A recent Bloomberg report highlights the possibility that Bitcoin might decline to its annual support level of $50,000 by 2026, depending on certain macroeconomic factors.

At present, Bitcoin (BTC) is trading around $91,525 after an early-year rebound. However, this upward momentum weakened following a peak at $94,741 on January 5th when it failed to maintain that price point.

While some firms like Bernstein anticipate 2026 will be a year of recovery for Bitcoin after a volatile end to 2025, Bloomberg’s Senior Strategist Mike McGlone advises caution. His latest insights suggest that Bitcoin could still experience downward pressure this year if specific macro conditions arise.

Bitcoin’s Past Responses to Stock Market Volatility

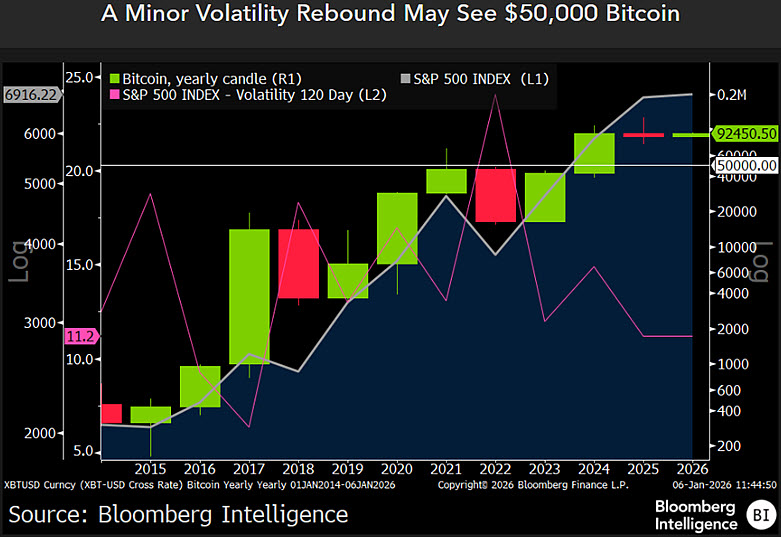

McGlone’s analysis draws from a long-term chart tracking Bitcoin’s yearly performance from 2014 through early 2026 alongside the S&P 500 Index and its associated 120-day volatility metric.

The data reveals an interesting trend: Bitcoin tends to rally strongly during periods when stock market volatility is low and stable. Conversely, when equity market volatility spikes, Bitcoin often retraces back toward significant long-term support levels.

For example, between 2014 and 2016, as stock market volatility fluctuated unevenly, Bitcoin mostly traded within the range of $200 to $600 — establishing an initial base during those years.

In late 2017, as stock market turbulence decreased significantly, Bitcoin surged dramatically close to $20,000 by December. However, a reversal occurred in early 2018, Btc