Bitcoin is exhibiting signs of a potential breakout, as $136 million worth of short position liquidations hint at a possible shift in market dynamics, with critical resistance points under close watch.

Over the last 24 hours, Bitcoin (BTC) has gained momentum, rising by 2.4% to reach approximately $92,502.

The cryptocurrency’s price has fluctuated within a 24-hour range between $90,040.61 and $94,489.84. This movement reflects some volatility but an overall upward trend. Currently, Bitcoin’s market capitalization stands at around $1.85 trillion with trading volumes hitting roughly $52.71 billion in the past day—indicating robust market activity.

Examining recent performance metrics reveals that Bitcoin experienced a slight dip of 0.1% over the past week but posted an impressive 6% gain over two weeks—highlighting growing positive sentiment recently. Despite this short-term optimism, monthly figures show a decline of nearly 13%, and yearly data reflect a drop of about 4.7%, suggesting longer-term bearish pressure remains.

As BTC consolidates near the $92K threshold and tests vital resistance levels, traders are vigilantly observing price movements for any signs that could trigger an upward breakout.

Bitcoin Support and Resistance Zones

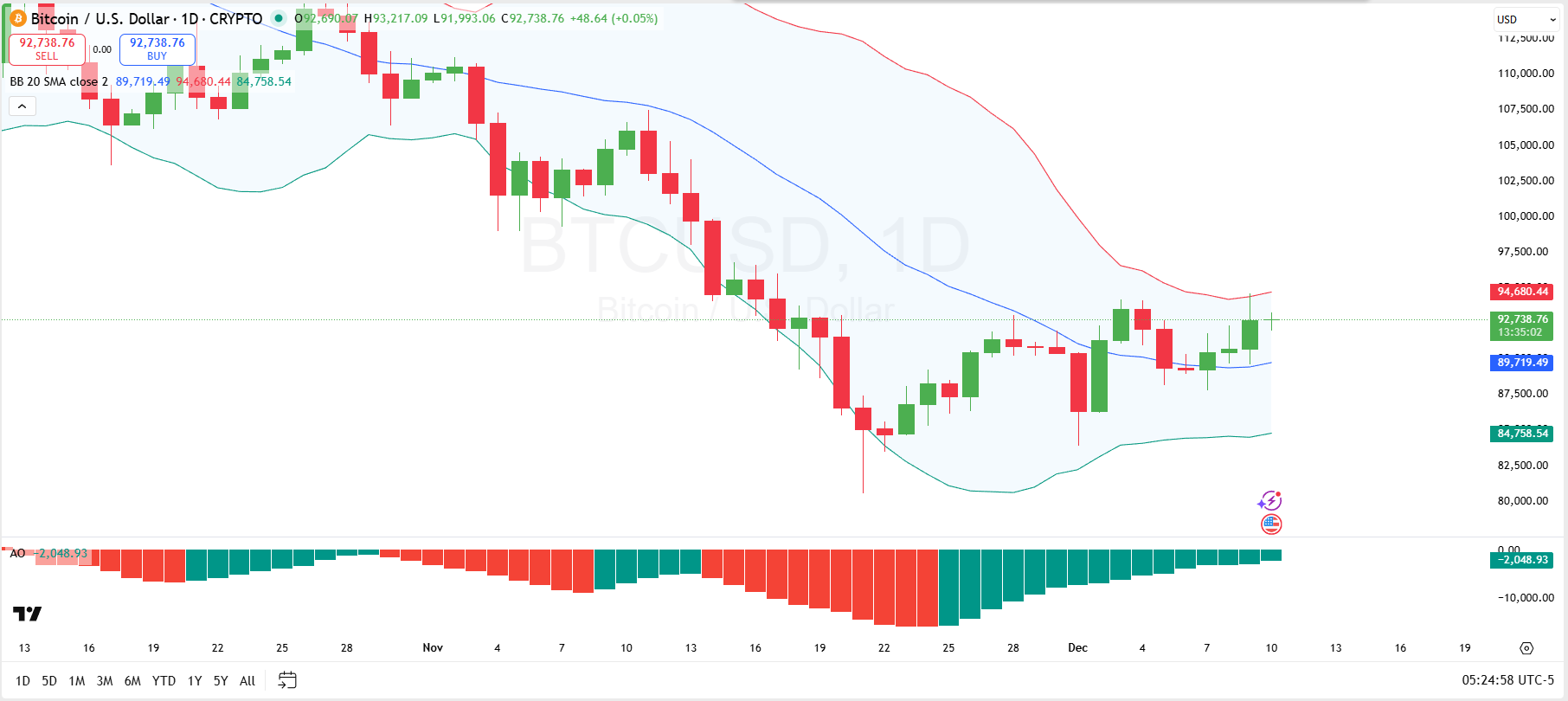

From a technical perspective, Bitcoin currently trades above the middle band on its Bollinger Bands indicator. The upper band sits near $94,680 while the lower band rests around $84,758. Recently, BTC approached this upper boundary creating potential resistance before retreating toward the middle line positioned close to $89,758.

A decisive move beyond this upper Bollinger Band could pave way for BTC to challenge its next key resistance level at approximately $97,500. Conversely, a drop below the middle band might increase selling pressure targeting support near $84,758 liquidity zone.

The Awesome Oscillator (AO) currently registers negative values around -2048, suggesting bearish momentum prevails in short term trends.

However, green bars appearing on AO histograms throughout December indicate weakening downward force alongside emerging bullish energy. if AO shifts into positive territory soon, this may mark changing sentiment favoring upward price action toward higher resistances.

An Overview of Bitcoin Liquidations

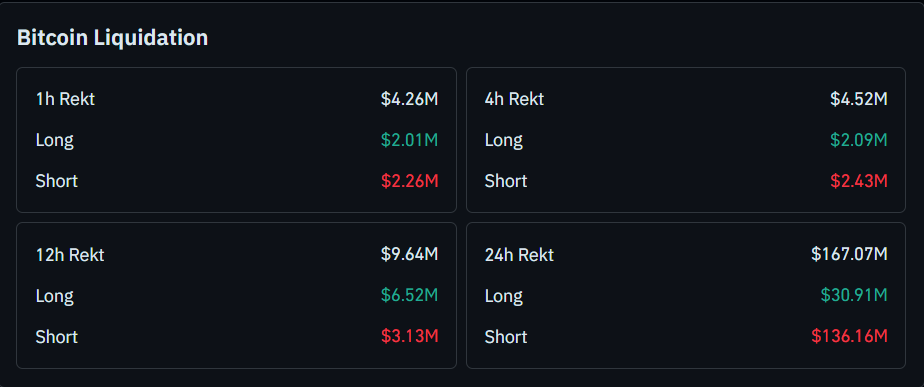

Diving into liquidation statistics offers valuable insight into trader behavior across various timeframes:

- The total liquidations during recent four-hour intervals amount to about $4.52 million; twelve-hour periods see roughly $9.64 million cleared from positions.

- The four-hour data reveals more shorts being liquidated ($2.43M) than longs ($2.09M), implying some recent short squeezes occurred.

In contrast, twelve-hour stats show long positions account for larger liquidation volume ($6.52M) compared to shorts ($3.13M), indicating prevailing bearish tendencies possibly triggering cascading sell-offs among longs.

The most striking figures emerge from twenty-four hour liquidation totals reaching an enormous ~$167 million overall.—Of these liquidations,$136 million stem from shorts being forced out while longs face substantial pressure too with nearly ~$31 million wiped out.—””'s large-scale short position clearances may signal readiness within markets for reversal moves should bullish forces strengthen further going forward.””.