Reflecting on the year 2025, it is evident that precious metals triumphed over bitcoin in the battle for sound money and against currency debasement. Gold experienced one of its most remarkable years, soaring by 65%, while bitcoin faced a decline of 7% during the same period.

Up until August, both assets showed comparable performance with gains of approximately 30%. However, after that point, gold’s value skyrocketed while bitcoin encountered a significant downturn.

This stark contrast highlighted gold’s victory in the narrative surrounding currency debasement, leaving bitcoin trailing far behind.

Currently, bitcoin is attempting to recover from a substantial correction of 36% from its peak in October and is struggling within the $80,000 range.

Nevertheless, despite this price weakness, capital movements tell an alternative story.

Bradley Duke, managing director at Bitwise Asset Management, noted that inflows into bitcoin exchange-traded products (ETPs) surpassed those into gold ETPs throughout 2025 despite gold’s impressive performance this year.

The introduction of U.S. spot bitcoin ETFs in January 2024 marked a significant milestone for institutional adoption. The second year has seen robust participation continue even though prices have not followed suit as expected.

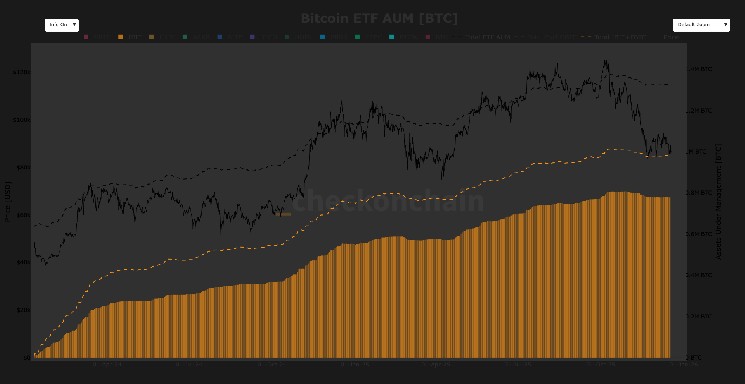

A key insight from this ongoing correction phase for bitcoin is the resilience shown by ETF investors. Even with a notable price drop of 36%, total assets under management (AUM) for Bitcoin ETFs decreased by less than 4% overall.

According to data from Checkonchain, U.S.-based ETFs held approximately 1.37 million BTC at their peak in October and still maintain around 1.32 million as of December 19th. This indicates that most selling pressure did not originate from ETF holders themselves. Furthermore, BlackRock’s iShares Bitcoin Trust (IBIT) has strengthened its position during this correction phase and now commands nearly a dominant market share with about 780 thousand BTC under management—just shy of reaching the critical threshold of holding nearly two-thirds market share overall.

The evidence clearly shows that outflows from ETFs were not responsible for driving down Bitcoin’s value during this recent correction period.