In the past month, long-term Bitcoin holders have offloaded approximately 183,000 BTC. This includes a notable instance where around 8,000 BTC was transacted in a single day, as indicated by on-chain analytics that monitor the behavior of seasoned investors and their daily expenditure.

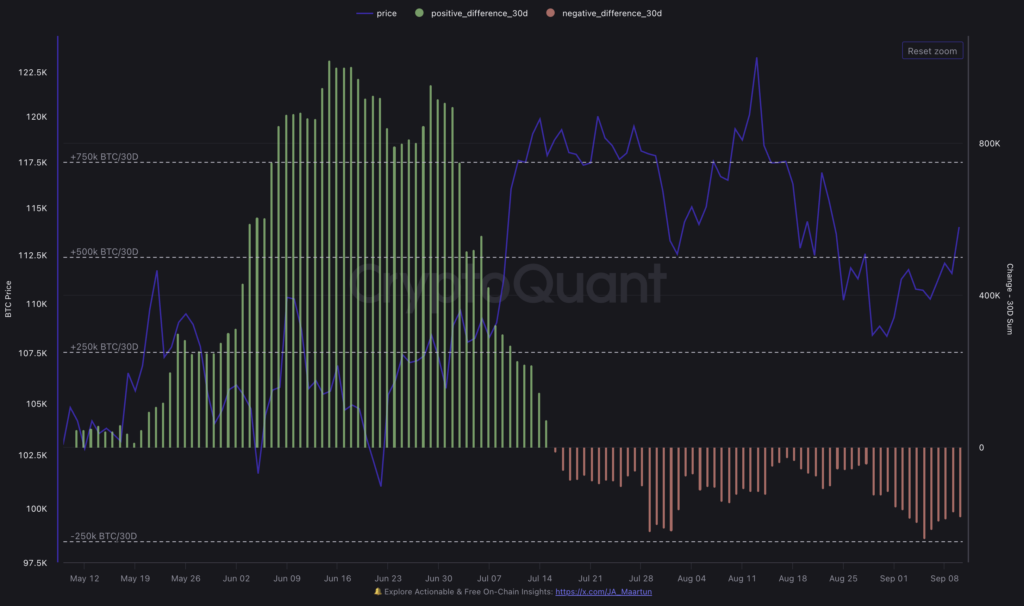

According to CryptoQuant’s analysis of Long-Term Holder (LTH) Net Position Change over the last 30 days, this decline in holdings aligns with a brief period of distribution. Additionally, data from Glassnode reveals that early September witnessed the largest single-day movement from long-term holders since the beginning of this year.

Simultaneously, there has been an increase in coins classified as illiquid supply—those historically less likely to be moved—which reached an unprecedented level of nearly 14.3 million BTC by late August. Glassnode categorizes these coins as belonging to entities that rarely engage in transactions; this category has expanded even amid price declines following mid-August peaks.

This suggests that while older wallets are distributing their assets, there is also significant accumulation happening among those who typically do not trade frequently. This dynamic is crucial for understanding how much new Bitcoin supply is actually available for trading purposes.

The activity surrounding spot Bitcoin ETFs adds another dimension to this scenario. On September 10th alone, U.S.-based products experienced substantial inflows amounting to approximately $757 million according to SoSoValue’s aggregated dashboard data.

A similar trend can be observed through Farside Investors’ ongoing tracking efforts which aggregate daily movements across various platforms. The simultaneous rise in primary-market demand alongside older coins being reintroduced into circulation serves as a straightforward absorption test; buyers must either step up or remain passive.

The Importance of Methodology

The LTH Net Position Change metric calculates changes over a month regarding supplies held by long-term investors and reflects a negative shift totaling about 183,000 BTC recently.

CryptoQuant’s daily measure tracks how many long-held coins are moved on-chain each day—this contributed significantly to the spike seen earlier in September.

Both datasets define “long-term holders” using a threshold of holding for at least 155 days and adjust for entities involved to avoid double counting; however they differ slightly: one monitors rolling balance changes while the other focuses on daily transaction volumes.

The context within market cycles helps interpret these movements effectively. Historically during bullish phases, seasoned wallets tend to sell when prices rise while new demand absorbs excess supply until selling pressure diminishes again—a pattern documented extensively by Glassnode’s Week On-Chain series highlighting distribution phases and profit-taking moments near market peaks throughout previous cycles.

“The current situation mirrors some aspects from those periods; illiquid coins have reached all-time highs indicating low turnover among owners while simultaneously an identifiable segment of older supplies has become active recently.

If ETF allocations persistently create incremental buying pressure then we will quickly see shifts reflected across realized flows exchange balances along with positioning among short-term holders . The mechanics behind absorption processes are straightforward ; issuance remains fixed , raising questions about whether primary-market participants OTC desks shorter-tenure wallets can offset inventory released by LTHs .

Three key indicators will dictate future outcomes :

First , if LTH Net Position Change trends back towards zero or positive territory it would indicate cooling off after heavy distributions which historically precedes periods where supplies mature into longer tenures again .

Second , consistent breadth across multiple ETF issuers such as IBIT FBTC BITB ARKB showing simultaneous inflows rather than just one fund dominating would suggest more robust primary-market demand tracked via Farside issuer breakdown SoSoValue metrics .

Thirdly profitability metrics concerning older coins like LTH-SOPR may reveal whether sellers profited before becoming inactive or if further supplies could emerge should prices rebound upwards again .

A Brief Retrospective Offers Valuable Insights

Analysis conducted by Glassnode regarding distribution phases indicates spikes related specifically towards increased spending patterns often cluster near local highs before diminishing once newer hands absorb existing inventories effectively creating tighter floats overall despite movement occurring amongst aged currencies themselves too! An important distinction present today compared previous cycles involves presence established buyers through spot ETFs which didn’t exist back then allowing real-time monitoring based upon issuer flow disclosures! If these flows maintain stability alongside expanding illiquid supply effects lead us toward tighter tradable floats even post-movement amongst aging assets themselves ; conversely should they falter whilst continuing distributions persist markets bear extra burdens needing clearance at lower valuations overall!

For readers wishing track developments closely consider overlaying simple visuals depicting both CryptoQuant’s recent thirty-day net change figures against corresponding US-based spot ETF net flows sourced from either SoSoValue Farside including annotations marking critical points such early-september session showcasing largest recorded spends thus far ! Highlight late-August observations noting high levels around fourteen point three million btc too ! Clarity matters here not color choices so keep focus sharp watching next sets buyer actions absorbing what previously held onto longer terms now released into circulation!

The immediate outlook remains contingent upon forthcoming data releases surrounding upcoming daily etfs prints monthly lth balance alterations determining effectiveness absorption witnessed throughout recent distributions totaling one hundred eighty-seven thousand btc respectively!