The leading cryptocurrency, Bitcoin (BTC), is exhibiting signs of a potential upward movement as the market closely monitors today’s Federal Reserve meeting. The Fed is anticipated to announce its first interest rate reduction since December 2024.

On-chain analytics indicate that traders are gearing up for a price increase, believing that a more accommodating monetary policy could serve as the trigger for BTC to regain the $120,000 mark.

Bitcoin Poised for Takeoff as Fed Rate Cut Expectations Elevate Investor Sentiment

The two-day Federal Reserve meeting commenced on Tuesday, generating heightened excitement within the crypto sector. Traders are optimistic that lowering interest rates will channel new investments into riskier assets, thereby boosting BTC’s value.

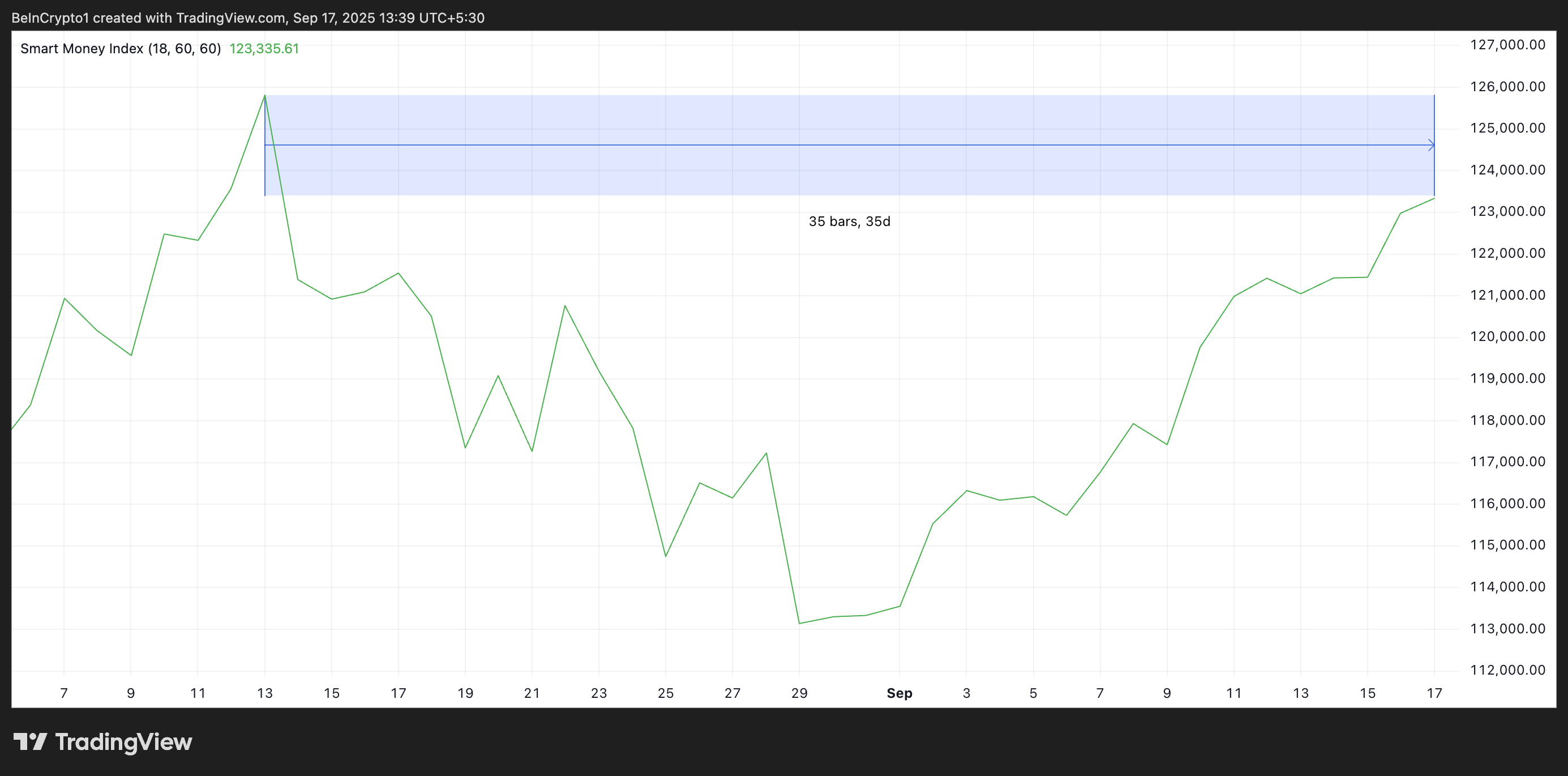

Technical indicators lend support to this optimistic outlook. For instance, Bitcoin’s Smart Money Index (SMI) is trending upwards, suggesting that significant players are increasingly incorporating this digital asset into their portfolios. Currently, this momentum indicator stands at a 35-day peak of 123,400.

If you’re interested in token technical analysis and market updates: Want more insights like these? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

The SMI tracks institutional investor behavior by examining price fluctuations during specific trading hours—especially during end-of-day sessions.

An increase in the SMI indicates rising confidence among institutional investors and suggests a bullish market sentiment. The uptick in BTC’s SMI shows that major investors are accumulating ahead of the FOMC meeting and reflects strong optimism regarding an ongoing rally.

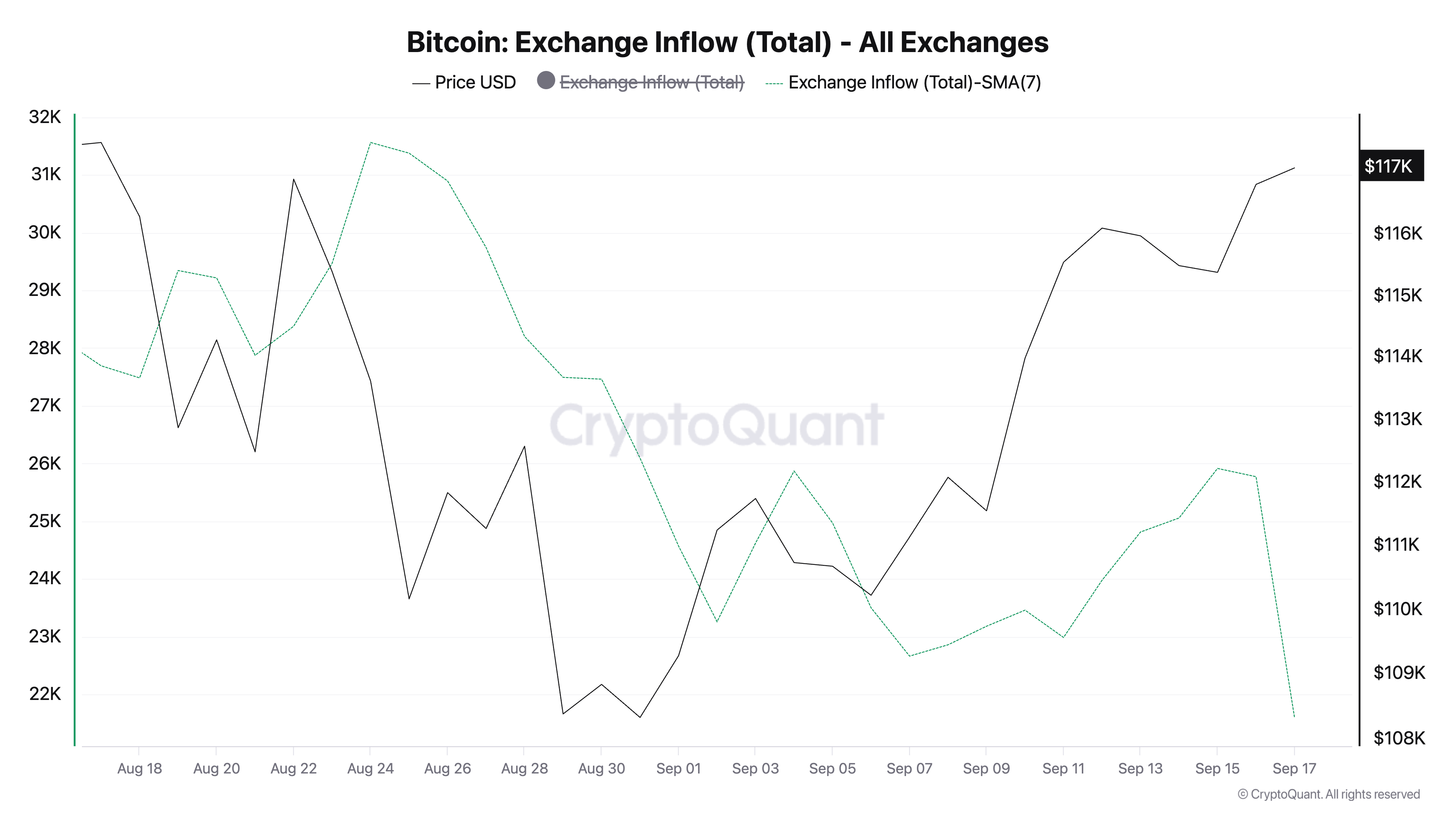

Moreover, Bitcoin exchange inflows have plummeted to their lowest levels in over one-and-a-half years—a sign indicating reduced sell-offs across the broader market.

According to data from CryptoQuant, the seven-day moving average of exchange inflows has dropped significantly from 51,000 BTC in July down to just 21,000 BTC now.

The average deposit per transaction has also seen a decline; it halved from 1.14 BTC mid-July down to 0.57 BTC by September. A recent report from CryptoQuant suggests this trend indicates less selling pressure from larger holders of Bitcoin.

This pattern points towards easing selling pressure throughout the market which may stabilize prices and foster conditions conducive for an extended upward trajectory for Bitcoin’s value.

$120K Within Reach if Market Maintains Key Support Levels

With fewer coins being deposited onto exchanges alongside increased accumulation activity ,the overall sentiment appears positive . This raises prospects for an ascent toward $120 ,000 soon .

Nonetheless ,for such growth materialize ,the leading cryptocurrency must first surpass resistance at $119 ,367 transforming it into supportive ground . Success here could lead towards targeting $122 ,190 .

Conversely,a shift away from holding patterns toward distribution might hinder progress . In such cases,the coin’s valuation could retreat towards support around$115 ,892 .

The post Is The Fed ’s Rate Cut The Catalyst That Will Enable Bitcoin To Reclaim$120K ? appeared first on BeInCrypto.