Bitcoin’s recent dip from the $125K liquidity zone has triggered a necessary pullback towards the $120K mark. This movement seems more of a correction than an impulsive drop, with robust support aligning around the 100-day moving average and previous breakout levels.

Technical Analysis

By Shayan

The Daily Chart

In the daily timeframe, Bitcoin faced rejection at the $125K–$126K liquidity area, coinciding with past highs and a significant resistance cluster. This led to a retracement towards the $117K–$120K support zone, bolstered by an ascending trendline intersection, 100-day MA alignment, and crucial Fibonacci retracement points.

A bounce from this level could establish it as a higher low, paving the way for further bullish momentum. The RSI cooling off from overbought conditions indicates that momentum has reset, allowing for market stabilization before another potential rally. However, closing below $117K on a daily basis might weaken this structure and suggest deeper corrections toward $108K where prior demand zones exist.

The 4-Hour Chart

The short-term outlook on Bitcoin’s 4-hour chart shows signs of waning momentum after surpassing its previous all-time high. Following its breach above $125K, Bitcoin formed a Three Drives pattern—three successive peaks with decreasing strength—a classic indicator of buyer fatigue.

This resulted in healthy retracement to between $115K–$117K which stands as key support due to overlapping Fibonacci levels along with lower breakout boundaries forming critical technical confluence areas; strong bullish reactions here may attract fresh buying interest aiming again at targets between approximately ~$123k-$125k range once more!

Conversely failing hold these regions would confirm shifting short-term trends exposing lower liquidities near ~$108k previously consolidated pre-breakout stages.

Sentiment Analysis

By Shayan

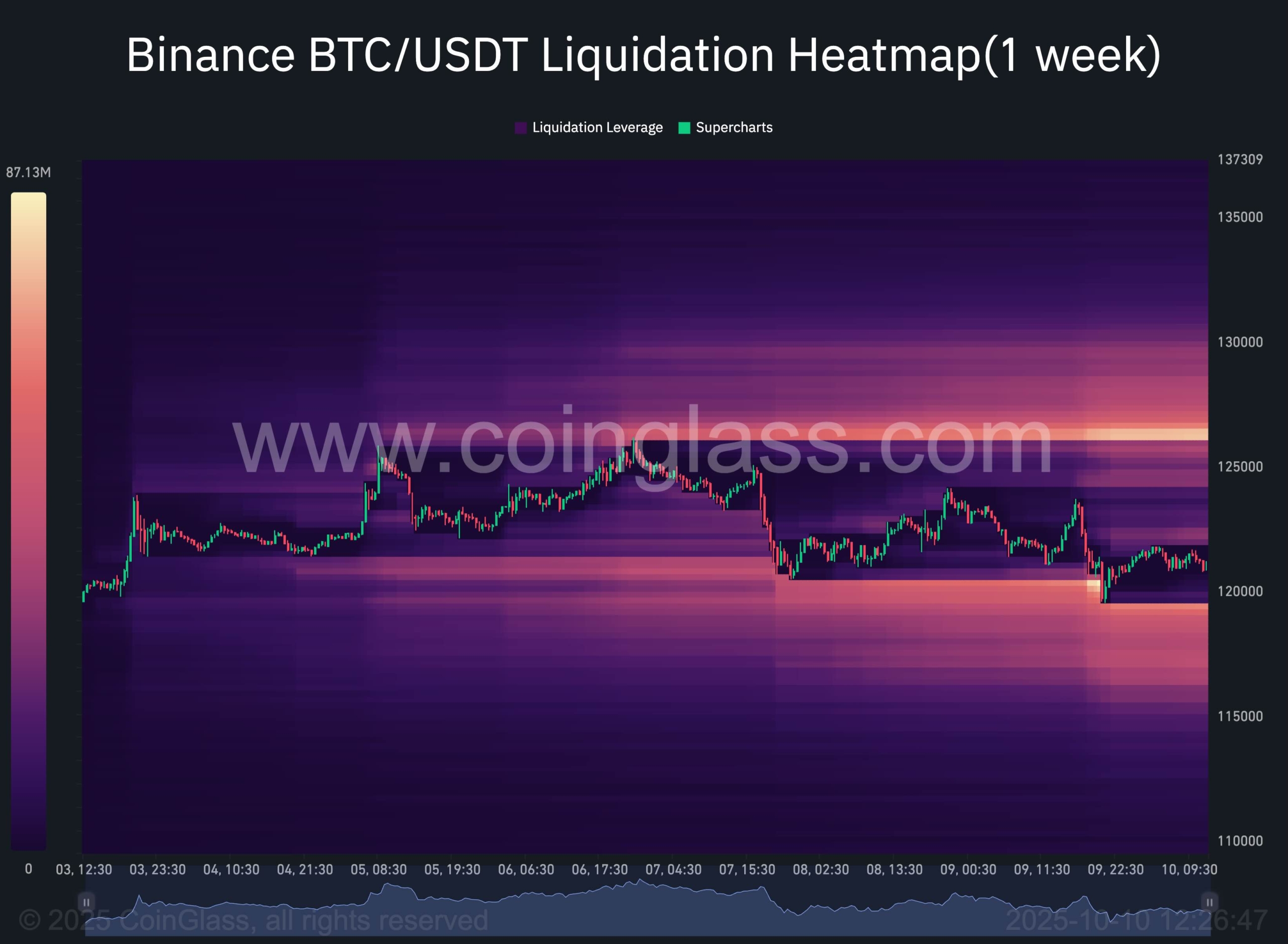

A weekly Binance liquidation heatmap offers insights into dynamics driving recent rejections/pullbacks; dense concentrations found within ranges spanning roughly ~124-126 thousand dollars coincide precisely triggering latest rejection events confirming substantial numbers leveraged shorts opened upon entering upper bands resulting unwinding fueling sharp responses thereafter…

Below current prices new pockets have emerged around ~118-120 thousand indicating zones over-leveraged longs likely face liquidations should prices dip further acting magnets pulling BTC into thresholds before demand resurfaces.

Interestingly enough heatmaps also reveal significant concentrations extending beyond ~126 reaching upwards through ~130-132 suggesting major targets institutional algorithmic players (“smart money”) implying once resistance reclaimed cleared acceleration rapid next band inevitable…

For now however on-chain landscapes favor short term consolidation biases digesting liquidation waves awaiting renewed directional movements local demands stabilize leverage resets potentially primed upward legs targeting richly liquidated regions nearing ~130 thousand!