Global financial markets might be on the brink of heightened turbulence following a cautionary statement from Goldman Sachs, which indicated that systematic investment funds could offload tens of billions of dollars worth of stocks in the upcoming weeks.

This potential surge in selling activity is likely to impact not only equities but also extend to assets like Bitcoin, gold, and silver as liquidity conditions worsen.

Goldman Sachs Signals Potential Acceleration in CTA Liquidations Amid Thinning Liquidity

Goldman’s trading team reports that Commodity Trading Advisers (CTAs), which are trend-following funds, have already initiated sell signals within the S&P 500 index. These CTAs are anticipated to continue their net selling stance shortly, regardless of whether market prices stabilize or decline further.

STOCK MARKET DOWNTURN CONTINUES, GOLDMAN TRADERS CAUTION

According to Goldman Sachs, U.S. equities may endure additional downward pressure this week due to CTAs triggering sell orders within the S&P 500.

The firm projects that CTAs might liquidate up to $33 billion worth of stocks over this period…

— *Walter Bloomberg (@DeItaone) February 8, 2026

The bank estimates an approximate $33 billion equity sell-off could occur within a single week if market conditions deteriorate further.

More alarmingly, Goldman’s analytical models predict that systematic selling could escalate by as much as $80 billion over the next month should the S&P 500 persist in its decline or breach critical technical thresholds.

The current market environment is fragile. Analysts at Goldman have observed a degradation in liquidity alongside shifts in options positioning patterns that may exacerbate price volatility.

A phenomenon known as “short gamma” positioning means dealers often must sell into falling markets and buy during rallies—actions which amplify intraday price swings and overall volatility.

The key issue here is the short gamma flip below 6,900 points. This explains why every one percent drop feels magnified threefold. When dealers hedge by selling into declining markets despite strong fundamentals like record earnings, it creates what we call a ‘Gamma Trap’ until levels above 7,000 are reclaimed…

— ur-trading (@urtrading) February 8, 2026

Additionally, Goldman pointed out other systematic strategies such as risk-parity and volatility-control funds still possess capacity to reduce their exposure if volatility escalates further. Consequently, selling pressure may not be confined solely to CTAs.

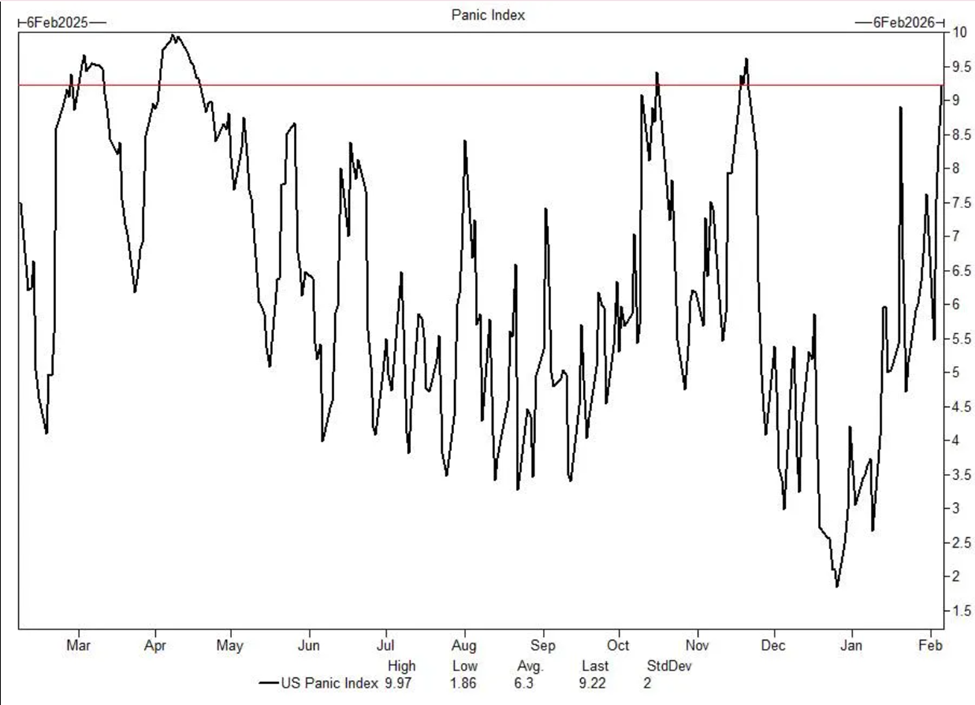

Investor sentiment appears increasingly strained too: Goldman’s proprietary Panic Index recently neared levels typically associated with extreme market stress.

Goldman Sachs Panic Index. Source: Goldman Sachs

Meanwhile, a shift has been noted among retail investors who had spent much of last year aggressively buying on dips but now show signs of exhaustion with recent data indicating net sales rather than purchases.

Broad Market Impact Extends To Bitcoin And Precious Metals

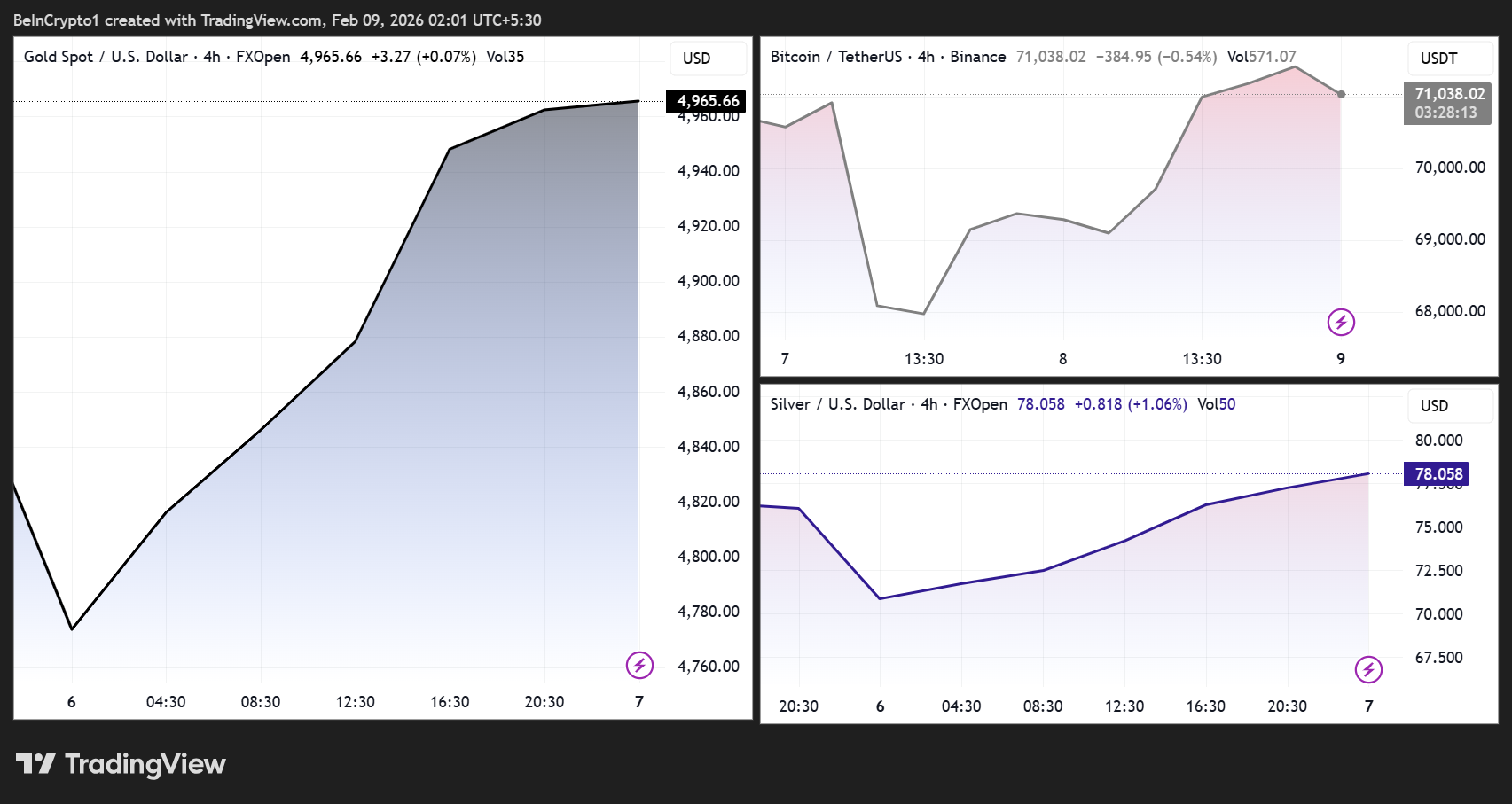

While Goldman’s primary focus was on stock markets , these developments carry broader implications . Historically , significant equity sell – offs driven by large flows combined with tightening liquidity tend to increase volatility across macro – sensitive assets including cryptocurrencies .

Bitcoin , which has shown increasing correlation with overall risk appetite during periods marked by liquidity stress , faces potential renewed fluctuations should forced equity liquidations intensify .

Crypto-related equities along with speculative trades favored by retail investors have already demonstrated vulnerability amid recent swings , highlighting ongoing fragility in positioning .

Moreover , turmoil within stock markets can trigger complex cross-asset movements . Although risk aversion generally weighs down commodities broadly , precious metals such as gold and silver often attract safe-haven inflows during times marked by uncertainty — resulting in sharp directional moves influenced heavily by prevailing liquidity dynamics and dollar strength .

Price Trends for Gold,& nbsp ;Bitcoin,& nbsp ;and Silver.& nbsp ; Source : TradingView

Liquidity remains a pivotal factor amid these uncertainties . With systematic fund deleveraging underway coupled with rising volatility plus seasonal tendencies toward weaker performance approaching , instability across financial markets seems poised for continuation over coming weeks .

Expect more equity declines next week given ongoing deleveraging among systematic players through Friday execution days ., — Negentropic @Negentropic_ February 08, 2026

If predictions from Goldman materialize,the forthcoming month will likely test resilience across equities while exerting spillover effects onto Bitcoin along with precious metals sectors.

The post Risks Rise for Bitcoin,GOLD,and SILVER AS GOLDMAN SACHS Warns $80 Billion In Stock Selling appeared first on BeInCrypto.