Cathie Wood, the CEO of Ark Invest, suggests that Bitcoin may increasingly become a significant component in institutional investment portfolios. In her market forecast for 2026, she highlighted the cryptocurrency as an effective tool for diversification.

In her comprehensive analysis, Wood emphasized Bitcoin’s minimal correlation with other key asset categories such as gold, stocks, and bonds. This characteristic makes it a compelling option for asset managers to consider seriously.

“For those seeking enhanced returns relative to risk levels, Bitcoin presents itself as an excellent diversification opportunity,” she stated.

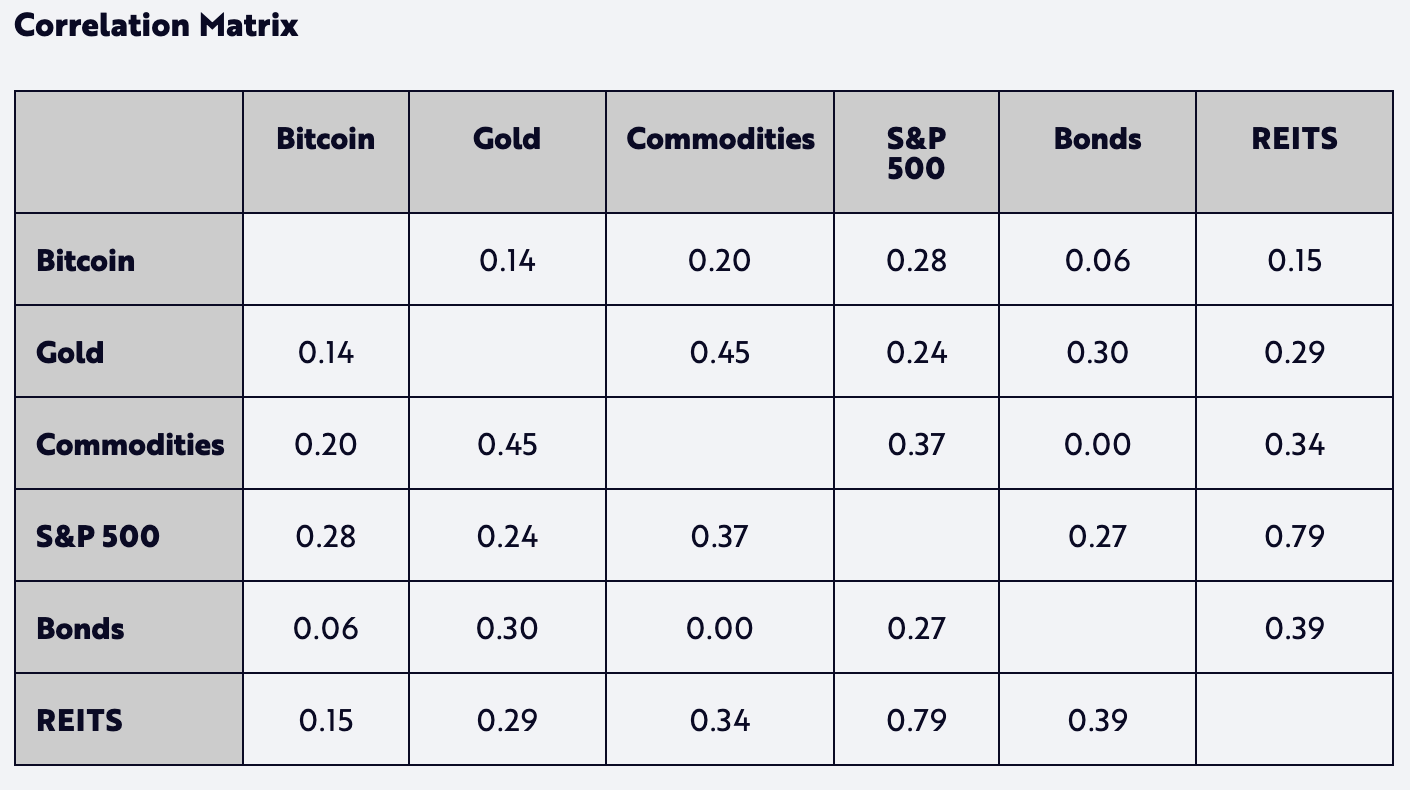

Wood noted that since 2020, Bitcoin has exhibited lower price correlations with equities and fixed-income securities than these assets have shown among themselves. For instance, the correlation between Bitcoin and the S&P 500 was recorded at just 0.28—significantly lower than the 0.79 correlation seen between the S&P 500 and real estate investment trusts—indicating that Bitcoin’s unique position could make it a more attractive investment choice.

Asset correlations (Ark Invest)

Asset correlations (Ark Invest)

This perspective may allow large institutional investors who are focused on managing risk-adjusted portfolios to view Bitcoin not merely as a speculative asset but rather as a strategic addition.

Contrastingly, Wood’s optimistic outlook coincided with Jefferies strategist Christopher Wood’s recent pivot regarding his recommendations on including Bitcoin in investment portfolios. On Friday he retracted his previous suggestion of allocating 10% of investments into cryptocurrency in favor of gold instead. Having initially incorporated Bitcoin into his model portfolio in late 2020 and increasing its share to ten percent by early 2021, Jefferies’ Wood expressed concerns that advancements in quantum computing might undermine the security of the Bitcoin blockchain over time—thus diminishing its viability as a long-term store of value.

While Jefferies has adopted a more cautious stance towards investing in bitcoin lately, Cathie Wood’s views resonate with sentiments echoed by other prominent financial institutions recently. Morgan Stanley’s Global Investment Committee proposed an “opportunistic” allocation strategy allowing up to four percent exposure to bitcoin; similarly Bank of America has permitted wealth advisors to recommend this approach.

CF Benchmarks also recognized BTC as an essential part of any portfolio strategy indicating that even conservative allocations could enhance overall efficiency through improved returns alongside greater diversification benefits. Additionally, Brazil’s leading asset management firm Itaú Asset Management advised maintaining a small allocation toward bitcoin as protection against foreign exchange fluctuations and market volatility.

Read more: Ark Invest predicts bitcoin prices could soar between $300K and $1.5 million by 2030