MicroStrategy’s recent acquisition of Bitcoin has quickly attracted criticism. Just a day after the company revealed its substantial purchase, Bitcoin experienced a sharp decline.

On December 14, MicroStrategy disclosed that it had bought 10,645 BTC for approximately $980.3 million, averaging about $92,098 per coin. At that moment, Bitcoin was trading near its recent peak.

Poor Timing in the Short Run

The timing turned out to be unfortunate. Within just one day following MicroStrategy’s announcement, Bitcoin’s price dropped to around $85,000 and even dipped lower briefly. At the time of writing this article, BTC remains below the $80,000 mark.

MicroStrategy acquired 10,645 BTC for roughly $980.3 million at an average price of about $92,098 per bitcoin and has achieved a BTC Yield of 24.9% YTD 2025. As of December 14th 2025 we hold 671,268 BTC purchased for approximately $50.33 billion at an average cost of ~$74,972 per bitcoin.

— Michael Saylor (@saylor) December 15th ,2025

The drop in Bitcoin prices occurred amid broader market turmoil driven by fears over potential interest rate hikes by the Bank of Japan (BOJ), forced liquidations due to leverage unwinding and risk reduction measures taken by market makers. MicroStrategy’s purchase happened just before this wave intensified.

Bitcoin’s price decline was primarily caused by liquidation events rather than direct spot selling.

“This movement should be interpreted less as a collapse in fundamental demand and more as part of structural deleveraging.” – @xwinfinance

— CryptoQuant.com (@cryptoquant_com) December 16th ,2025

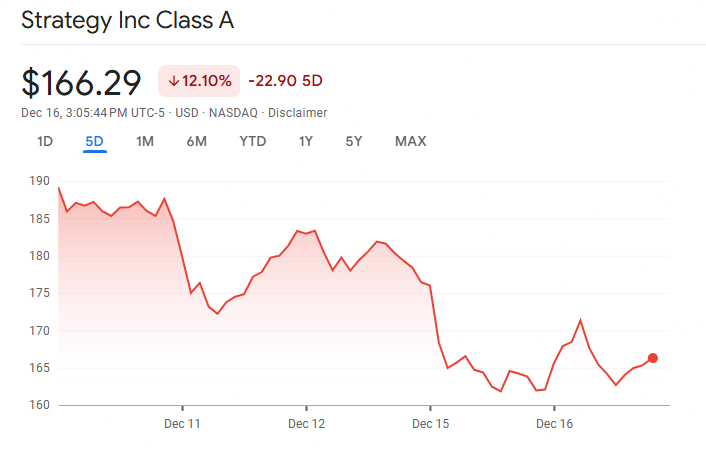

As Bitcoin slid downward sharply during these days so did shares in MicroStrategy — dropping over twenty-five percent within five trading sessions — significantly underperforming even Bitcoin itself.

Although there was some recovery today in MSTR stock prices they remain well below levels seen prior to announcing their latest buy.

MSTR Stock Prices Over The Past Week. Source: Google Finance

The Numbers Behind Investor Concerns

Currently MicroStrategy holds a total inventory of approximately 671,268 bitcoins, which were accumulated at an aggregate cost near $50.33 billion with an average acquisition price close to $74,972 each.

From a long-term standpoint, if held until now, if markets stabilize or rise again, taking profits remains likely.

However, a short-term perspective paints different optics since with current prices hovering around $85,000, specific tranches from their latest purchase are already showing unrealized losses on paper.

The firm’s market Net Asset Value (mNAV) ratio currently stands roughly at <strong>1&period11</strong>,&period meaning shares trade only about eleven percent above underlying bitcoin holdings value—a premium rapidly shrinking amid falling crypto prices coupled with equity investors reassessing risks..

MicroStrategy mNAV Chart. Source: Saylor Tracker

Reasons Behind The Market's Strong Reaction

The issue is not whether investors doubt MicroStrategy’s belief in owning bitcoin but rather concerns over timing decisions and risk management strategies employed..

Macro-economic risks leading up to this drop were widely anticipated &mdash ; including warnings surrounding BOJ potentially raising rates again &mdash ; which could threaten yen carry trades that have historically influenced cryptocurrency markets negatively during tightening cycles .

Critics argue that instead waiting patiently until macroeconomic conditions became clearer , Microstrategy aggressively purchased near resistance levels right before liquidity tightened globally .

🚨 JAPAN WILL CRASH BITCOIN IN FIVE DAYS!!!

Many underestimate how much Japan’s actions will impact bitcoin.

The Bank Of Japan is expected raise rates once more on Dec19.

That might seem minor…until you remember:

Japan holds significant influence… pic.twitter.com/0a9Aimfn88

— NoLimit (@NoLimitGains) December14 ,2025

A Question Of Perspective: Mistake Or Strategy?

Whether it was actually misguided depends largely on your timeframe focus . From short term trading angles , yes – buying immediately preceding such drops appears ill-timed because share values plunged further amplified via leverage effects plus shrinking NAV premiums .

However from strategic accumulation perspectives : microstrategy never aimed specifically toward perfect bottom-timing but emphasized gradual long term growth through consistent purchasing regardless short term volatility fluctuations . CEO Michael Saylor stresses accumulating greater amounts matters far more than pinpoint entry precision alone .

Ultimately real risk lies beyond initial transaction itself—it hinges upon what unfolds next : if btc stabilizes while macro pressures ease then new purchases blend into overall basis costs seamlessly whereas continued declines prolong scrutiny against decision making quality .

In conclusion although microstrategy may not have executed worst single btc buy during year twenty twenty-five yet undoubtedly secured one among most uncomfortable acquisitions so far considering immediate aftermath impacts on stock performance &amp;amp;amp;euro;risk sentiment dynamics alike .

–––-

Original article titled “Did MicroStrategymake Its WorstBitcoin Purchaseof2025?” first appearedon BeInCrypto.