The U.S. Securities and Exchange Commission (SEC) has opened the door for a significant influx of new cryptocurrency exchange-traded products (ETPs), a development that experts believe could transform the flow of capital into digital currencies.

On Wednesday, the SEC approved broad listing criteria for “commodity-based trust shares” on regulated platforms such as Nasdaq, Cboe BZX, and NYSE Arca.

Read more: SEC Simplifies Spot Crypto ETF Listing Process, Greenlights Grayscale’s Large-Cap Crypto Fund

The updated regulations eliminate the requirement for each crypto ETP to submit individual rule filings under Section 19(b) of the Exchange Act. Instead, offerings with underlying assets that meet specific objective eligibility criteria—such as trading on markets affiliated with the Intermarket Surveillance Group (ISG) or having futures contracts listed on a CFTC-regulated designated contract market for at least six months—can now be listed using these generic standards.

What Lies Ahead?

This regulatory change represents a pivotal moment for the cryptocurrency sector by removing much of the bureaucratic hindrance that has historically delayed new crypto product launches, according to analysts.

“The floodgates for crypto ETFs are about to swing wide open,” stated Nate Geraci, an influential ETF analyst and president of NovaDius Wealth Management.

“Prepare yourself for an overwhelming wave of new applications and product launches,” he added. “Whether you embrace it or not, cryptocurrencies are entering mainstream finance through ETFs.”

Matt Hougan, chief investment officer at Bitwise—a digital asset management firm and ETF issuer—described this move by the SEC as a milestone in cryptocurrency’s evolution.

“This is indicative that we have arrived in major league territory,” he noted. “However, this is merely just the beginning.”

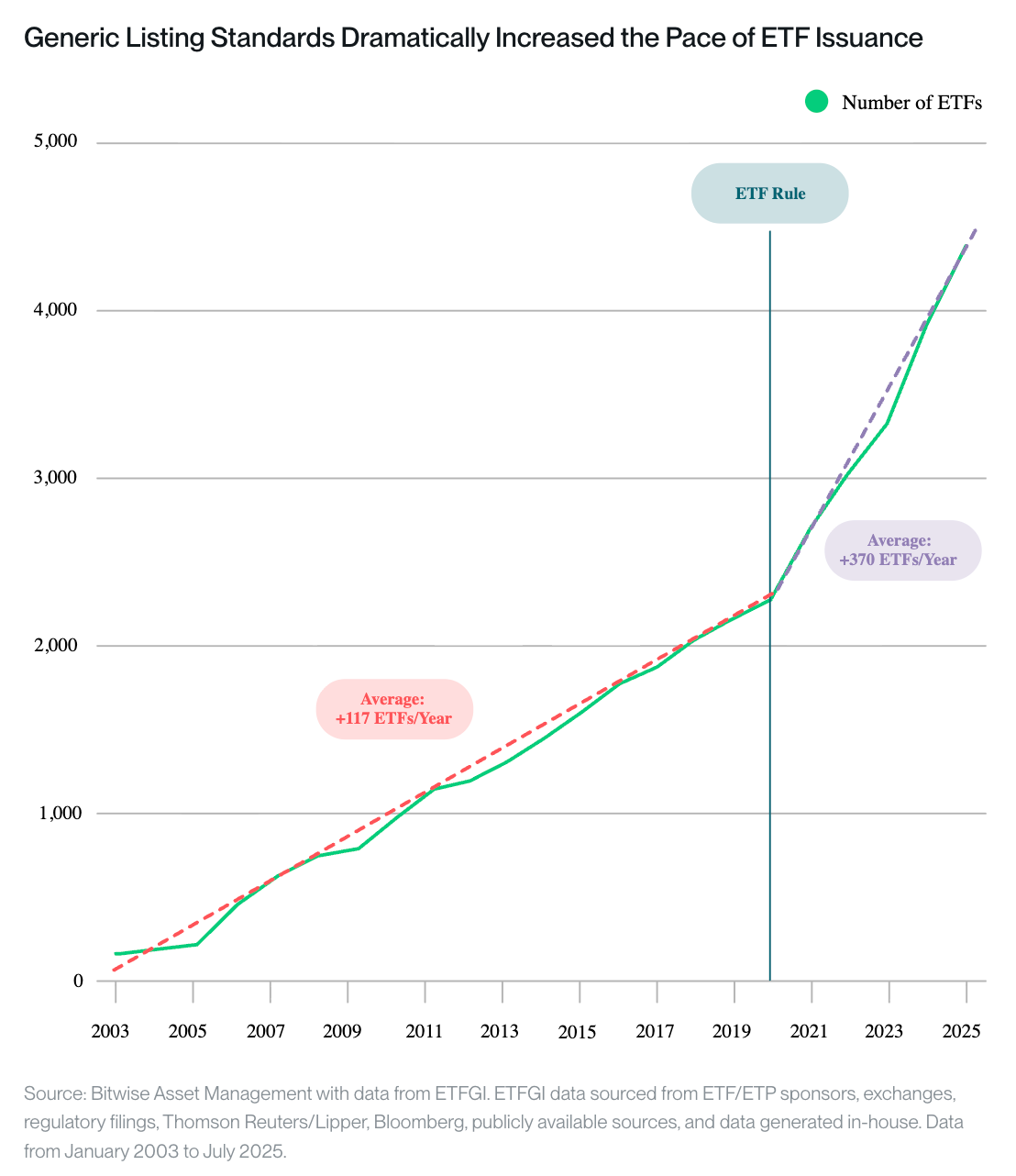

Historical trends support forecasts indicating that there will be an increase in new crypto ETF introductions under these revised guidelines. When generic listing standards were established by the SEC in 2019 for bond- and stock-based products, there was more than a threefold increase in ETF launches within one year—from 117 to 370—as pointed out by Hougan.

ETF launches before and after adopting generic listing standards. (Bitwise Asset Management/ETFGI)

Implications For Cryptocurrency Valuations

Hougan advised caution against assuming that newly introduced crypto ETPs will automatically result in substantial capital inflows. “The presence of a crypto ETP does not ensure significant investment interest,” he remarked. “There must be genuine demand for its underlying asset.”

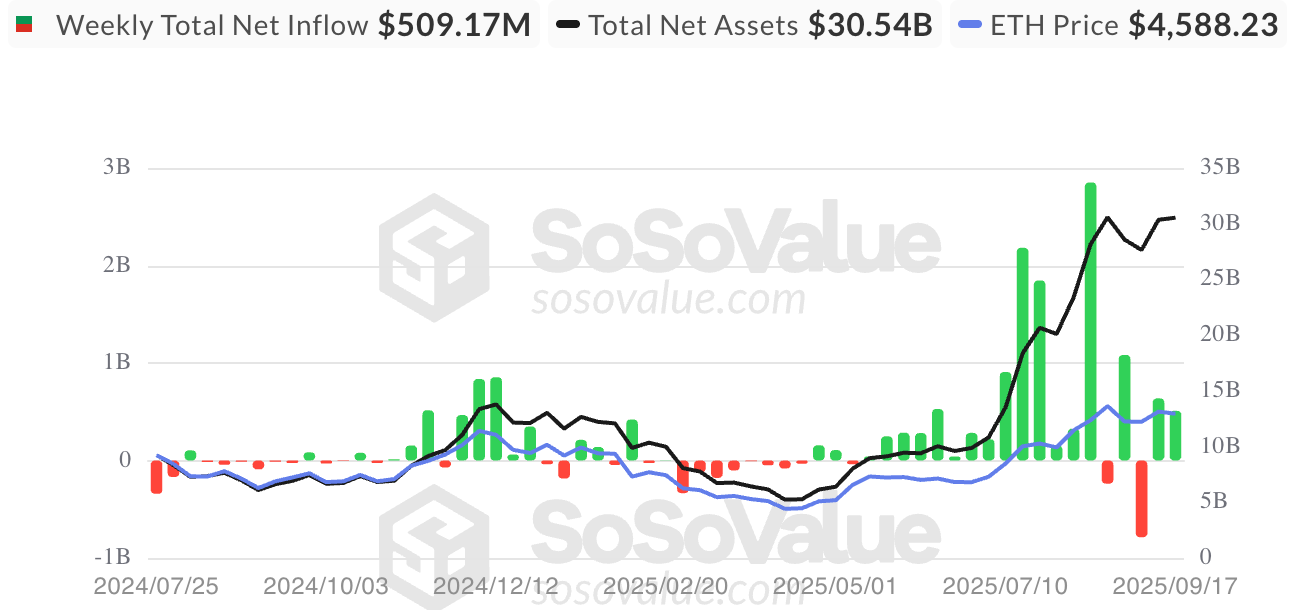

A case in point is how spot ether (ETH) ETFs experienced slow initial uptake; they only began attracting meaningful investments nearly one year post-launch when stablecoin activity surged alongside Ethereum’s evolving investment narrative.

U.S.-listed spot ETH ETF flows (SoSoValue)

Conversely, products linked to smaller-cap assets lacking clear use cases may find it challenging to draw investor interest without renewed fundamental backing.

Nonetheless, Hougan contended that ETPs significantly lower entry barriers for traditional investors; they facilitate easier transitions into cryptocurrencies once market sentiment shifts positively. Additionally, they help clarify what cryptocurrencies are all about when names like Avalanche AVAX$34.12, Chainlink LINK$23.68 appear within brokerage accounts,” he explained.

“Currently we observe lesser-known assets being integrated into these financial wrappers,” Paul Howard from Wincent shared with CoinDesk via note.” For institutions unable to directly hold spot [crypto], these vehicles offer essential wrappers while injecting liquidity into their ecosystems.”

The tokens poised to gain from this trend include large-cap altcoins such as Dogecoin DOGE $0 .2678 , XRPXRP$3 .0155 , SolanaSOL$238 .67 , SuiSUI$3 .6686s pan>, Aptos APT$4 .6108. “Investors are now seeking opportunities beyond Bitcoin BTC$116 ,015 .09“, Howard stated.