Bitcoin (BTC) bulls are striving to overcome a recurring pattern of selling pressure observed during U.S. trading hours this Friday.

After dipping below $85,000 late Thursday afternoon, BTC rebounded once more following the close of U.S. markets, climbing back above $89,000 as Friday began. However, this price point has consistently acted as a ceiling throughout the week, with sellers repeatedly pushing prices down—sometimes within minutes and other times over several hours.

Currently, the leading cryptocurrency remains relatively stable ahead of the upcoming holiday weekend, trading around $88,400—a modest 0.3% increase in the last 24 hours.

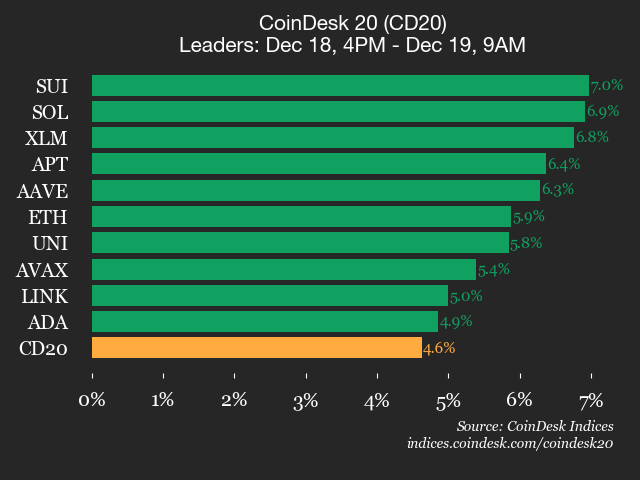

Ethereum (ETH) surged close to $3,000 with a 1% gain over the past day. Among altcoins leading overnight recoveries are Solana’s SOL at approximately $125.34 and SUI at about $1.4315.

The U.S. stock market is enjoying another robust session today as well—with Nasdaq advancing by roughly 1%. Major AI-focused companies such as Nvidia, Oracle, and AMD have seen their shares rise between 3% and 6%.

For further details: Oracle TikTok deal boosts AI mining stocks

Stocks linked to digital assets mirrored this positive momentum during their rebound phase. Ethereum treasury firm BitMine (BMNR) climbed nearly 8%, while Galaxy Digital (GLXY) and stablecoin issuer Circle (CRCL) each gained around 3%.

MSTR—known for being one of the largest corporate holders of Bitcoin—also experienced an increase exceeding 3%, pushing its market-to-net-asset-value ratio up to approximately 1.09.

In addition, BitDigital (BTBT) surged by about 10%, fueled by news that WhiteFibre (WYFI), in which BitDigital holds roughly a 70% stake—and which itself rose by around11%—has inked a decade-long colocation contract for a substantial40MW capacity with Nscale valued near $865 million.This development significantly boosted BTBT’s share value.