Bitcoin has once again surpassed the $120,000 threshold, indicating a resurgence in bullish activity that brings it closer to its historic peak.

This significant price increase is a reflection of growing investor confidence as new funds enter the market. The involvement of mid-sized investors and ETF contributions seems pivotal in this scenario.

Robust Support for Bitcoin

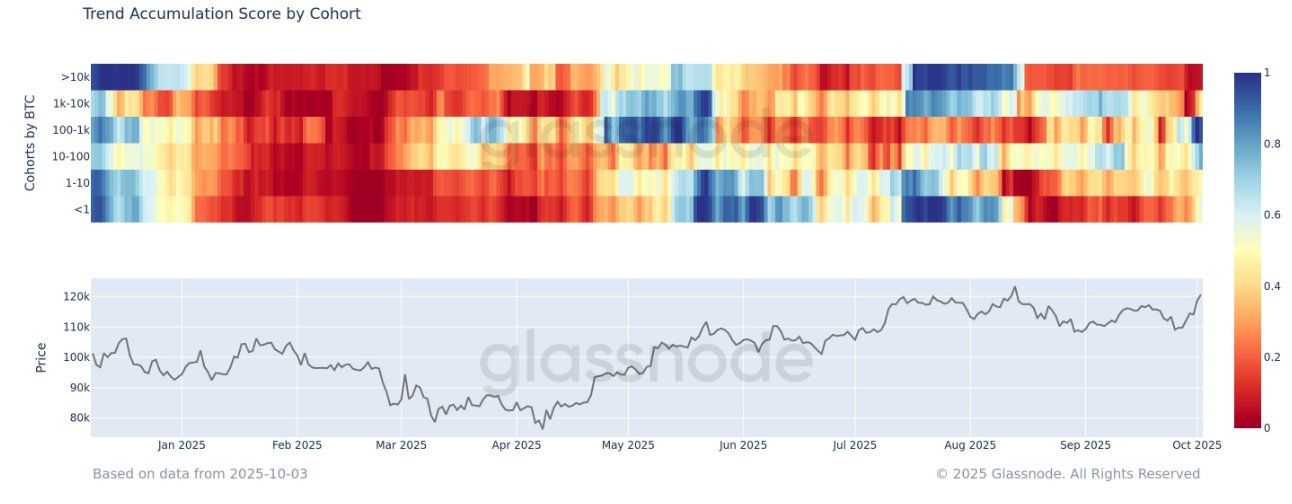

The Trend Accumulation Score reveals a substantial transformation in market dynamics. Mid-level Bitcoin holders are actively acquiring more, counteracting the ongoing sell-off by larger players. This surge in demand provides essential structural backing for Bitcoin’s current upward trajectory, laying down a firmer base for potential future growth.

The distribution by large-scale holders has decelerated while smaller investors remain mostly steady. This equilibrium minimizes the threat of sudden sell-offs and strengthens market stability. The shift in investor behavior points to an improved environment conducive to Bitcoin’s expansion.

Bitcoin Trend Accumulation Score. Source: Glassnode

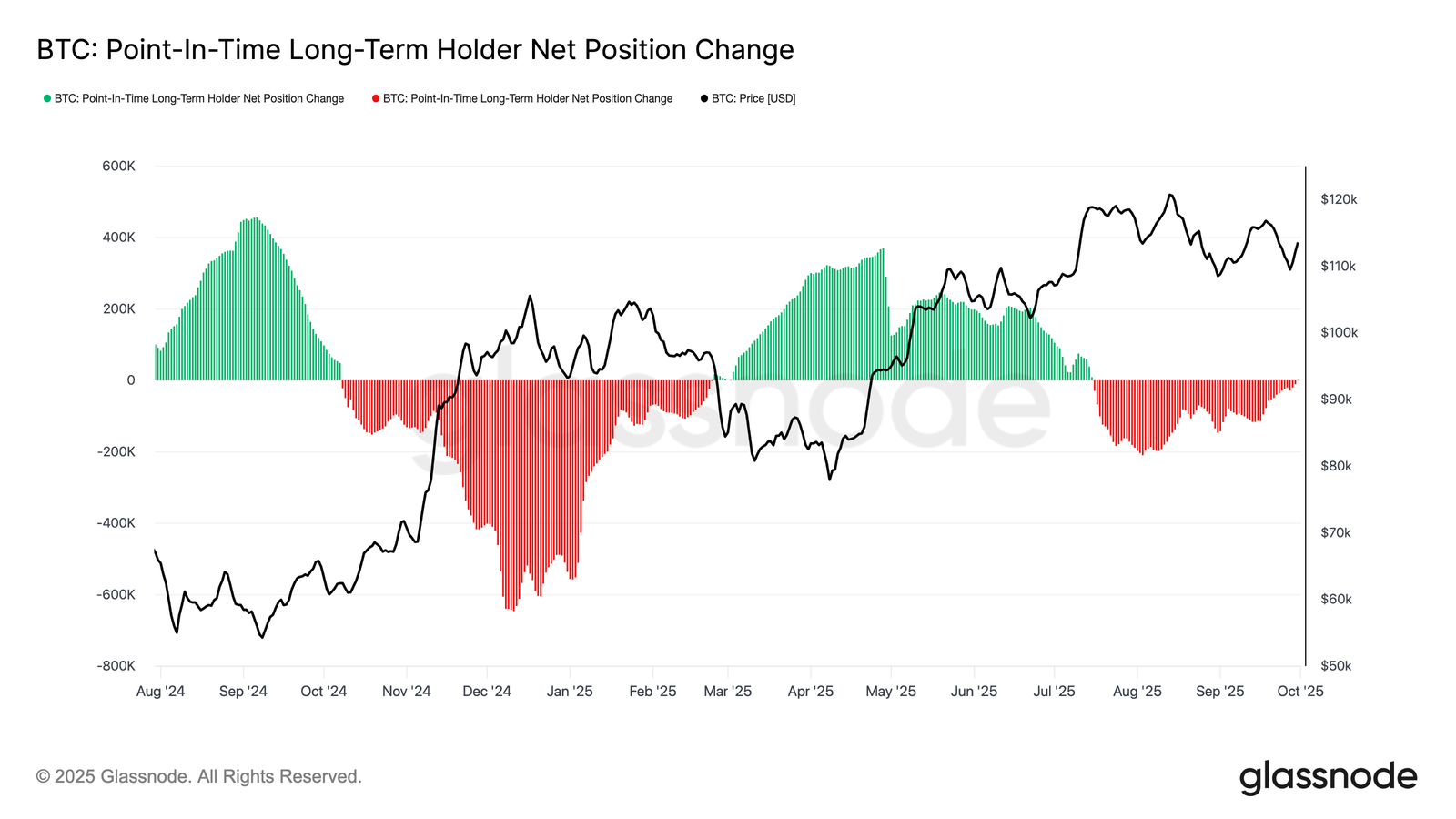

The Long-Term Holders Net Position Change (3D) metric has moved towards neutrality after extended periods of heavy selling activity. This indicates that profit-taking among long-term holders is diminishing, making the market less susceptible to intense selling pressure—a positive sign for sustained price robustness.

With supply pressures easing off, external influences like ETF inflows and institutional interest could now spearhead momentum shifts. Should these inflows persist steadily, they will offer Bitcoin crucial support needed to sustain its rally and challenge its former all-time high mark.

Bitcoin HODLer Net Position Change. Source: Glassnode

Aiming Higher with BTC Price

Currently trading at $120,290, Bitcoin is striving to establish $120,000 as a solid support level. Maintaining this position is vital for sustaining momentum and avoiding short-term setbacks.

The immediate hurdle lies at $122,000—this represents the last resistance before reaching an all-time high of $124,474 . A smooth breakthrough beyond this point would pave way for setting new records &#59;&#59; strengthening bullish sentiment across markets!

<img decoding="async" src="https://cnews24.ru/uploads/e2b/e2b403b726f7ba0d5a9c219ad6cff894b5a9ac.jpg" size="1825x849" alt="Bitcoin Price Analysis.>

Source: TradingView

If however market conditions deteriorate leading into increased selling pressure then there exists risk whereby bitcoin loses key supports set around levels mentioned earlier dropping further downwards towards possible low points such as 117261 potentially negating prior optimistic forecasts whilst signaling temporary pause within overall upward trend cycle!

<The original article titled Fresh Demand Emerges As Prices Reach New Heights appeared first on BeInCrypto>