Midnight’s impressive upward momentum continues unabated, driven by robust investor enthusiasm that has propelled the token to unprecedented price levels. This project, linked to Charles Hoskinson—the visionary behind Cardano—remains in the spotlight as it maintains its bullish trajectory.

Despite already achieving significant gains, both technical indicators and broader market trends hint at further room for growth.

Investors Eye a Bright Horizon for Midnight

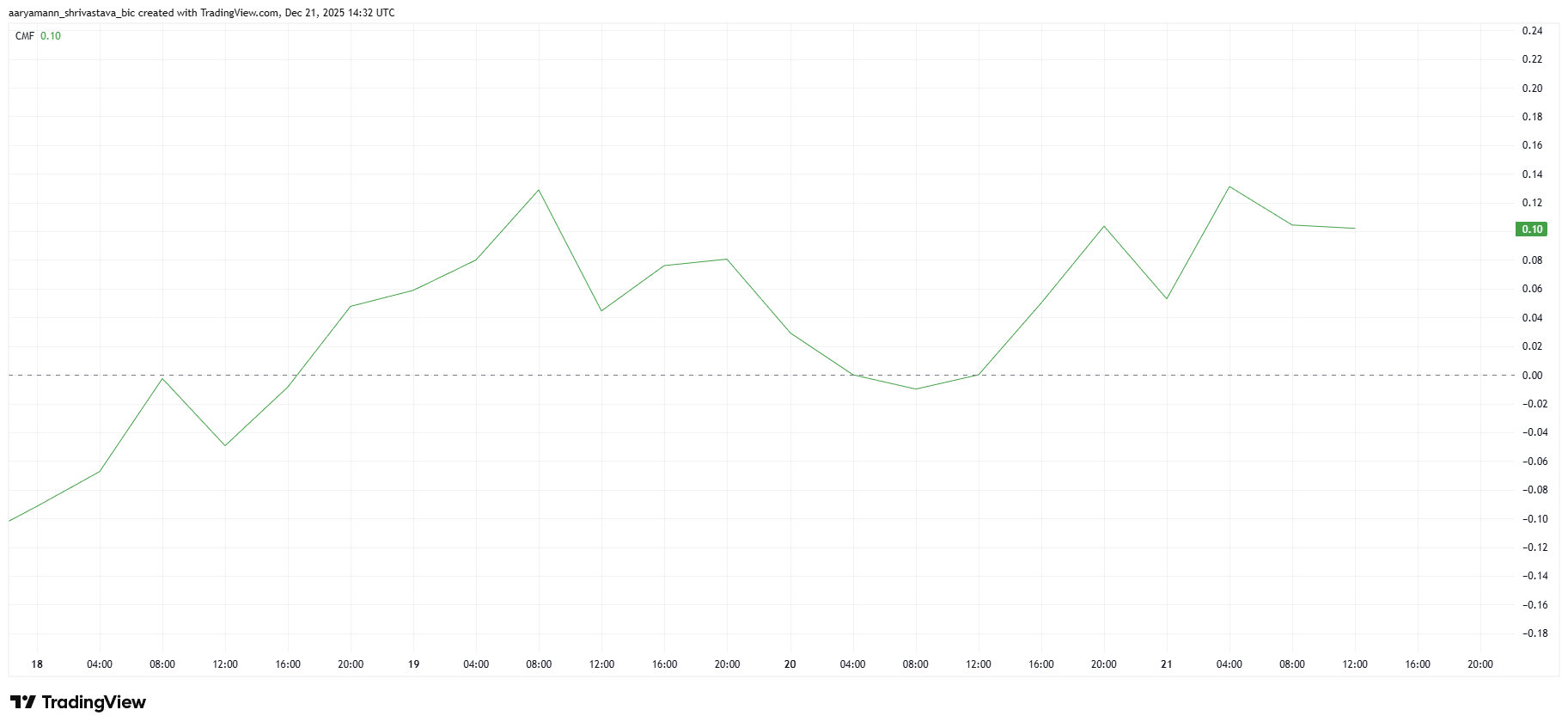

The backing for NIGHT tokens remains solid among investors. The Chaikin Money Flow indicator is positioned above zero, signaling consistent net capital inflows. Although there was a minor dip in this metric over the last two days, funds continue to flow into the asset, suggesting sustained confidence rather than profit-taking.

A substantial portion of this demand stems from Midnight’s association with Charles Hoskinson. His involvement lends credibility and increases visibility within the crypto community.

This narrative-driven enthusiasm is expected to keep attracting fresh investments into NIGHT in the near term, helping maintain elevated price levels.

NIGHT CMF. Source: TradingView

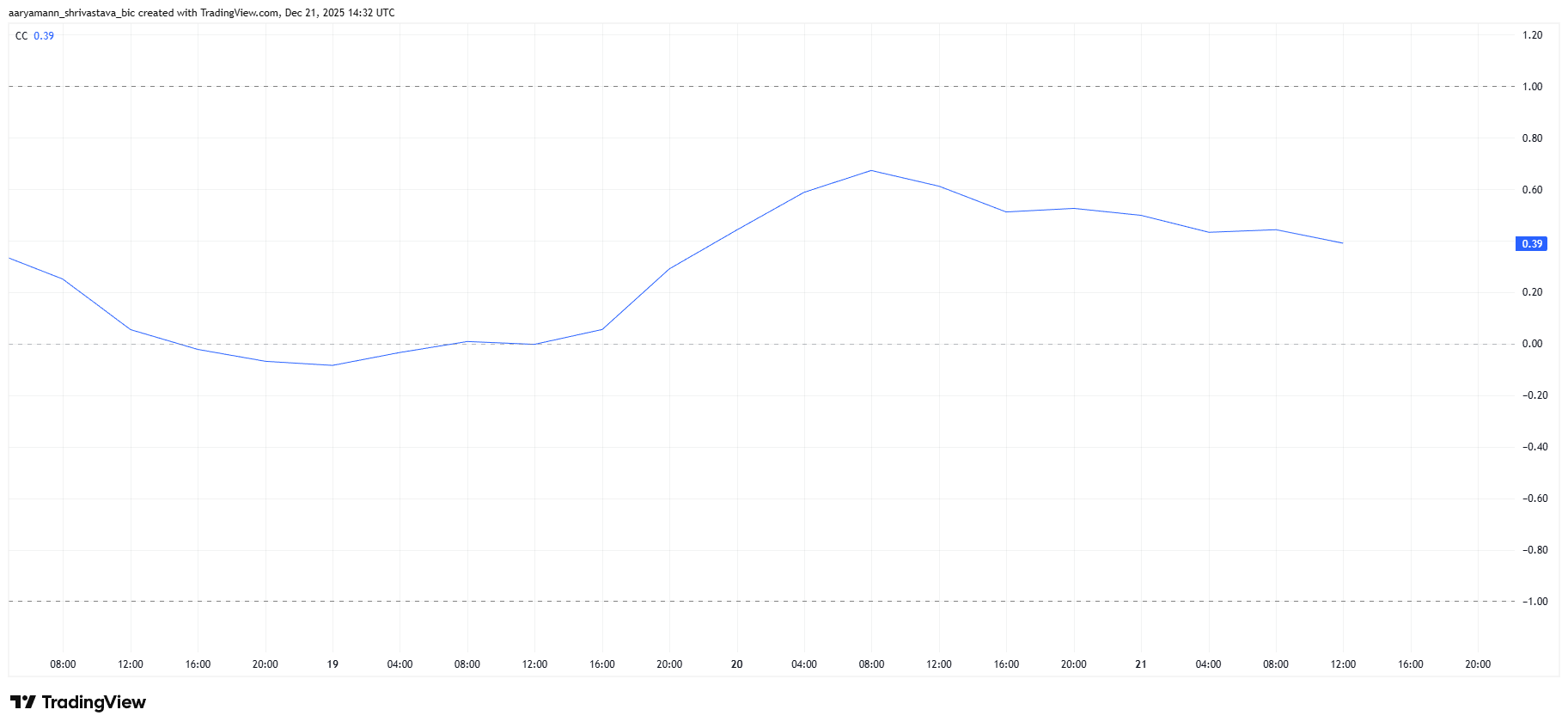

From a macro perspective, conditions are favorable for NIGHT’s continued strength. The token exhibits minimal correlation with Bitcoin’s price movements, shielding it from wider market volatility. This independence has enabled NIGHT to climb steadily even as Bitcoin faces challenges regaining upward momentum.

Assets with low correlation often benefit during periods when Bitcoin consolidates without clear direction. Since BTC lacks definitive recovery signals currently, NIGHT’s capacity to advance based on its own fundamentals offers a distinct advantage that may sustain its outperformance shortly.

NIGHT Correlation To Bitcoin. Source: TradingView

NIGHT Token Hits Record Highs

The value of Midnight surged by 42.7% within just one day and was trading close to $0.093 at publication time. This sharp upswing led to an intraday peak reaching $0.096—a new all-time high—highlighting strong buying pressure and persistent interest following recent breakout moves.

The prevailing optimistic sentiment combined with supportive macroeconomic factors points toward additional upside potential ahead. Should these trends continue uninterrupted, NIGHT might surpass the psychological barrier of $0.10 soon—a milestone likely to attract more speculative capital and further fuel momentum.

NIGHT Price Analysis . Source: TradingView

However, risk factors persist if investors start locking in profits aggressively. a surge in selling pressure could drag prices down toward key support around $0&period075. if this level breaks, bears may gain control leading prices lower possibly down near $0&period060, such moves would undermine current bullish setups while increasing market volatility substantially.