A recent evaluation by Bloomberg strategist Mike McGlone indicates that Bitcoin has lost its volatility advantage compared to silver, all while maintaining its long-term support levels.

Since reaching a peak of $126,000 in early October 2025, Bitcoin has faced significant selling pressure. Following this high point, BTC experienced a sharp decline to a cycle low of $80,537 by late November—marking a substantial drop of 36% within just two months.

Bitcoin Stagnates as Silver Rises

A brief recovery occurred in early December when the price momentarily exceeded $90,000; however, this rebound proved to be fragile. Each subsequent effort to break through the resistance zone between $90,000 and $94,000 faltered and pushed Bitcoin back into the upper range of the $80,000s. Currently, BTC is trading around $87,990.

In contrast to Bitcoin’s struggles during this timeframe, silver (XAG) has been on an upward trajectory since October 2025. This rally peaked on December 29th when silver reached an all-time high of $84.

However, strong selling pressure emerged immediately after hitting this level leading to a swift single-day decline of 9%. Silver is now priced near $76 which suggests that its momentum has diminished just as Bitcoin approached critical technical support levels.

Bitcoin’s Volatility Premium Declines Against Silver

Mike McGlone from Bloomberg Intelligence recently pointed out this performance divergence in his latest analysis regarding the relationship between Bitcoin and silver.

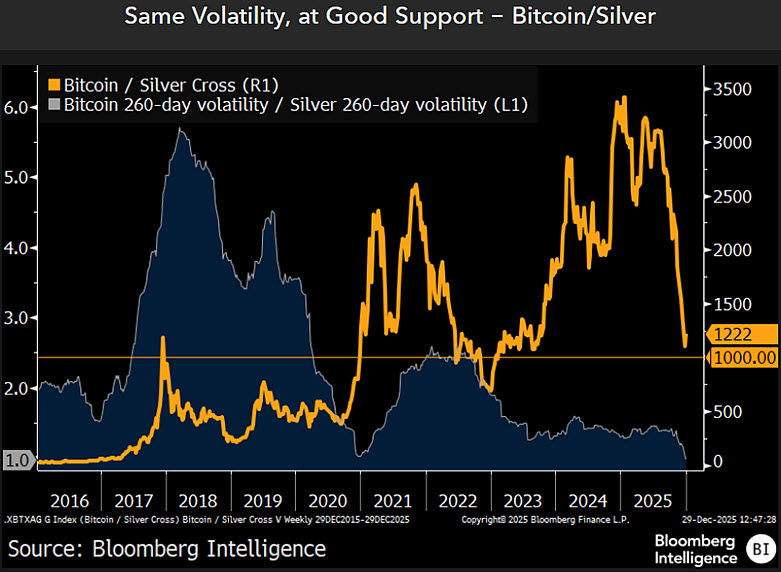

The accompanying chart highlights both assets’ volatility over a span of 260 days alongside their ratio. By December 29th 2025 ,Bitcoin’s volatility had decreased to match that of silver for the first time ever with their ratio dropping down to parity at exactly 1.0.

This marks a significant shift from previous cycles where Bitcoin consistently exhibited much higher volatility—peaking above ratios like five in 2017 and nearly two-and-a-half in 2021. The recent convergence towards parity with silver suggests that Bitcoin may have matured beyond being viewed as an extreme outlier asset class.

The Long-Term Support for the Bitcoin-to-Silver Ratio

The price ratio between bitcoin and silver is currently approaching crucial long-term support around the level of approximately 1:1000x as it coincides with silver’s surge towards $84 on December 29 while BTC remained stagnant during that period .

This specific threshold has historically acted as solid support during past cycles including those seen in both late-2018/early-2019 & again throughout much-of-2022 . Each time prior instances approached these zones resulted not only easing sell pressures but also paving way for longer term recoveries thereafter!

An important observation made here is how such turning points usually arise amidst periods where market volatilities compress rather than spike upwards! McGlone emphasized how present conditions suggest potential risk calming around current supports – indicating possibilities toward trend reversals ahead!

Sustained inability from Silver crossing above key psychological barrier ($84) allowed BTC maintain aforementioned supports leaving both assets positioned near major technical levels instead runaway trends ! If any slight edge returns back into favor upon volatilities expanding once more then we could see ratios widening again allowing room for outperformances without requiring excessive speculative actions involved either !

Potential Metal Outperformance Over Crypto In Year Ahead (2026)

Additionally through secondary evaluations done recently; Mr.Mcglone compared performances across indices involving metals versus cryptocurrencies noting reclaiming strengths witnessed throughout year ’25! He reported observed increases rising sharply up towards approx’28 by end-year against earlier values sitting closer down below ~13 previously recorded prior too!

This growth occurred simultaneously whilst S&P500 displayed heightened levels remaining elevated relative ultra-low figures registered back within year ’21 itself.Mr.Mcglone argued such environments typically favor metals over riskier crypto-assets especially whenever maintained controlled elevations persist ongoingly hence expecting precious metals continuing outperforming digital currencies moving forward into next calendar year(‘26)!

Nearing Future Outlook For Bitcoins Price Movements

<Currently outlook surrounding bitcoins immediate future remains uncertain given robust resistances looming overhead past mark exceeding ($90k). Market analyst Lennaert Snyder highlighted importance surrounding key supportive area found roughly($86k-$900), pointing out liquidity sweeps occurring there attempting hold onto said thresholds presently!

$BTC appears trying sustain ~$86K supportive floor.

As noted yesterday’s analysis sweeping through (~$86K liquidity could present interesting opportunities longs post-reversals.

Having executed sweep already thus far indications show attempts holding steady at those ranges currently.!

Before entering longs though prefer seeing some clearer signals… pic.twitter.com/ZKCW0T6M1x

— Lennaert Snyder (@LennaertSnyder) Dec30th ,’25.

Snyder perceives stronger chances emerging closer toward ($85k or slightly lower), meanwhile keeping watchful eye fixed upon pivotal line marked (~$90600); failure breaking beyond might invite short-sellers whereas successful reclaim would signal continuation ahead !

Additionally Michaël van de Poppe pointed out repetitive rejections faced above(88K), observing sideways movements sustained weeks now increasing likelihood sharp breakout soon enough once markets finally free themselves!! </P