Cryptocurrency investment products failed to extend their inflow streak last week as spot prices declined.

Global crypto exchange-traded products (ETPs) recorded $812 million of outflows in the week to Friday, ending a two-week run of inflows, CoinShares reported on Monday.

Total assets under management (AUM) declined to $221 billion from a record-setting $241 billion the previous week, likely due to fading confidence over US interest rate cuts, wrote CoinShares’ head of research, James Butterfill.

The outflows came as Bitcoin dropped 3.4% from $112,000 on Sept. 22 to an intraweek low of $109,000, according to data from CoinGecko.

Solana is the standout performer

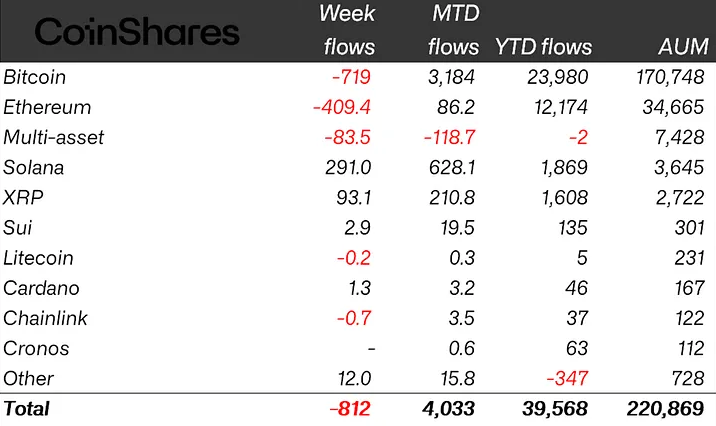

Bitcoin (BTC) and Ether (ETH) ETPs logged significant losses last week, with $719 million and $409 million of outflows, respectively.

Solana (SOL) funds emerged as the standout performer, with $291 million in inflows, likely in anticipation of forthcoming exchange-traded fund (ETF) launches in the US, Butterfill said.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

Despite the failure to maintain the inflows last week, crypto ETPs managed to hold substantial cumulative inflows, including $4 billion in month-to-date inflows and $39.6 million in year-to-date, CoinShares’ Butterfill noted.

According to the analyst, crypto funds are well-positioned to maintain momentum to potentially match last year’s record of $48.6 billion.

Magazine: ETH co-founder moves $6M of ETH, crypto index ETF expands: Hodler’s Digest, Sept. 21 – 27