As the Supreme Court prepares to deliver its verdict on Trump’s tariff policies, market tensions are rising in mid-January. Investors and traders are closely analyzing trade regulations, executive powers, and potential fiscal consequences.

Table of Contents

Summary:

The markets are on edge as January progresses toward the Supreme Court’s decision regarding tariffs imposed during Trump’s administration. Traders remain vigilant about shifts in trade policy, executive authority boundaries, and financial risks.

The cryptocurrency sector is showing slight positive movement—Bitcoin up by 1.5%, Ethereum by 0.5%, and XRP increasing 0.7%—reflecting cautious optimism among investors.

Court rulings at lower levels have invalidated tariffs based on IEEPA statutes; if this stands at the Supreme Court level, it could force the U.S. government to repay over $130 billion, sparking debates about fiscal strain and executive power limits.

Bitcoin holds a bullish stance near $92,070; meanwhile Ethereum and XRP may experience short-term fluctuations but maintain promising long-term prospects.

This ruling might encourage increased capital inflows into cryptocurrencies as investors seek alternatives amid uncertainty—benefiting Bitcoin, Ethereum, and XRP over time.

A Closer Look at Crypto Markets: Calm Before a Key Decision

Todays’ crypto prices show moderate gains with Bitcoin climbing 1.5%, Ethereum edging up 0.5%, and XRP rising by 0.7%. The prevailing mood is one of caution as market participants await clarity from the Supreme Court ruling.

The lower courts previously dismissed tariffs justified under IEEPA authority; should this judgment be upheld federally, it would compel significant repayments exceeding $130 billion—a major burden for federal finances—and ignite discussions around presidential powers related to trade policy enforcement.

The Significance of This Verdict for Cryptocurrencies

This upcoming decision acts as a critical test for economic stability overall. Historically cryptocurrencies perform well during periods when traditional policies appear unstable because they offer alternative investment avenues outside conventional frameworks.

If confidence in trade or fiscal management diminishes due to this ruling’s outcome,

capital flows into digital assets could accelerate substantially.

Even if tariffs remain intact,

persistent inflationary pressures combined with ongoing geopolitical concerns keep crypto’s long-term outlook robust.

“””””

<p>This upcoming decision acts as a critical test for economic stability overall.

n

u003CBTCu003E u003C/BTCu003E &amp;amp;amp;amp;amp;;nbsp;n

n

nnnnnnu0026nbsp;;u0026nbsp;;u0026nbsp;;n&x2014 rr

An Outlook on Bitcoin: Fluctuation Coupled With Optimism

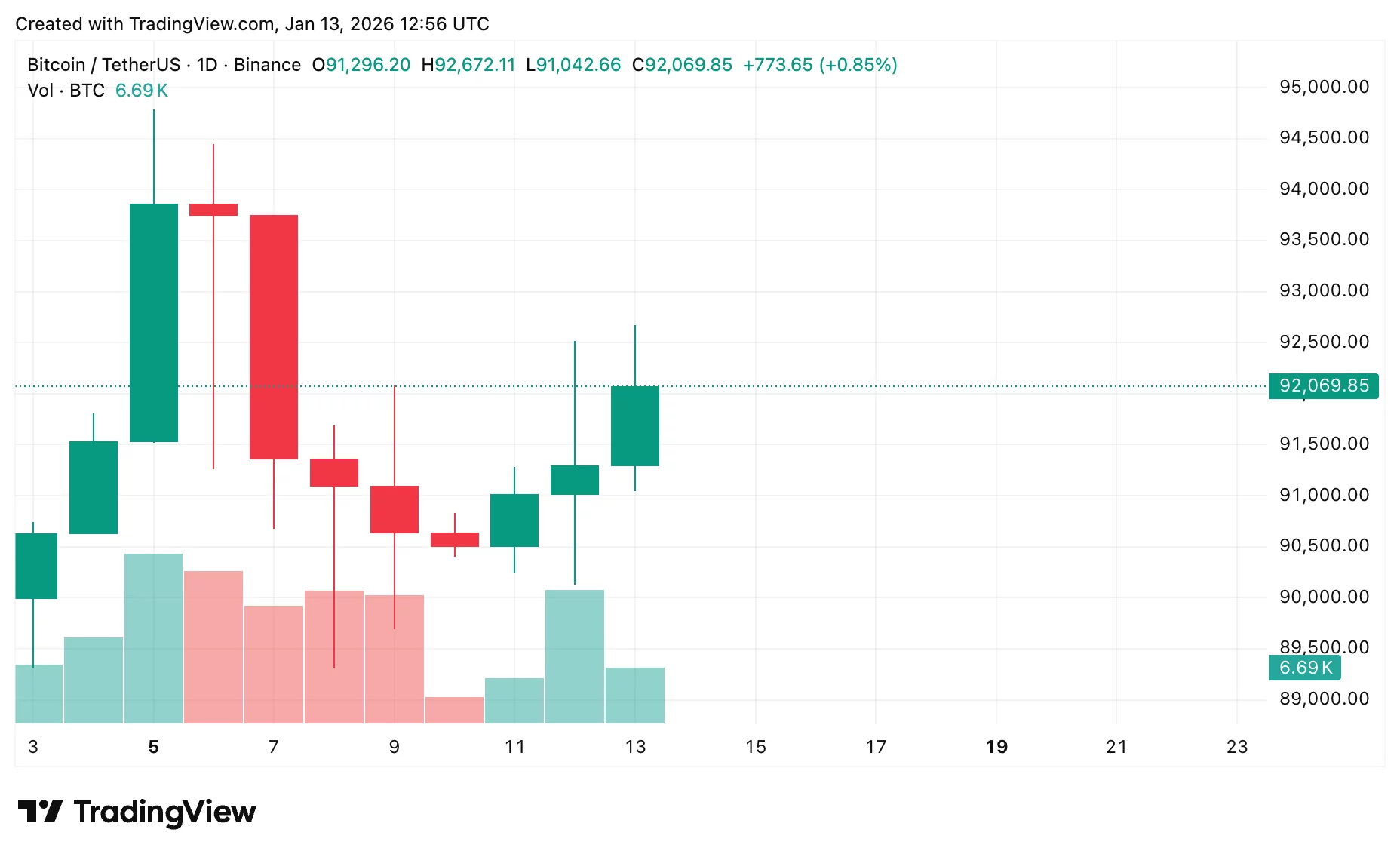

Bitcoin (BTC) currently trades close to $92,‑070 , holding above key support near $90,&?#8209;,000 but facing resistance from exponential moving averages (EMA). While there's risk that prices might dip towards approximately $86,&?#8209;,000 , substantial declines seem improbable unless broader market conditions deteriorate significantly.

BTC daily chart – January 2026 | Source: crypto.news

The forecast remains optimistic regarding Bitcoin price movements. Reversals or removals of these tariffs could enhance its appeal as an inflation hedge while geopolitical uncertainties further strengthen its case over time.& lt ; / p & gt ;

An Analysis Of Ethereum’s Position : Sensitive To Risk Appetite Changes

Ethereum (ETH) lingers around roughly $3,& nbsp ;133 . It may experience some instability depending upon trader reactions following any unsettling news from judicial decisions related directly or indirectly to tariff rulings.

ETH daily chart – January 2026 | Source:& nbspcrypto.news

Short term volatility is anticipated within ETH pricing however longer term fundamentals look promising once institutional investments resume momentum alongside infrastructure developments enhancing network capabilities.

You might also find interesting:

Standard Chartered projects that Ethereum will outperform Bitcoin throughout next decade cycles.

XRP Prospects Amid Market Uncertainty

XRP trades near approximately $ 02 .06 currently . Historically Ripple tends toward larger price swings when markets face uncertainty — initially prompting traders toward safer holdings before sentiment improves causing renewed interest pushing altcoins like XRP higher again.

XRP daily chart – January 2026 | Source:& nbspcrypto.news

XRP price forecasts suggest initial caution may soon give way into notable upward momentum once broader market conditions stabilize favorably.

Final Reflections

The much-anticipated Supreme Court verdict arrives mid-January keeping traders alert across all asset classes including crypto assets where bitcoin remains steady while ethereum along with xrp potentially benefit post-ruling due largely ongoing fiscal pressures plus international trading concerns which continue fueling cryptocurrency attractiveness over extended horizons.

If you want more details:

XRP ETF now available in New York — How enthusiasts can earn stable returns reaching up to five thousand XRP per day?