Bitcoin entered 2026 hovering around the $88,000 mark, continuing a prolonged period of sideways movement. Although price fluctuations seem minimal on the surface, underlying blockchain data indicates subtle shifts occurring within the market dynamics.

According to three key metrics from CryptoQuant, selling pressure is gradually diminishing despite ongoing macroeconomic uncertainties that are limiting upward momentum.

Accumulation Signals from Long-Term Investors

The cryptocurrency has faced challenges in overcoming critical resistance levels following a significant decline in late 2025. The absence of strong buying activity has kept market sentiment tentative as traders await clear signs that the correction phase is over.

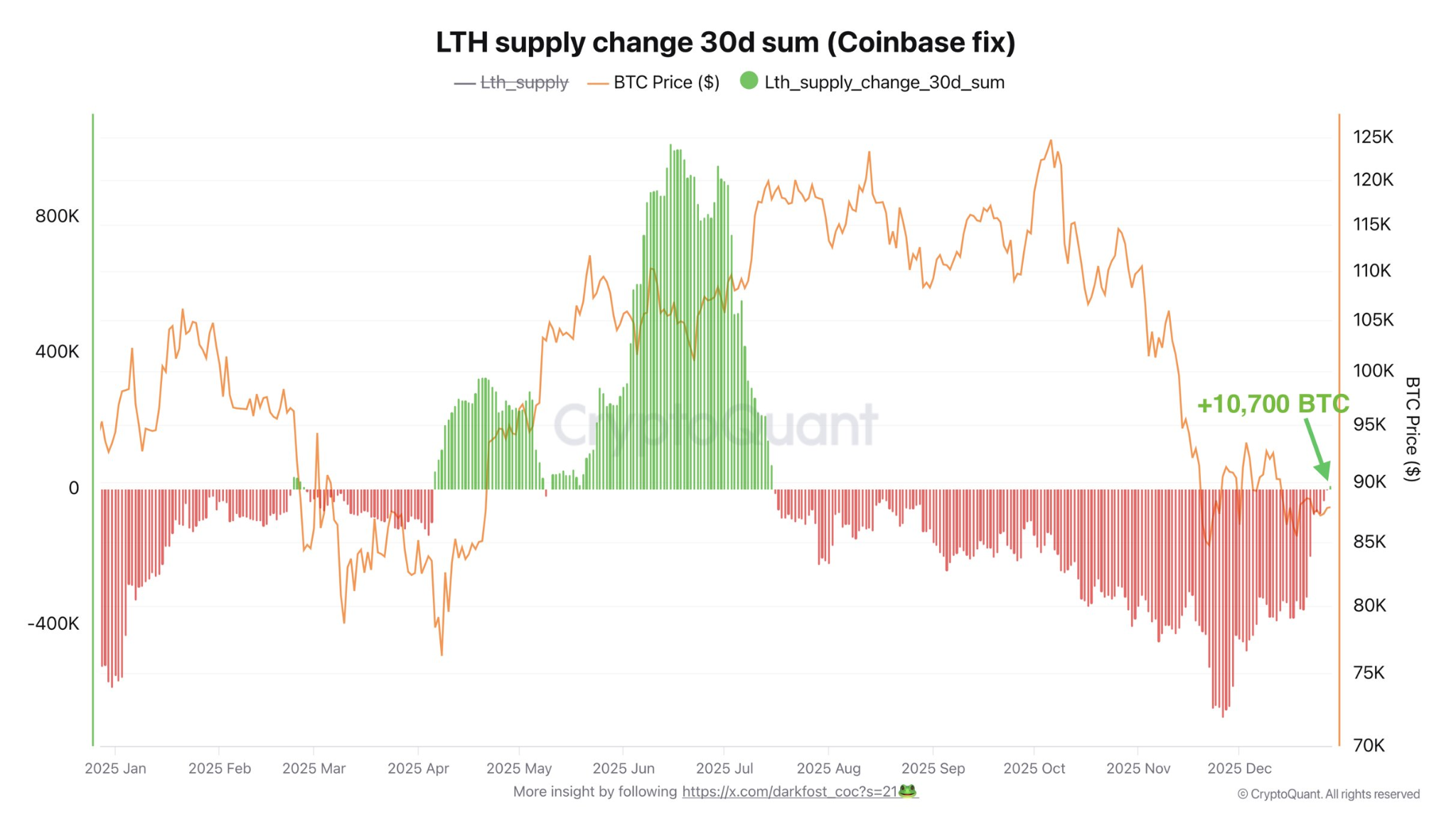

The first notable indicator comes from tracking long-term holder (LTH) supply changes. After enduring months of negative net flows, there has been a recent positive shift amounting to approximately 10,700 BTC added back into LTH wallets over the past 30 days.

This development implies that long-term investors are halting large-scale coin sales and instead accumulating more Bitcoin. Such behavior typically emerges during consolidation periods rather than at market peaks.

LTH SOPR Indicates Stability Rather Than Panic Selling

A second important metric monitors the spent output profit ratio (SOPR) for long-term holders—measuring whether these investors sell their coins at gains or losses.

Currently positioned near a neutral value of 1.0, this suggests LTHs are neither capitulating nor offloading assets at losses en masse. Historically, this pattern reflects markets stabilizing after corrections instead of entering further steep declines.

🚨 Old Coins Moving

Long-Term Holder SOPR just surged to 101.7 📈

→ Strong profit realization by long-term holders.🔁 9 BTC moved

⏳ Last active: June 2014Early holders are distributing. 👀 pic.twitter.com/wswH9FlSSy

— Maartunn (@JA_Maartun) January 1, 2026

Diminished Sell Pressure Reflected by Exchange Outflows

The third signal involves Bitcoin’s exchange netflow data showing sustained outflows — meaning more BTC is leaving exchanges than being deposited back in recently.

This reduces immediate selling availability on spot markets but hasn’t yet triggered a price surge due to cautious demand amid tighter liquidity conditions and postponed expectations regarding US interest rate cuts.

Can Bitcoin Break Above $100K This January?

When viewed collectively, these indicators present an optimistic yet cautious outlook.

supply-side pressures appear to be easing while confidence among long-term holders remains intact.

''''' &;#8203;supply-side pressures appear to be easing while confidence among long-term holders remains intact.&;#8203;, but weak demand combined with macroeconomic headwinds keeps prices range-bound.

A swift rally toward $100K would likely depend on new positive catalysts emerging soon.

Without such triggers, Bitcoin may continue consolidating throughout early +++, potentially forming a foundation for stronger gains later in +++.

The original article titled “u005CWill Bitcoin Price Reclaim $100u002C000 in January? Three Charts Hold The Answeru201D was initially published on BeInCrypto.