BlackRock is intensifying its involvement in the “Bitcoin as a portfolio component” strategy by transforming the cryptocurrency’s natural price fluctuations into a source of distributable income.

On January 23, the asset management giant, overseeing $14 trillion in assets, submitted a registration for its new product: the iShares Bitcoin Premium Income ETF.

This fund aims to mirror Bitcoin’s price movements through holdings that include IBIT shares while generating income by selling call options tied to IBIT and occasionally indices linked to spot bitcoin exchange-traded products (ETPs).

If approved, this ETF would further develop an emerging trend initiated by spot Bitcoin ETFs: using ETF shares as proxies, listed options as volatility instruments, and ETFs or structured notes as vehicles that convert volatility risk into yield-oriented products.

Converting Volatility Into Income

The filing clearly outlines how this works. The proposed ETF plans to actively manage an option-writing strategy—selling call options on IBIT shares and sometimes on ETP indices related to spot bitcoin offerings—to generate premium income.

Essentially, it sells other investors the right to purchase IBIT shares at predetermined prices while distributing collected premiums as cash flow. This approach is familiar in equity markets but applied here where volatility is central rather than incidental.

A notable feature of this fund is that it will not fully overwrite its holdings. Instead, it intends to sell calls covering between 25% and 35% of net assets—a partial overwrite designed to maintain more upside potential compared with traditional buy-write strategies while still producing steady premium payouts.

The actual distribution depends heavily on implied volatility levels. If implied volatility decreases, premiums shrink unless managers either sell calls closer to current prices (which limits upside) or increase their overwriting percentage—an inherent tension fueling ongoing discussions around these products.

Wintermute Highlights Risks From Excessive Volatility Sellers

Jake Ostrovskis from Wintermute described BlackRock’s filing less as a retail launch and more like a shift in market structure dynamics.

He noted that Bitcoin option volatilities already face oversupply due to recent launches of spot ETFs, structured notes, and options on IBIT itself. Additional systematic call selling could push market-implied premiums down over time—a fundamental challenge for “income” labeled strategies relying on covered calls which essentially get paid for taking convexity risk off others’ hands.

This saturation can lead markets to lower option premiums across the board when too many participants follow similar selling tactics—resulting in reduced distributable cash flows for all involved parties running comparable approaches.

The Potential Scale Advantage With BlackRock

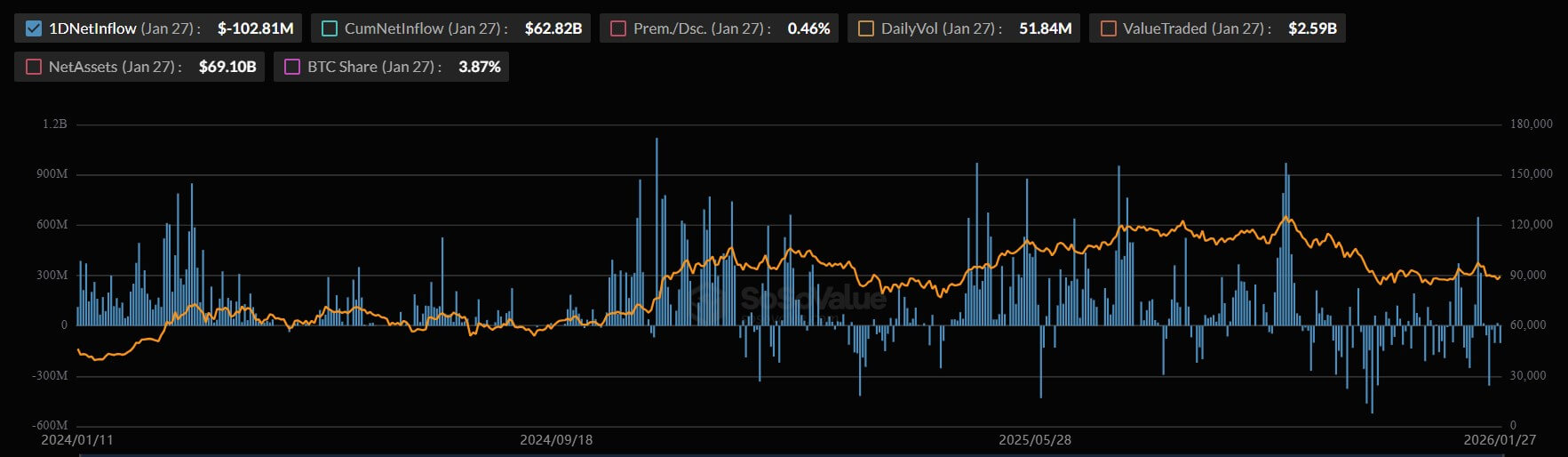

The reason Wall Street watches closely is BlackRock’s ability to scale distribution efficiently at industrial levels. As of January 27th, 2026 data shows IBIT holds approximately $69.2 billion in net assets—the largest Bitcoin ETF—and has attracted cumulative inflows exceeding $62 billion according to SoSo Value analytics.

Market insiders argue that both size and structural design set IBIT apart from competitors:

- Brian Brookshire, former head of Bitcoin Strategy at H100: highlights efficiency gains since BlackRock writes calls against actual owned shares instead of synthetic positions common elsewhere;

- Dan Hillery, treasury lead at Buck Token: emphasizes hedging behavior where sold calls are balanced with long underlying exposure sustaining demand despite capped upside potential;

Together these factors reframe how institutional allocators view BTC exposure—not just speculative asymmetric bets but regulated proxies allowing them harvest bitcoin’s inherent volatility via consistent cash flow generation aligned with income targets and risk budgets alike.