U.S. President Donald Trump has proposed utilizing import tariff revenues to fund a new stimulus package, potentially providing a boost to cryptocurrency markets amid the ongoing government shutdown.

In an interview with One America News Network on Thursday, President Trump mentioned his consideration of issuing up to $2,000 in stimulus checks for Americans. This initiative would be financed by the income generated from import tariffs.

Trump highlighted that while tariff revenues are just beginning to accumulate, they are expected to eventually bring in over a trillion dollars annually. He also noted that part of this revenue would be allocated towards reducing the nation’s $37 trillion federal debt.

The suggested “dividend” plan aims to distribute between $1,000 and $2,000 per person but requires congressional approval before implementation.

President Trump’s discussion with One American News Network. Source: YouTube

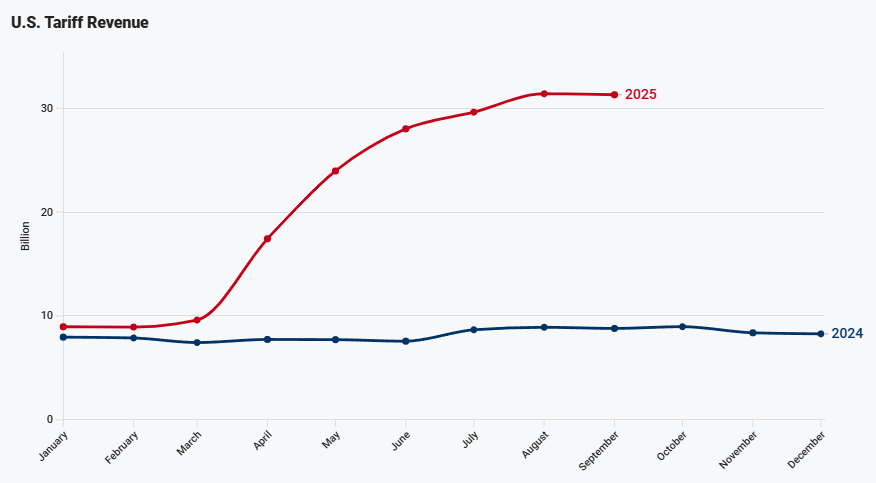

The U.S. Treasury Department’s data reviewed by Fox Business indicates that approximately $214 billion has been collected from tariffs so far in 2025.

Revenue from U.S. tariffs. Source: Department of the Treasury, Fox Business

Related: The French central bank’s deficit is ‘great’ for Bitcoin: Arthur Hayes

A Potential Liquidity Boost from Stimulus Checks

The prospect of another stimulus package could serve as a liquidity booster for crypto markets during these uncertain times marked by government shutdowns—similar to what was observed during the 2020 market cycle.

This development might act as an “additional liquidity catalyst,” according to analysts at Bitfinex exchange who drew parallels with how COVID-19 stimulus checks previously introduced fresh retail investor liquidity that propelled Bitcoin (BTC) during the pandemic period.

An overview of BTC/USD weekly chart (2020–2021). Source: Cointelegraph/TradingView