums within single wallets during recent years.

Notably, there has never been any previous two-year span where this metric decreased before now.

Is There a Decline in Investors Holding Over 0.1 BTC?

At first glance, these figures imply fewer Bitcoin holders maintaining several thousand dollars’ worth of BTC on hardware wallets like Ledger or Trezor.

Yet it remains unclear whether the actual number of individuals owning less than that threshold has diminished as well.

The modern Bitcoin ecosystem differs greatly from its early days: thousands of centralized exchanges and financial instruments such as ETFs and derivatives now provide indirect exposure to Bitcoin’s price movements without requiring direct on-chain ownership by users themselves.

This complexity makes it impossible to accurately separate combined on-chain holdings into individual owner balances based solely on blockchain data.

Read more: Over ninety-five percent of all bitcoin is mined and actively circulating

Evolving Methods for Distributing Bitcoin Across Multiple Addresses

The traditional hardware wallet remains one of the safest ways to store bitcoins securely but many alternatives exist today. For instance, numerous investors prefer ETFs or other exchange-traded products that comply with retirement account regulations unlike direct spot bitcoin holdings.

Apart from these proxies gaining popularity among investors lies an increasing adoption of advanced security techniques involving unspent transaction output consolidation:

- Using extended public keys enables distributing funds across multiple wallets controlled by one private key;

- Nesting wallets inside others like Matryoshka dolls creates decoy layers enhancing protection;

- Clever cryptographic methods such as XOR combine seed phrases from different wallets for added security;

These strategies are becoming widespread practice — meaning retaining large amounts (>0.1 BTC) within single addresses is no longer necessary regardless how substantial an investor’s portfolio might be.

Nevertheless , monitoring changes in this common pattern offers valuable insights into how participants interact with the Bitcoin network .

While accumulation trends favored consolidating significant balances under individual address control through most parts of 2023 , recent years show an opposite movement .