With just ten days remaining in the year, Bitcoin has not met the lofty expectations that shaped market optimism at the beginning of 2025.

The leading cryptocurrency started strong, gaining nearly 10% in January and fueling positive sentiment. Experts pointed to clearer U.S. regulatory frameworks, increased institutional treasury adoption, and consistent ETF inflows as key drivers for a robust bull market.

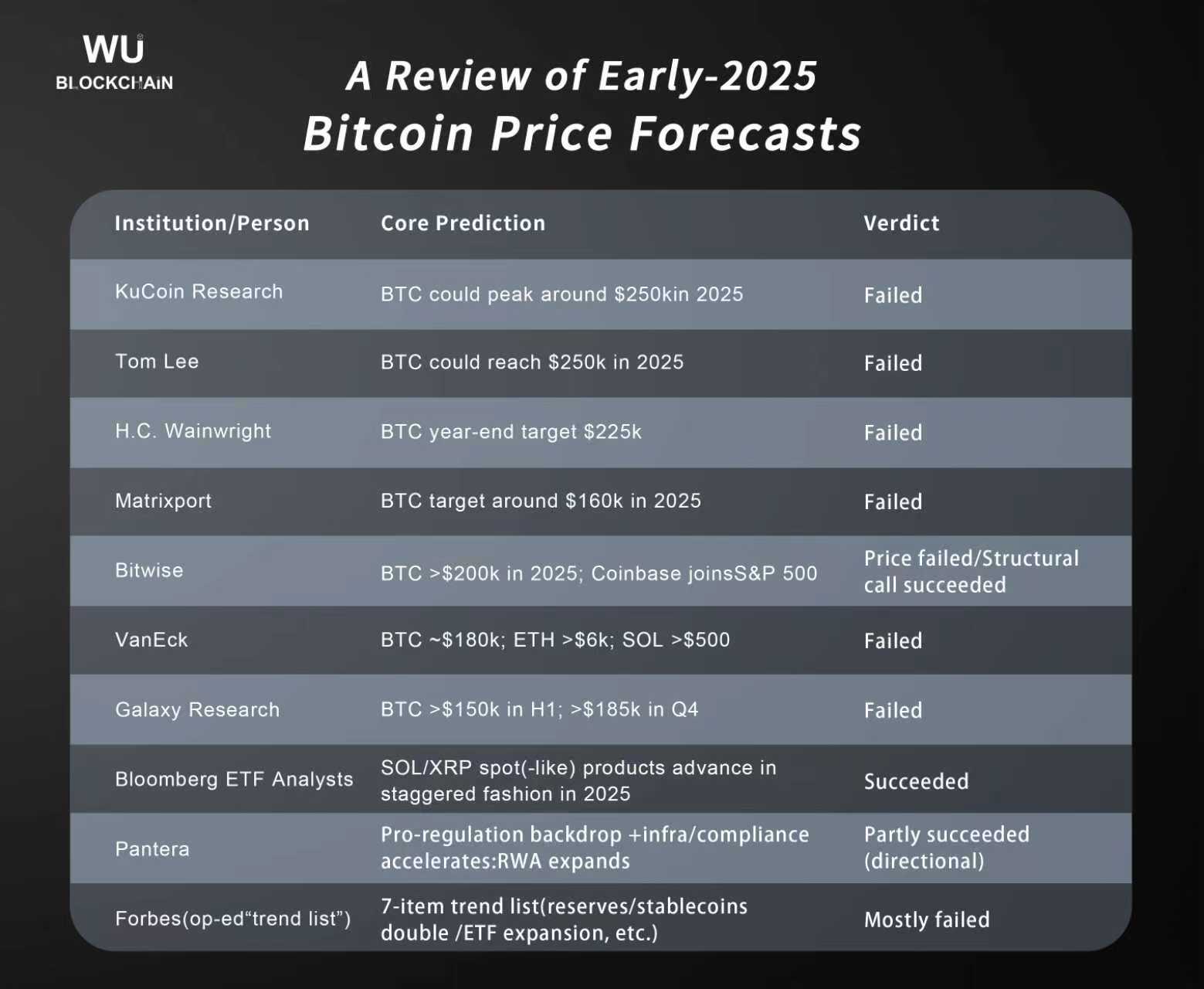

Bitcoin Falls Short of Most Optimistic Projections

These optimistic factors led to ambitious price forecasts, with many estimates clustering between $200,000 and $250,000. However, momentum sharply declined starting in October. Over the last three months alone, Bitcoin has dropped more than 21%, currently trading near $90,130—down roughly 3.6% for the year.

If this trend continues through year-end, Bitcoin will close its first negative annual performance since the bear market of 2022—leaving numerous bullish predictions unmet.

Crypto journalist Colin Wu recently emphasized how far these forecasts missed their marks. In a Substack post, he described how from late 2024 into early 2025 the market was driven by a shared narrative focused on post-halving strength combined with ETF expansion and increasing institutional involvement amid friendlier regulations.

This outlook encouraged institutions and prominent analysts to set aggressive price targets. Wu noted that while progress regarding regulation compliance and industry structure generally aligned with expectations, most price predictions overestimated Bitcoin’s rally throughout 2025.

KuCoin Research

At the start of 2025, KuCoin Research presented one of the most bullish outlooks by combining historical post-halving trends with anticipated strong demand from institutions and ETFs—predicting Bitcoin could reach approximately $250,000 during the year.

The firm also forecasted that excluding Bitcoin, total crypto market capitalization might surge to around $3.4 trillion, potentially fueled by an extensive altcoin season.

Although KuCoin correctly foresaw advancements in compliant products such as Solana and XRP ETFs, Bitcoin’s actual price trajectory diverged significantly—it peaked just above $126,000 before retreating back toward about $90,000, falling well short of their target.

Tom Lee

In January , Fundstrat’s Tom Lee publicly announced a bold target of $250,000 for Bitcoin based on improving liquidity conditions, a favorable regulatory environment, and what he termed growing resilience within markets.

However, persistent declines coupled with heightened volatility throughout éeacute;réeacute;réeacute;€“n't sustain upward momentum despite multiple rallies—and never approached Lee’s projected level.&

n

n